The graph (GRT) price prediction: What is The Graph?

By Peter Henn

Updated

It aims to help people access understand statistics and data on the blockchain, but what is The Graph (GRT)? Let’s see what we can find out, and also take a look at some of the graph price predictions that were being made as of 7 February 2023.

What is The Graph?

One of the most important things when it comes to the blockchain is its open, decentralised nature. If blockchain technology is going to take over, as many of its fans predict, then it needs to be both accessible, useful and easy to work with.

One of the areas where blockchain technology might well need to improve is in the way people can access and search for data on the various systems out there.

As it stands, many platforms and networks that are based on the blockchain can be designed in a way which makes it hard to get hold of certain statistics, which can be pretty unhelpful when it comes to trying to actually get hold of information about the system in question.

One platform that aims to make this easier is The Graph. Founded by a team including Yaniv Tal, Brandon Ramirez and Jannis Pohlmann, the system is designed to allow people to create their own data graphs using information from the blockchain.

It does this by taking data and indexing it, grouping into separate sub-graphs using something called an application programming interface (API). These sub-graphs can then be put together to make a larger graph thus, at least in theory, making the network a useful tool for collecting data.

Quicker and easier

It could be argued that The Graph’s way of doing things is quicker and easier than the old, centralised, process, which could be time-consuming and end up with some potentially inaccurate results. The sub-graphs themselves are, in many cases, made by the system’s users, thus making the platform one that is decentralised.

As the system’s website says: “Before The Graph, teams had to develop and operate proprietary indexing servers. This required significant engineering and hardware resources and broke the important security properties required for decentralisation.”

Every blockchain-based network needs to have its own native cryptocurrency, and The Graph has the conveniently-named graph token, also known by its ticker handle of GRT. This token is used to pay people who provide services on the platform. It can also be bought, sold, and traded on crypto exchanges.

One thing that we need to point out at this stage is that The Graph does not really appear to be designed for someone with a beginner’s, or even an intermediate understanding of blockchain technology. The system’s whitepaper is chock-a-block with technical terms and jargon.

While there are some who might consider this to be a good thing, it could equally be argued that the dense phrasing could put off an investor who just wants to understand what they are putting their money into.

We will leave it up to you whether passages such as “The Graph Node in turn translates the GraphQL queries into queries for its underlying data store in order to fetch this data, making use of the store’s indexing capabilities…” are a help or a hindrance to understanding what it is that The Graph does and what it is used for.

It is also worth noting that, because GRT is based on the Ethereum (ETH) blockchain, it is a token, rather than a coin. You might see references to such things as a graph coin price prediction, but these are not, technically speaking, correct.

The graph price history

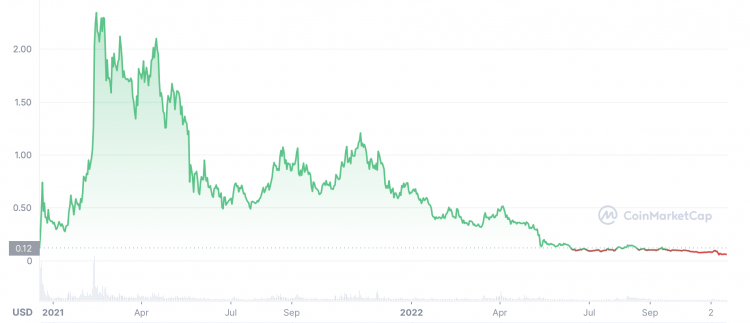

GRT price history from launch to present - Credit: CoinMarketCap

GRT price history from launch to present - Credit: CoinMarketCapLet’s now cast our eyes over some of the GRT price history. While past performance should never be taken as an indicator of future results, knowing what the token has done in the past can help give us some very important context when it comes to either making or interpreting a graph price prediction.

GRT was worth about $0.12 when it first came onto the open market in late December 2020. After this, the crypto market went through a sustained bullish period, and GRT responded well, reaching an all-time high of $2.88 on 21 February 2021.

Although it fell down from then, it still performed relatively respectably until late May, when it dropped below the dollar and stayed there until a couple of brief resurgences in August and November. Ultimately, though, it closed the year at $0.6446.

While both the graph and the crypto market had a good 2021, things were not so positive in 2022. While GRT initially rallied to a high of $0.7287 on 5 January, it then experienced a significant decline, with Russia’s invasion of Ukraine seeing it hit a low of $0.3054 on 24 February.

