Your guide to trading the GBP/JPY pair

Why is the GBP/JPY an important market?

British pound / Japanese yen (GBP/JPY) is one of the most traded currency pairs, representing the amount of Japanese yen it takes to purchase one British pound sterling in the forex market. Learn what it means for investors and CFD traders.

Trade 120+ forex CFDs with Capital.com.

GBP/JPY trading hours

The forex market is available 24 hours a day, five days per week – UK trading, in particular, has historically experienced heightened volatility between 8am and 4pm (GMT). However, there are other times when this currency pair experiences higher volumes - typically around major market announcements, such as economic data releases or interest rate calls.

In the following sections, we're going to take a look at the history of GBP/JPY, which factors have influenced its movements over time, and reasons this pair remains actively traded.

History of GBP/JPY

The British pound – also called ‘pound sterling’ or ‘GBP’ – dates back to around 775 AD. The United Kingdom’s sovereign currency evolved into its current, decimal form in 1971. As of August 2025, GBP remains the fourth most-traded currency in forex and the fifth strongest currency in the world.

The Japanese yen was officially adopted in 1871 by the Meiji government, and as such, has a complex and rich history. Since inception, the yen’s value has grown considerably – in large part – due to the strong Japanese industrial complex, which has comprised technological developments, agricultural innovation, and a range of exportable products.

The ‘yen carry trade’ is a phenomenon that occurs when investors borrow yen at a low-interest rate then purchase foreign currency that pays a relatively high interest rate on its bonds. For example, a yen carry trade might involve borrowing yen and converting it into higher-yielding assets, such as foreign bonds, in order to benefit from the interest rate differential. The carry trade is maintained by Japan’s historically low interest rates.

However, past performance doesn’t guarantee future results. Forex values and central banks’ interest rates are subject to change.

