What is AMD stock, and how do you trade it?

Learn about Advanced Micro Devices (AMD) and its stock price history, along with its trading hours and how to trade AMD CFDs.

What is AMD?

AMD is a leading semiconductor company, designing cutting-edge CPUs, GPUs, and adaptive computing solutions. Founded in 1969 by Jerry Sanders and ex-Fairchild Semiconductor engineers, it’s headquartered in Santa Clara, California, with legal roots in Delaware.

A key rival to Intel and Nvidia, AMD’s Ryzen and EPYC processors go head-to-head with Intel’s Core and Xeon chips, while Radeon GPUs challenge Nvidia’s GeForce and RTX A-series. The company also powers PlayStation 5 and Xbox Series X/S with custom chips.

In 2022, AMD acquired Xilinx, expanding into adaptive computing. Its chips now fuel top-tier supercomputers, including Frontier – the world’s first exascale system, capable of over one quintillion operations per second.

AMD vs Nvidia vs Intel: What are the differences?

Advanced Micro Devices (AMD), Nvidia, and Intel are three of the largest companies in the semiconductor industry by market capitalisation. While they all produce high-performance chips, they also have differences. Here’s how they compare:

|

AMD |

Nvidia |

Intel |

|

|

Core business |

CPUs, GPUs, and adaptive computing |

GPUs and AI accelerators |

CPUs, AI chips, and networking |

|

CPU products |

Ryzen (consumer), EPYC (server) |

N/A |

Core (consumer), Xeon (server) |

|

GPU products |

Radeon RX, Radeon PRO |

GeForce (gaming), RTX A-series (professional) |

Arc (gaming), Data Centre GPUs |

|

AI & data centres |

Instinct MI300 & MI325X accelerators,, EPYC for data centre |

H200, A100 GPUs |

Xeon CPUs, Habana Labs' Gaudi AI accelerators |

|

Manufacturing |

Fabless (outsources to TSMC) |

In-house fabs (Intel Foundry Service) |

|

|

Market position |

Strong in CPUs, rising in AI GPUs |

AI and GPU leader |

Dominant in CPUs, invests in AI |

AMD vs Nvidia

AMD and Nvidia are direct competitors in the GPU space. Nvidia leads the AI and gaming GPU markets with its GeForce and enterprise-focused GPUs, leveraging its proprietary CUDA platform. Meanwhile, AMD’s Radeon graphics cards have gained ground in AI with its Instinct MI300 series accelerators. AMD also has a strong presence in CPUs, an area where Nvidia has announced plans to compete.

Looking ahead, AMD plans to launch the MI350 series in 2025. This next-generation accelerator aims to challenge Nvidia’s forthcoming ‘Blackwell architecture’ chips.

Learn about Nvidia and its stock price history with our Nvidia trading guide.

AMD vs Intel

AMD and Intel have long been rivals in the CPU market. Intel historically held a dominant position, but AMD’s Ryzen and EPYC processors have gained market share due to their high core counts and energy efficiency. In Q3 2024, AMD's data centre revenue reached $3.549 billion, surpassing Intel's $3.3 billion in the same period. This marked the first time AMD has outperformed Intel in data centre revenue, highlighting a significant shift in market dynamics.

What is AMD's share price history

AMD went public on 27 September 1972, issuing 620,000 shares of common stock at $15.50 per share in an over-the-counter transaction. The company started trading on the New York Stock Exchange on 15 October 1979, transitioning to the Nasdaq Stock Market on 2 January 2015.

In its early years, AMD's stock price remained relatively modest, reflecting its position as a smaller player in the growing semiconductor industry.

The early 2000s marked a period of significant growth for AMD, due to the success of its Athlon processors, which challenged Intel's dominance in the CPU market. This competitive edge helped lift AMD's share price to a high in 2000. However, the subsequent years saw increased competition and strategic challenges, leading to a decline in share value.

Past performance is not a reliable indicator of future results

A pivotal turnaround began in 2014 with the appointment of Dr. Lisa Su as CEO. Under her leadership, AMD undertook a comprehensive restructuring and refocused on high-performance computing and graphics technologies. This strategic shift culminated in the launch of the Ryzen and EPYC processor lines, which revitalised the company's market position.

The impact of these initiatives became evident as AMD's share price ascended, reaching an all-time high of $227.30 on 7 March 2024 – attributed to strong demand for AMD's processors and graphics cards, particularly in gaming and data centre applications.

In 2024, AMD's stock experienced volatility, closing the year at $120.79, a decline of approximately 42.9% from its peak. Factors contributing to this fluctuation included intensified competition in the AI chip market and broader market dynamics.

As of 30 January 2025, AMD's stock trades at approximately $117.35. Traders continue to monitor the company's performance, especially in emerging sectors such as artificial intelligence and data centre technologies, which are anticipated to influence AMD's future valuation.

