Tether price prediction: Can USDT keep its dollar peg?

What was the impact of the UST stablecoin crash on USDT? Can tether keep its dollar peg? Read more.

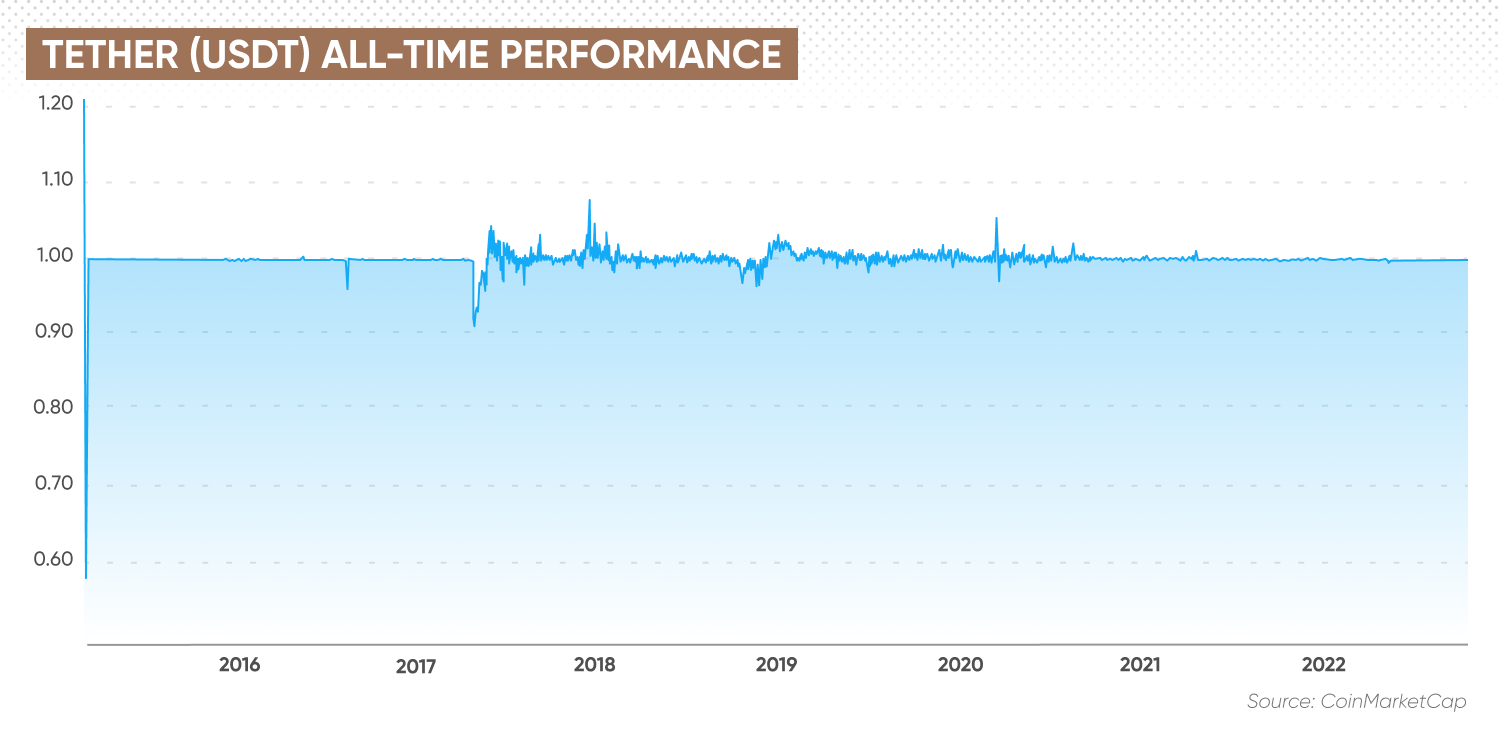

Tether (USDT), the world’s largest stablecoin by market capitalisation, showed signs of losing its dollar peg in the wake of the collapse of Terra’s UST stablecoin and the collapse of the Celsius Network lending platform.

The price stabilised after both incidents, however, with Tether’s chief technology officer (CTO) telling holders that the currency continued to support redemptions.

Tether, which aims to match USDT to USD at a rate of 1:1, dropped to a low of $0.9485 on 12 May 2022 as UST crashed, and did not get back to exact parity with the dollar until 20 July.

Since then, though, it has remained there, albeit with the occasional wobble.

Tether (USDT) Live Price Chart

What is tether (USDT)? How does the USDT stablecoin protocol differ from UST? What does the contagion from UST mean for tether? And what is the latest tether crypto price prediction after the recent instability?

