Your guide to trading the EUR/GBP Forex pair

Why is EUR/GBP important to traders?

As two of the most widely traded currencies, the euro and the British pound make the EUR/GBP pairing a commonly traded instrument. Learn why EUR/GBP is important to investors and CFD traders.

Trade [120]+ forex CFDs with Capital.com.

EUR/GBP trading hours

You can trade forex pair CFDs 24 hours a day, five days per week, but there are times when the EUR/GBP currency pair sees higher volatility.

The EUR/GBP has historically experienced heightened activity between 6am and 4pm (UTC) – which coincides with the opening hours of major European markets – and includes the overlap between the London and Eurozone sessions.

EUR/GBP history

As a relatively new currency, the euro has come a long way from its first inception. Introduced in 1999 for electronic transactions and accounting purposes, the euro saw the introduction of banknotes and coins in 2002. Today, the euro is the official currency for the majority of eurozone countries across the continent.

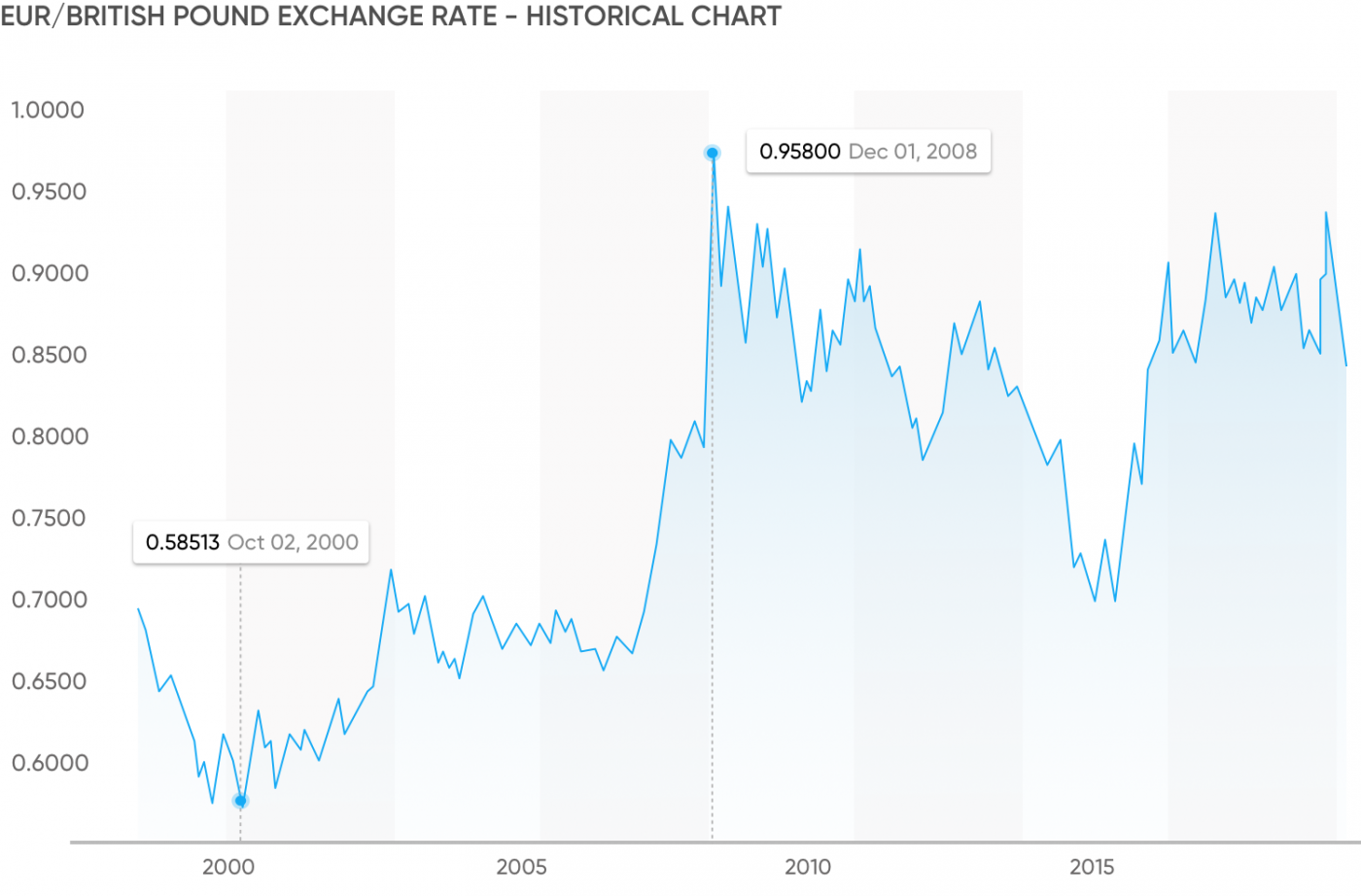

However, the euro hasn’t had an entirely smooth history. After the US sub-prime mortgage crisis, Europe experienced its own recession, and the euro experienced several large price swings as political and economic events buffeted the currency.