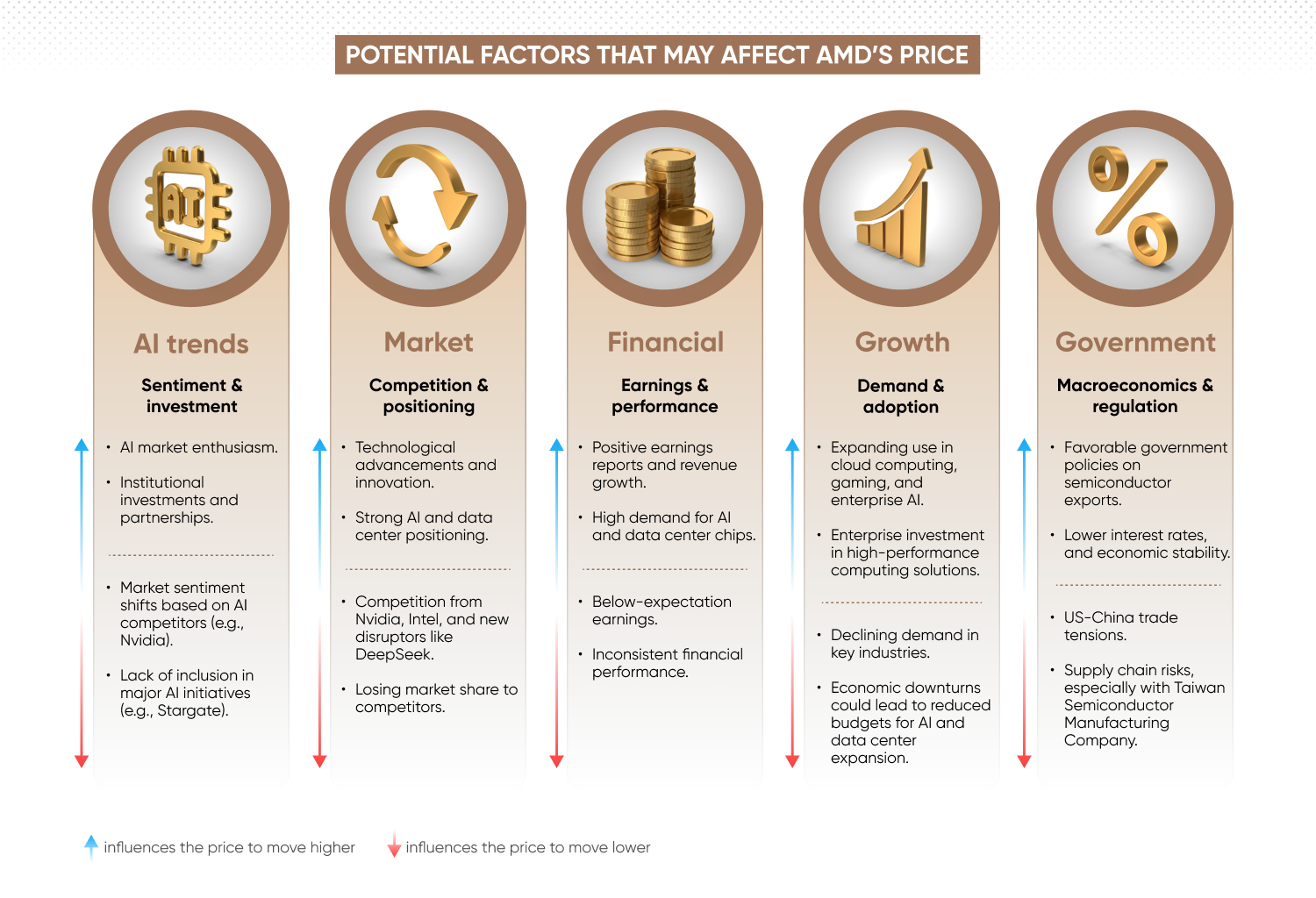

Which factors might affect the AMD live stock price?

AMD’s stock price can be affected by a range of influences, from broader market trends to company-specific developments. Here’s some of the key factors that could impact AMD’s price:

AI sentiment and institutional investment

AMD is a major player in the artificial intelligence (AI) hardware sector due to its MI325X and MI300 accelerators and EPYC processors. Market sentiment towards AI stocks, particularly Nvidia and AMD’s market positioning, may contribute to price fluctuations. Institutional investment in AI-related companies and strategic partnerships could also play a role in determining AMD’s price direction.

Competition and market positioning

The semiconductor industry is competitive, and AMD faces challenges from Nvidia and Intel. In January 2025, the announcement of the $500bn ‘Stargate’ project, which AMD is not currently a part of, impacted trader sentiment towards AI chipmakers. Changes in market share, technological advancements, disruptors such as China’s DeepSeek, and product launches from competitors may influence AMD’s stock price.

Financial performance and earnings reports

Quarterly and annual earnings releases can provide insights into AMD’s revenue growth, profitability, and market share. Above-expectation earnings, potentially driven by demand for data centre and AI chips, could lead to price rises, while lower-than-expected financial results may result in price decreases.

Industrial demand and adoption

AMD’s stock price is affected by demand for its products across sectors such as cloud computing, gaming, and enterprise data centres. AI adoption and enterprise investment in high-performance computing solutions could help drive long-term growth, while slowing demand or macroeconomic challenges may apply downward pressure on AMD’s price.