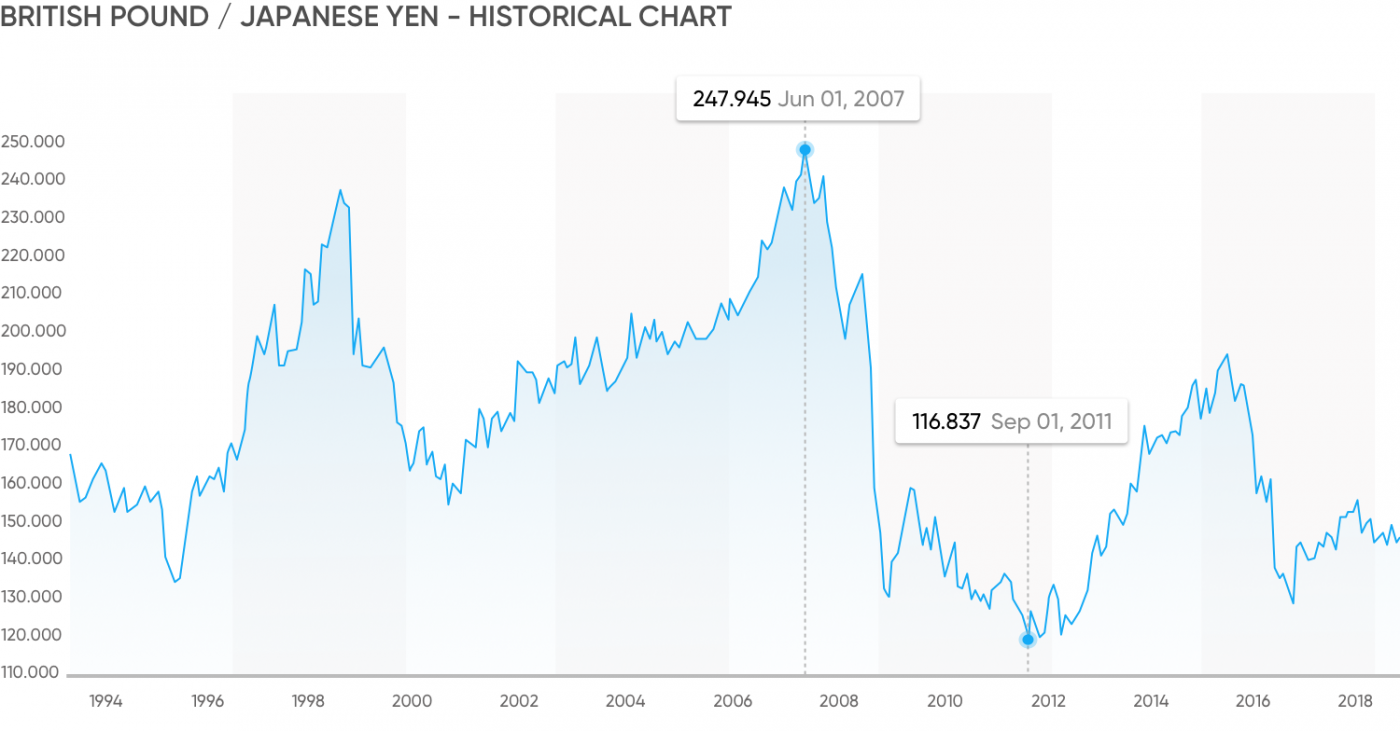

See the historic sterling-yen exchange rate below:

Past performance is not a reliable indicator of future results.

Factors influencing the GBP/JPY

Role of GBP

Factors influencing the GBP’s forex value include domestic economic performance. The UK government periodically releases three gross domestic product (GDP) reports: preliminary GDP, revised GDP, and final GDP. Such data releases serve as key indicators for both investors and forex CFD traders.

The UK’s central bank, the Bank of England (BoE) is responsible for setting monetary policy and interest rates in the country – which can have a significant impact on British pound forex pairs, such as GBP/JPY.

Role of JPY

Japan’s central bank – the Bank of Japan (BOJ) – and other financial institutions release regular reports that provide insight into the country’s economic performance. Interest rate changes can influence the Japanese yen’s value, in addition to monetary policy and trade balance. As a small country, Japan’s economy can also react to events like natural disasters potentially occurring in the region. These types of events may lead to heightened volatility in GBP/JPY rates.

How to trade GBP/JPY CFDs

You can trade GBP/JPY with either a spot forex contract or alternatively, they can trade a contract for difference (CFD) on a particular currency pair, and speculate on the price difference.

A CFD is a financial contract between a broker and an investor, where one party agrees to pay the other the change in value for a security. In other words, the price difference between the start to the end of the contract.

You could either open a long position (buy) if you anticipate the price to rise, or a short position (sell) when you expect the market price to fall.

For instance, to trade the GBP/JPY currency pair using CFDs, you speculate on the direction of the underlying asset. If you think the British pound will rise, then take a long position by buying the CFDs. If you think GBP will lose value against the JPY then you would take a short position by selling CFDs.

|

Open an account with Capital.com to access our advanced, award-winning* web platform and mobile apps, to trade anywhere, anytime. Simply sign up and pass verification to access [5,000]+ CFD markets. |

Trade CFDs on GBP/JPY with us.

Trade British Pound / Japanese Yen CFD

Past performance isn’t a reliable indicator of future results.

Why trade GBP/JPY CFDs with Capital.com

Advanced trading platform – our news feed provides you with personalised and unique content depending on your preferences, the SmartFeed includes analysis and educational material to help inform your decisions – recommending videos, articles, and news to sharpen your trading strategy.

Leverage and margin – CFDs are traded on margin (20:1 for non-major forex pairs). Leverage beyond 1:1 magnifies both potential gains and potential losses.

CFD trading – by trading CFDs on GBP/JPY, you speculate on whether its price will rise or fall. You can go short or long, set stop-loss* and take-profit orders to manage risk, and apply trading scenarios that align with your objectives.

Sharpen your analysis – stay informed about the latest moves with our [100]+ technical indicators – including chart-drawing tools and more.

We prioritise your safety – Capital.com puts a special emphasis on safety. Licensed by the FCA, MENA, ASIC, SCB, and CySEC, adhering to local regulations while prioritising our clients’ data security. You can submit withdrawal requests 24/7 – with funds stored in segregated accounts in accordance with regulatory requirements.

*Stop-loss orders aren’t guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee once activated.

If you want to master forex trading try our step-by-step forex course and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

FAQ

How is Forex different to other markets?

Given there is no central exchange and trading is decentralised, involving a wide range of participants, forex trading volumes can be significant compared to many other markets. This may result in competitive bid-ask spreads, which can potentially lower trading costs.

I keep seeing the word 'pip,' what does that mean?

A pip is merely the smallest increment of trade in the foreign exchange market. It stands for 'percentage in point'. GBP/JPY is quoted to two decimal points, so a pip is just the lowest amount that can possibly be added to (or subtracted from) this figure.

Does Capital.com take commission from my Forex trades?

The simple answer is 'no' – at Capital.com, you only pay the spread – which is the difference between the bid and ask prices – along with any applicable overnight funding charges. This differs from some brokers, who may charge a separate commission on each trade.