Your guide to trading the GBP/NZD pair

Why is the GBP/NZD pair important to traders?

The GBP/NZD pair brings together two of the world’s most-traded fiat currencies: the British pound and the New Zealand dollar. It shows us how much NZD is needed to buy £1 in GBP.

Sterling is the fourth most-traded currency worldwide, while the New Zealand dollar is 10th.

GBP/NZD is an example of a cross-currency pairing. This means these two currencies can be traded directly without being converted into US dollars first. Cross-currency transactions have grown in volume over recent years – driven by international traders who are keen to cut costs and avoid volatility associated with USD.

Because GBP/NZD can be prone to volatility and experience significant rate fluctuations, the pair can offer both potential trading opportunities and risks. It could also be used as part of a hedging or diversification strategy beyond major forex pairs, such as GBP/USD, EUR/USD, EUR/GBP, and USD/JPY.

GBP/NZD trading hours

The forex market is open 24 hours a day, five days per week.

Historically, the GBP/NZD pair has experienced heightened trading activity during the London session (8am to 4pm UK time) and Wellington session (9am to 5pm local time, or 10pm to 6am UK time). Major announcements from either the UK or New Zealand, such as economic data releases and interest rate calls, also influence elevated volumes.

History of GBP/NZD

Pound sterling can trace its origins to around 775 AD, when the silver penny was first used in England, serving as a foundation for what would become the modern pound following decimalisation in 1971. GBP represents a significant amount of daily trades around the world.

The New Zealand dollar is far newer and was introduced in 1967 to replace the New Zealand pound. During the changeover, 27m banknotes were printed, alongside 165m new coins. Today, the NZD has an average daily trading volume of around $136bn USD, according to recent Business for International Settlements data.

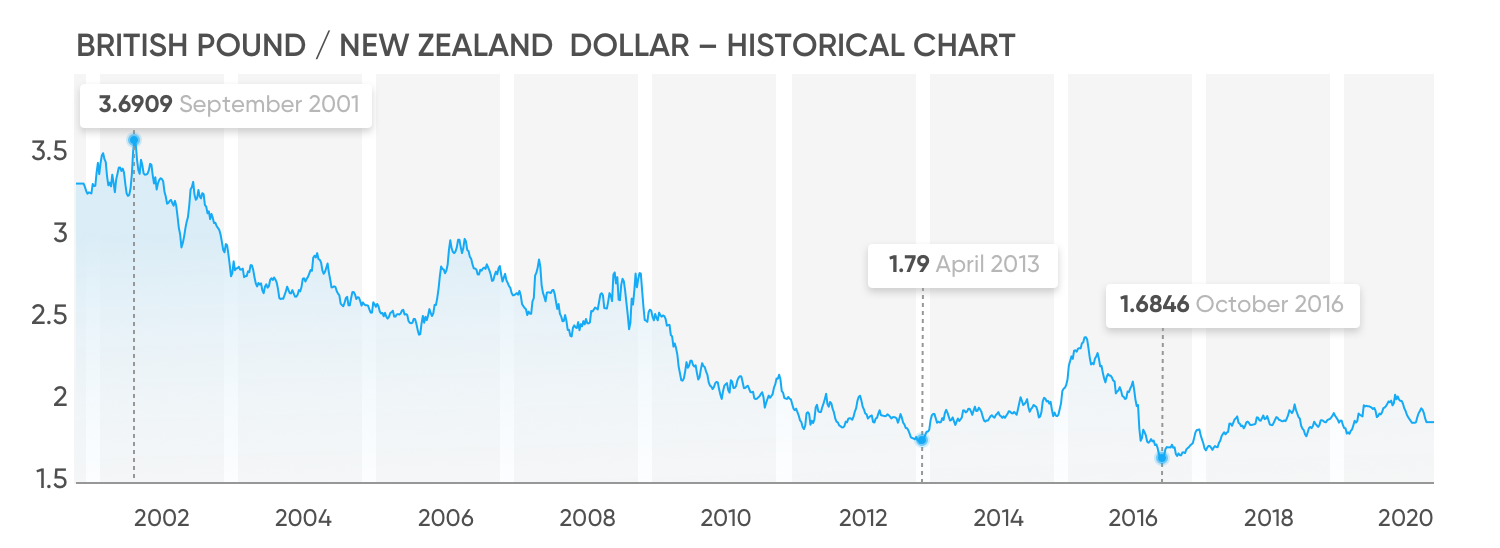

Stay informed of the latest moves with our GBP/NZD live price chart.