Macroeconomic and regulatory factors

Broader economic conditions, interest rate movements, and geopolitical factors – such as US-China trade relations – can impact AMD’s stock price. Government policies on semiconductor exports, particularly between the US and China, and potential supply chain disruptions at Taiwan Semiconductor Manufacturing Company, AMD’s primary chip supplier, are additional risk factors for traders.

Is AMD an AI stock?

AMD is not classified as a dedicated AI stock, but it is an established player in AI hardware. The company develops AI-focused products – including its MI325X and MI300 series of GPUs – designed for data centres and high-performance computing and generative AI. These accelerators are used for AI training and inference, competing with Nvidia’s offerings.

At CES 2025, AMD unveiled new processors tailored for AI-powered PCs, strengthening its AI hardware portfolio beyond data centres. The Ryzen AI Max series and the Ryzen AI 300 chips for Copilot+ PCs are designed for AI-driven personal computing, aiming to rival Intel’s Core Ultra processors with NPU (Neural Processing Unit) enhancements for on-device AI acceleration.

AMD’s fifth-generation EPYC server processors also support AI workloads in enterprise, AI, and cloud environments. The acquisition of Xilinx, completed on February 14, 2022, further expanded AMD’s AI capabilities by integrating adaptive computing solutions such as field-programmable gate arrays (FPGAs), which are widely used in AI and machine learning applications.

While Nvidia maintains a leading position in the AI chip market, AMD continues to expand its presence, with its products being adopted by cloud providers and enterprises. As AI demand increases, AMD’s role in the sector is expected to grow.

Learn more about AI shares with our comprehensive AI stock trading guide.

What are AMD’s stock trading hours?

AMD’s stock market trading hours are the same as the Nasdaq Stock Market – which is open Monday to Friday – where it's listed under the symbol, ‘AMD’:

NASDAQ Stock Market

- In winter, from 2:30pm to 9pm UTC

- In summer, from 13:30pm to 8pm UTC.

For more details on trading hours, visit our stock market trading hours page.

How to trade AMD shares with CFDs

If you want to take a position on AMD shares, you have two options. First, you can buy physical shares in the company through the exchange on which it’s listed. In this case, investing in AMD stocks means you will own a share, or shares, in the company. This can be considered a long-term investment, as you’re hoping for the price to rise over time.

Alternatively, you can trade a derivative product such as a contract for difference (CFD) on the underlying AMD stock market price, and speculate on its price movements without actually owning the asset. A CFD is a financial contract, typically between a broker and a trader, where one party agrees to pay the other the difference in the value of a security, between the opening and closing of the trade.

CFD trading is unlike traditional investing. With CFDs, you can either hold a long position (speculating that the price will rise) or a short position (speculating that the price will fall). CFDs are considered a short-term trade, as they tend to be used within shorter timeframes.

Another key difference between buying physical AMD shares and trading through a derivative is the leverage that can be employed with the latter. CFDs are traded on margin, which means that a trader can get exposure to larger positions with a relatively small outlay. In this scenario, both your profits and losses are amplified, making such trading risky. You can learn how to trade shares in our comprehensive guide to shares trading.

To trade AMD stock CFDs with us, just sign up for a Capital.com account, and once you’re verified, you can use our advanced web platform or download our intuitive yet easy-to-use app. It’ll take just a few minutes to get started and access the world’s most-traded markets.

FAQs

What is Advanced Micro Devices (AMD)?

Advanced Micro Devices (AMD) is a US-based semiconductor company that designs, manufactures – through outsourcing – and develops central processing units (CPUs), graphics processing units (GPUs), and adaptive computing solutions. Founded in 1969, the company competes with Intel in the CPU market and Nvidia in the GPU and AI accelerator sectors. AMD’s products are widely used in gaming, data centres, enterprise computing, AI, and embedded systems.

Which factors can influence AMD share prices?

AMD’s share price can fluctuate due to several factors, including competitive pressures, financial performance, and broader market conditions. A decline in AMD stock may be driven by weaker-than-expected earnings, concerns over AI market competition, semiconductor industry cycles, or macroeconomic conditions such as interest rate changes. Market sentiment may be influenced by supply chain challenges, geopolitical risks, geopolitical trade policies, or shifts in semiconductor demand.

Is AMD an AI stock?

AMD is not classified solely as an AI stock, but it is a significant player in AI hardware. The company produces AI-focused products such as the MI325X and MI300 series of GPUs, and EPYC processors for data centre AI workloads. While Nvidia remains dominant in AI chips, AMD remains a notable competitor in this space.

How can I trade or buy AMD shares?

You can buy AMD shares directly through an exchange where the stock is listed, such as the NASDAQ Stock Market, or trade its price movements using financial derivatives like contracts for difference (CFDs).

Buying shares outright means you own a stake in the company, whereas CFD trading allows speculation on AMD’s price movements without owning the underlying asset. With CFDs, traders can take both long and short positions to speculate on rising and falling markets.

Visit our other complete guides

How to trade Coinbase