In this article, we will look at recent events surrounding the stablecoin and attempt to answer these questions.

UST collapse renews Tether collateral concerns

Both tether (USDT) and terraUSD (UST) are stablecoins – cryptocurrency coins pegged in value to another asset or currency such as the US dollar. They are designed to provide a way for investors to hold funds in a digital format without exposure to the volatility of cryptocurrencies such as bitcoin (BTC) or ether (ETH).

Stablecoin holders can use them in decentralised finance (DeFi) apps to borrow, lend and earn interest.

UST quickly rose to become one of the largest stablecoins after Tether’s USDT and USDC. It is managed by a consortium including payments firm Circle Internet Financial, crypto exchange Coinbase (COIN) and bitcoin mining firm Bitmain.

UST had a market capitalisation of $18.7bn prior to the crash, while the USDT coin was valued at $83.24bn and USDC at $53.53bn. Tether’s market cap has since dropped to around $65.3bn as of 1 December 2022, with USDC holding up at $43.2bn, while UST’s value has plunged to $210m.

A key difference between UST compared to USDT and USDC is that UST is an algorithmic stablecoin (a non-collateralised stablecoin, which utilises algorithms to maintain a constant value), while USDT and USDC are collateralised.

The UST algorithm used an on-chain swap function that exchanged 1 UST for $1 of LUNA, regardless of the price. This aimed to incentivise users to exchange UST for LUNA if its value fell below $1 and swap LUNA for UST if the stablecoin price rose above $1, burning some of the LUNA and reducing its circulating supply to support the price. The rest was sent to the corporate treasury.

UST’s growth was driven by the Anchor protocol, which paid holders 20% interest on deposits. However, Terra was subsidising the 20% interest with funds from the corporate treasury – without users minting more UST and pushing up the LUNA price, Terra would be unable to sustain the payments.

On 9 May 2022, traders began selling UST to force it to depeg from the US dollar. The LUNA price quickly collapsed as UST sales created more and more LUNA, resulting in hyperinflation.

The value of UST dropped to $0.7934 on 12 May and has continued to decline, falling to just $0.07601 on 19 May, while the USDT/USD price has stabilised. The Luna Foundation Guard, which had bought bitcoin following criticism that the dual-token protocol was not backed by collateral, was forced to sell its bitcoin holdings in a failed attempt to stabilise LUNA.

The contagion from the Terra stablecoin collapse spread not only to bitcoin (BTC) – as more than 80,000 coins were released onto the market within a short period of time – but also to the tether cryptocurrency, which has faced questions in the past about whether its dollar peg was fully backed by collateral.

In 2019, when the New York State Attorney General investigated the tether token, it was alleged that “the operators of the Bitfinex trading platform, who also control the tether virtual currency, have engaged in a cover-up to hide the apparent loss of $850m of co-mingled client and corporate funds,” and that from at least June until September 2017, the coin was not backed by US dollar holdings.

As a result, Tether and Bitfinex reached an agreement to pay an $18.5m fine to settle a dispute.

Tether regains its dollar peg

In an analysis on 12 May 2022, Anders Nystee and Mads Eberhardt, analysts at Dutch bank Saxo, noted:

“Given the recent losses UST investors suffered, many users may be questioning if they can trust Tether USDT,” the company said in a blog post on 16 May.

It went on to explain that these instances did not reflect a loss of the peg or reserve backing, but showed that selling interest on the exchanges exceeded their limited liquidity on the coin, noting:

“Any given exchange will not have enough liquidity on its books to process the exchange of every USDT token for dollars. In instances where exchange liquidity is too low, investors come to Tether to request a redemption, which is exactly what happened in May. On 11 and 12 May, the price of USDT deviated from its typical price of $1 on a few exchanges. This caused investors to purchase USDT on those exchanges for a discount and then redeem those USDT tokens with Tether on a 1-to-1 basis.”

From 11 to 16 May 2022, Tether processed $7bn of USDT crypto redemptions for verified individuals, the statement said.

On 19 May 2022, Tether Holdings released its quarterly assurance report, setting out the details of its total reserves. The data showed a 17% reduction in its commercial paper investments and an increase in its holdings of US Treasury bills. By 31 March 2022, its consolidated total assets amounted to at least $82.42bn, ostensibly supporting its market cap.

A more recent analysis from Saxo Bank’s Mads Eberhardt on 4 July 2022 underscored the transparency issues plaguing the cryptocurrency:

While tether’s supply has greatly decreased in the past few months, Eberhardt noted that traders continue to favour the stablecoin over other similar cryptos as “trading pairs quoted in tether are often much more liquid compared to similar USDC trading pairs”.