Past performance is not a reliable indicator of future results.

Factors influencing the GBP/NZD pair

One of the main drivers in the GBP/NZD rate is the economic health of the UK and New Zealand. When getting involved in GBP to NZD trading, it is worth paying attention to a wide range of economic factors including GDP growth, import and export data, employment figures and inflation rates.

Political events can also have a significant influence on the pair. A notable example in recent years was the uncertainty surrounding Brexit, with post-Brexit trade relations and regulatory changes continuing to have an impact on the pound’s value.

The price of sterling and the New Zealand dollar is also impacted by monetary policies enacted by the Bank of England and the Reserve Bank of New Zealand. For instance, whenever these central banks think inflation is rising too quickly, they may use various monetary policy tools in an attempt to bring it under control. Interest rates are a key measure, but other tools may also be employed, depending on the situation.

In addition, the New Zealand dollar is a commodity-based currency. The country’s main trading partners are the US, Australia and China. Therefore, the NZD can face uncertainty if economic growth declines in any of these nations – or if there’s an overall slowdown in global trade. In this scenario, the GBP/NZD rate could rise if the New Zealand dollar weakens. Conversely, if the New Zealand dollar strengthened, the GBP/NZD rate could fall.

How to trade GBP/NZD CFDs

You can trade GBP/NZD either through spot forex trading or by using a contract for difference (CFD) on the currency pair to speculate on price movements.

A CFD is a financial contract between a provider and a client, where the parties agree to exchange the difference in value of an underlying asset between the opening and closing of the contract. This lets you speculate on price movements without taking ownership or physical delivery of the actual currency pair.

For example, you might open a long position (buy) if you expect the price of GBP/NZD to rise, or a short position (sell) if you anticipate the pair will fall.

|

CFDs are complex instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand how CFDs work and carefully consider whether you can afford to take the high risk of losing your money. |

Past performance is not an indication of future performance

Need more support? Try our step-by-step forex course to guide you through the basics to the advanced concepts and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

Why trade GBP/NZD CFDs with Capital.com

Advanced technology – our news feed delivers curated content based on your interests; SmartFeed offers analysis and educational material that may help inform your decisions, recommending videos, articles, and news which could support your trading strategy.

Trade on margin – CFDs are traded on margin. Leverage beyond 1:1 magnifies both potential gains and potential losses. Professional clients may be eligible for higher leverage, depending on regulatory classification.

Contracts for difference (CFDs) – by trading CFDs on GBP/NZD, you speculate on whether its price will rise or fall. You can go short or long, set stop-loss and take-profit orders to manage risk, and apply trading scenarios that align with your objectives. Please note that execution of stop-loss and take-profit orders is not guaranteed and may be subject to market conditions.*

Sharpen your analysis – stay informed about the latest price movements with [100]+ technical indicators – including chart-drawing tools and more.

We prioritise your safety – Capital.com places strong emphasis on security. The platform operates through subsidiaries that are authorised and regulated by the FCA, MENA, ASIC, SCB, and CySEC, and other relevant authorities.

Rapid withdrawals – withdrawal requests can be submitted 24/7, and are processed within one business day. Actual receipt of funds depends on your payment provider or bank processing times. Client funds are held in segregated accounts where required by local regulations.

*Stop-loss orders aren’t guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee when activated.

Need more support? Try our step-by-step forex course to guide you through the basics to the advanced concepts and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

FAQs

How is Forex different from other markets?

Forex operates without a central exchange. Trading is decentralised and conducted over the counter, involving a wide range of participants worldwide. This structure tends to result in high trading volumes and can offer competitive bid-ask spreads, potentially lowering trading costs compared to some other markets.

I keep seeing the word 'pip', what does that mean?

The term ‘pip’ is commonly referred to as 'percentage in point' or 'price interest point', although it is not a strict acronym.

A pip is a unit of measurement for currency movement. It is typically the fourth decimal place in most currency pairs, but for pairs involving the Japanese yen, a pip is usually the second decimal place. For example, if the GBP/NZD moves from 1.1920 to 1.1921, that's a one pip movement.

Does Capital.com take a commission from my Forex trades?

The simple answer is 'no' – at Capital.com, you only pay the spread – which is the difference between the bid and ask prices – along with any applicable overnight funding charges. This differs from some brokers, who may charge a separate commission on each trade.