The following weeks saw a return to form as it went on a bull run culminating in a high of $0.5488 on 2 April. Following that, though, a series of market crashes saw it collapse to below $0.10 in June.

Although there was something of a recovery to $0.1505 on 13 August, things then went down over the following months and, following the market crash triggered by the collapse into bankruptcy of the FTX (FTT) exchange, GRT fell to a low of $0.05729 on 9 November, and there was a further slide later in the month to a low of $0.05196 on 22 November. There was something of a recovery to a high of $0.07482 on 10 December but there was another slump with it closing the year at $0.05538, down more than 90% from the end of 2021.

In January, however, there was some good news for GRT investors. A combination of The Graph's link to artificial intelligence related tokens and a buoyant market saw it close the month at $0.08882, representing a monthly increase of 60%, while it shot up even further in February, reaxhing a high of $0.2286 on 7 February 2023, its highest price since before the depegging of the UST stablecoin and the collapse of the associated LUNA cryptocurrency in May 2022 saw crypto prices drop across the board. Following that, the collapse of the Silvergate bank saw it fall to $0.106 on 10 March before a recovery led to trade at around $0.1405 on 3 April 2023.

At that time, there were a little under 8.9 billion GRT in circulation out of a total supply of 10,623,053,044. This gave the crypto a market cap of around $1.25bn, making it the 43rd largest crypto by that metric.

The graph price prediction round-up

With that all over and done with, let’s cast our eyes over some of the graph price predictions that were being made as of 3 April 2023. It is important to recognise at this stage that price forecasts, especially when it comes to something as potentially volatile as cryptocurrency, very often turn out to be wrong. Also, many long-term crypto price predictions are made using an algorithm, which means that they can change at a moment’s notice.

First, CoinCodex had a rather downbeat short-term graph price prediction for 2023, suggesting that the crypto could reach $0.1247 on 8 April before falling further down to $0.110895 on 4 May. The site’s technical analysis was, perhaps unsurprisingly, bearish, with 16 indicators sending negative signals against 12 making bullish ones.

Next, PricePrediction.net made a GRT price prediction which suggested that the token could be worth $0.18 this year, $0.27 next year and $0.39 the year after that. By 2026, the site said, the graph could be worth $0.54, with it potentially moving to $0.78 in 2027 and potentially breaking past the dollar barrier to trade at $1.14 in 2028 before it possibly closes the decade at $1.70. The site then made a graph price prediction for 2030 that said it could stand at a potential $2.52 before possibly hitting $5.48 in 2032.

Meanwhile, CryptoPredictions.com made a graph token price prediction that saw it close 2023 at $0.165 before it hit $0.2516 12 months on. The site's graph price prediction for 2025 saw it open the year at $0.25875 and close it at $0.27825.

Finally, WalletInvestor made a graph crypto price prediction that looked like bad news for the token's holders. The site said that it thought GRT could plummet over the next year or so, collapsing to just $0.0157 in April 2024.

When considering a GRT token price prediction, it’s important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin or token’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never trade with money that you cannot afford to lose.

FAQs

Is the graph a good investment?

It is hard to say. The token has enjoyed something of a recovery in 2023 so far, so we will have to see what it can do to maintain that good performance. A lot will depend on how the crypto market behaves as a whole.

Remember, you should always carry out your own thorough research before making an investment. Even high market cap cryptocurrencies can be affected by bear markets. So investors should be prepared to make losses and never purchase more than they can afford to lose.

Will the graph go up or down?

No one can really tell at this stage. While the likes of PricePrediction.net are rather upbeat about the graph’s future, sites such as WalletInvestor are far more bearish in their assessments. Remember, price predictions very often end up being wrong, and prices can, and do, go down as well as up.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether GRT is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors. Keep in mind that past performance is no guarantee of future returns. And never invest money that you cannot afford to lose.

Should I invest in the graph?

Before you decide whether or not to invest in the graph, you will have to do your own research, not only on GRT, but other data-related crypto coins and tokens.

Ultimately, though, this is a question that you will have to answer for yourself. Before you do so, however, you will need to conduct your own research and never invest more money than you can afford to lose because prices can go down as well as up.

Markets in this article

Related topics