On 19 August 2022, a report by accounting firm BDO said that Tether had assets totalling at least $66.4bn, down 20% from $82.4bn in March. By September, Tether announced that it had launched on the Near Protocol (NEAR) blockchain.

Tether has remained under the spotlight as the world’s largest stablecoin by market cap, and as a result has in no way been immune to scrutiny. In its most recent statement, Tether claimed to have eliminated $30bn of commercial paper without any losses. In an effort to give the crypto “the most secure, liquid reserves in the market”, the company has replaced its dollar holdings with US Treasury Bills.

Tether liquidates Celsius position with ‘no losses’

On 13 July 2022, crypto lender Celsius Network (CEL) said it had filed for bankruptcy, becoming the latest victim of a dramatic slide in prices that rattled the market. The decision came a month after the lender paused withdrawals and transfers between customer accounts due to “extreme market conditions”.

USDT reacted to the news by slipping as low as $0.9975 on 13 June 2022, as Tether was exposed to Celsius via a BTC-denominated loan.

As rumours of Celsius’s insolvency continued to circulate, Tether stepped in to clarify that its investments in Celsius had nothing to do with the stability and health of USDT.

In a more recent statement issued on 8 July 2022, Tether explained that its lending arrangement with Celsius prevented any downside risk to its underlying business.

Specifically, the BTC-denominated loan granted to Celsius was overcollateralised by 130%, while “the decision to liquidate the collateral to cover the loan was a part of the original terms of the agreement between the two entities”.

What is the prognosis for USDT? Can it maintain its dollar peg, or could it be the next stablecoin to collapse? We look at projections for USDT’s value below.

Tether price prediction: Analyst’s views

Analyst Vetle Lunde at cryptocurrency research company Arcane wrote on 16 May 2022 that the drop in the value of tether to a low of $0.945 on the FTX exchange was “a clear signal of peak irrationality and chaos in the market”. He reported:

Lunde went on to consider the “implications of a hypothetical USDT collapse” with a disclaimer: “We do not view this as a likely event, be very cautious when it comes to jumping on the USDT FUD [Fear, uncertainty, and doubt] bandwagon post the very unrelated UST situation.

“In the aftermath, it would likely be a massive blow to the confidence of the industry. The effects are difficult to assess. Funds, market makers, and possibly even exchanges could go bankrupt. It would be an Mt Goxian event,” Lunde wrote, referring to the $460m hack of the Mt Gox crypto exchange in Japan in 2014.

Tether (USDT) price prediction 2022-2025

The issue with tether is that, because it is a stablecoin, it should always stay at around $1. Therefore, it does not really matter how far we go in the future – whether for a tether price prediction for 2025 or a tether price prediction for 2030, the score should, at least in theory, remain at $1.

As of 1 December 2022, algorithm-based forecast website Wallet Investor had a USDT price prediction which saw the stablecoin remaining largely pegged to the US dollar over the next five years. Its tether coin price prediction has only slight variations in the rate, ranging between $0.998 and $1.005.

DigitalCoinPrice had a tether price prediction for 2022 that saw the price reach $1.01 towards the end of the year, and then stay there. The website’s tether price prediction for 2023 saw the coin trading at $1.01 throughout the year.

Algorithm-based forecasters didn’t provide longer-term tether crypto price predictions for 2040 and 2050.

When considering any tether (USDT/USD) forecast, it’s important to keep in mind that cryptocurrency markets remain extremely volatile and unexpected events like the Terra crash are difficult to accurately predict. As such, analysts and algorithm-based forecasters can and do get their outlook wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any trading decision. Keep in mind that past performance is no guarantee of future returns, and never invest money that you cannot afford to lose.

FAQs

Is tether a good investment?

It all depends on how you see things, and whether tether is able to do what it is designed to do, which is stay at the dollar level. Remember, you should always carry out your own thorough research before making an investment.

Even high market cap cryptocurrencies have proved vulnerable to the current bear market, so investors should be prepared to make losses and never purchase more than they can afford to lose.

Will tether go up or down?

Tether is a stablecoin designed to maintain a 1:1 peg to the value of the US dollar. While the price dipped to $0.9485 in the wake of the collapse of the Terra stablecoin, its value has since moved back to $1. That said, even stablecoins can be hit by volatility, so you will have to remember that prices can go down as well as up.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether USDT is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors.

Keep in mind that past performance is no guarantee of future returns, and never invest any money that you cannot afford to lose.

Should I invest in tether?

This is a question that you will have to answer for yourself. Before you do so, however, you will need to conduct your own research.

Never invest more money than you can afford to lose, because prices can go down as well as up.