The origins of the pound sterling date back to approximately 775, though it wasn’t decimalised until 1971. Today, GBP is the fourth most-traded currency in the foreign exchange market and represents a significant portion of trades across the globe.

Past events which affected the rate of the pound sterling have included: the devaluation of sterling in 1967; the UK exiting the Exchange Rate Mechanism in 1992; the volatility following the global financial crisis in 2008; and, more recently, the UK’s withdrawal from the European Union in 2020.

Past performance is not a reliable indicator of future results.

Factors influencing the euro to pound rate

Recessions and economic crises can influence currency values, in addition to indicators, such as economic data releases and interest rate calls.

Role of EUR

One of the key influencing factors on the euro to pound sterling rate is interest rates. Because of this, the European Central Bank (ECB) is one of the main financial institutions which traders and investors will closely follow.

Each policy meeting, the ECB will release statements and, on a quarterly basis, publish economic projections that provide insights into the future economic outlook and the levels of interest rates across the euro area.

One other major factor which plays a large role in the movement of EUR to GBP rates is economic data, such as the employment figures from the euro area. These consolidated figures are freely available and have played an influential role in EUR/GBP’s rate history.

Role of GBP

The price of the pound sterling is affected by a large number of factors, including, but not limited to, monetary policies enacted by the Bank of England (BOE). For example, when the BOE deems that inflation is rising too quickly, they might utilise various monetary policy tools, such as changing interest rates, to try and control this.

The UK’s Office for National Statistics (ONS) releases three estimates of quarterly GDP: first estimate, second estimate, and final estimate – providing further insights into economic performance.

How to trade EUR/GBP

Past performance isn’t a reliable indicator of future results.

You can trade EUR/GBP either through spot forex trading or by using a contract for difference (CFD) on the currency pair to speculate on price movements.

A CFD is a financial contract between a broker and a trader, where the parties agree to exchange the difference in value of an underlying asset between the opening and closing of the contract. This lets you speculate on price movements without ownership or physical delivery of the actual currency pair.

You may open a long position (buy) if you expect the price of EUR/GBP to rise, or a short position (sell) if you anticipate the pair will fall in value.

|

CFDs are complex instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand how CFDs work and carefully consider whether you can afford the risk of losing your money. |

Why trade EUR/GBP CFDs with Capital.com?

Advanced technology – our news feed delivers curated content based on your interests; SmartFeed offers analysis and educational material to inform your decisions – recommending videos, articles, and news to help enhance your trading strategy.

Trade on margin – CFDs are traded on margin (up to 20:1 for retail clients on non-major forex pairs such as EUR/GBP; leverage may vary depending on your jurisdiction and regulatory status). Leverage beyond 1:1 magnifies both potential gains and potential losses.

Contracts for difference (CFDs) – by trading EUR/GBP CFDs, you speculate on whether its price will rise or fall. You can go short or long, set stop-loss and take-profit orders to manage risk, and apply trading scenarios that align with your objectives.*

Sharpen your analysis – stay informed about the latest moves with [100]+ technical indicators – including chart-drawing tools and more.

We prioritise your safety – Capital.com places strong emphasis on security. The platform operates entities authorised and regulated by the FCA, MENA, ASIC, SCB, and CySEC, and other relevant authorities. We adhere to local regulations and prioritise client data protection.

Rapid withdrawals – withdrawal requests can be submitted 24/7 – with client funds held in segregated accounts in accordance with local regulations.

*Stop-loss orders aren’t guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee once activated.

If you want to master forex trading try our step-by-step forex course and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

FAQ

Is there any commission in forex trading?

The simple answer is 'no' – at Capital.com, you do not pay a commission on forex CFD trades – you only pay the spread – which is the difference between the bid and ask prices – along with any applicable overnight funding charges. This differs from some brokers, who may charge a separate commission on each trade.

What differences does forex have to other markets?

Forex operates without a central exchange. Trading is decentralised and conducted over the counter, involving a wide range of participants worldwide. This structure tends to result in high trading volumes and can offer competitive bid-ask spreads, potentially lowering trading costs compared to some other markets.

What is bought and sold in forex trading?

In forex CFD trading, you are speculating on the relative value between two currencies, rather than buying or selling physical currency. For example, when trading EUR/GBP, you are effectively taking a position on whether the euro will strengthen or weaken against the pound sterling.

What does 'pip' stand for?

‘Pip’ stands for ‘percentage in point’. It represents the smallest standard unit of price movement in the forex market. For most major currency pairs, including EUR/GBP, a pip is typically equal to 0.0001.