Sunshine Biopharma (SBFM) stock forecast: Will it hit 2021 highs?

Will SBFM’s new cancer drug lift its stock price to new highs in 2022?

Nasdaq exchange-listed pharmaceutical company Sunshine Biopharma (SBFM)’s share price jumped over the past week after the company announced positive laboratory results on its newly developed cancer drugs.

The Montreal-based pharmaceutical company primarily focuses on the research, development and commercialisation of oncology and antiviral drugs. SBFM also engages in the development of science-based nutritional supplements. It’s also developing antiviral Covid-19 and cancer drugs.

Based on recent valuation, at the time of writing on 13 April, the company’s market capitalisation stood at $33.72m

Sunshine Biopharma announced on 5 April that “two of its newly designed mRNA molecules are effective at destroying cancer cells grown in culture”. The tests were performed on a variety of cancer cells including multidrug resistant breast cancer cells, ovarian and pancreatic cancer cells.

The positive laboratory results mean Sunshine Biopharma could develop effective drugs to treat breast, ovarian, pancreatic and other cancers. This boosted investors’ confidence in the company stock and led to a surge in its share prices.

Following the announcement, SBFM stock value spiked to a two-month high of $9.65 on 7 April, over four times the price of $2.26 on 4 April, the day before the announcement.

Stock analyst Ivan Brian wrote on FX Street on 7 April:

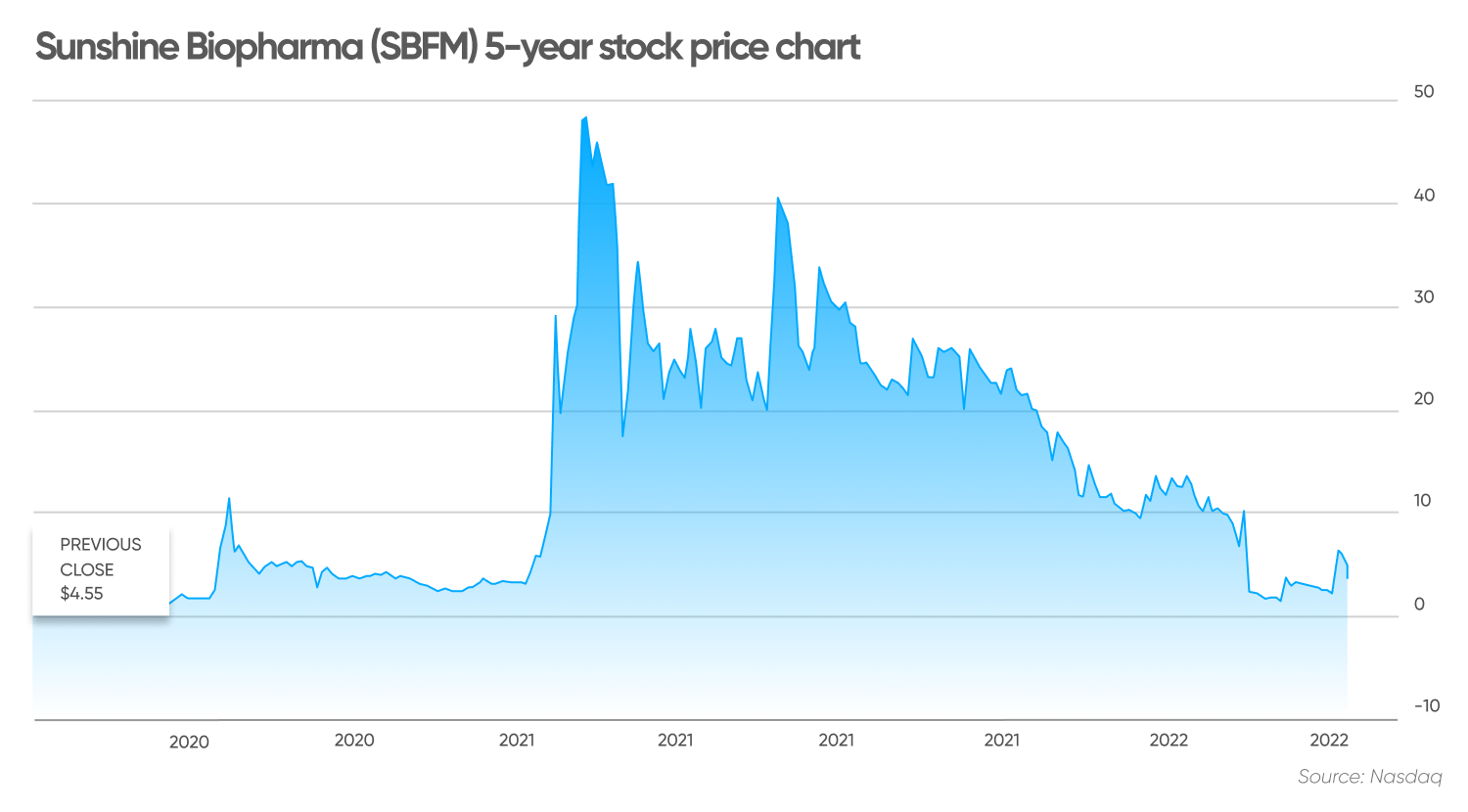

SBFM stock price has retreated from the April peak and was trading at $4.55 on 13 April. The price has fluctuated and lost value since the beginning of this year, starting in January at $14.00 and fell as low as $1.52 on 8 March before climbing in April.

According to the SBFM historical stock price, the all-time high was $48.40 on 11 February 2021, following an exclusive licence agreement with the University of Georgia to develop the university’s two patented Anti-Coronavirus compounds as treatment for the respiratory disease.

Are you interested to learn more about Sunshine Biopharma? Read this SBFM stock analysis for the latest SBFM stock news and predictions.

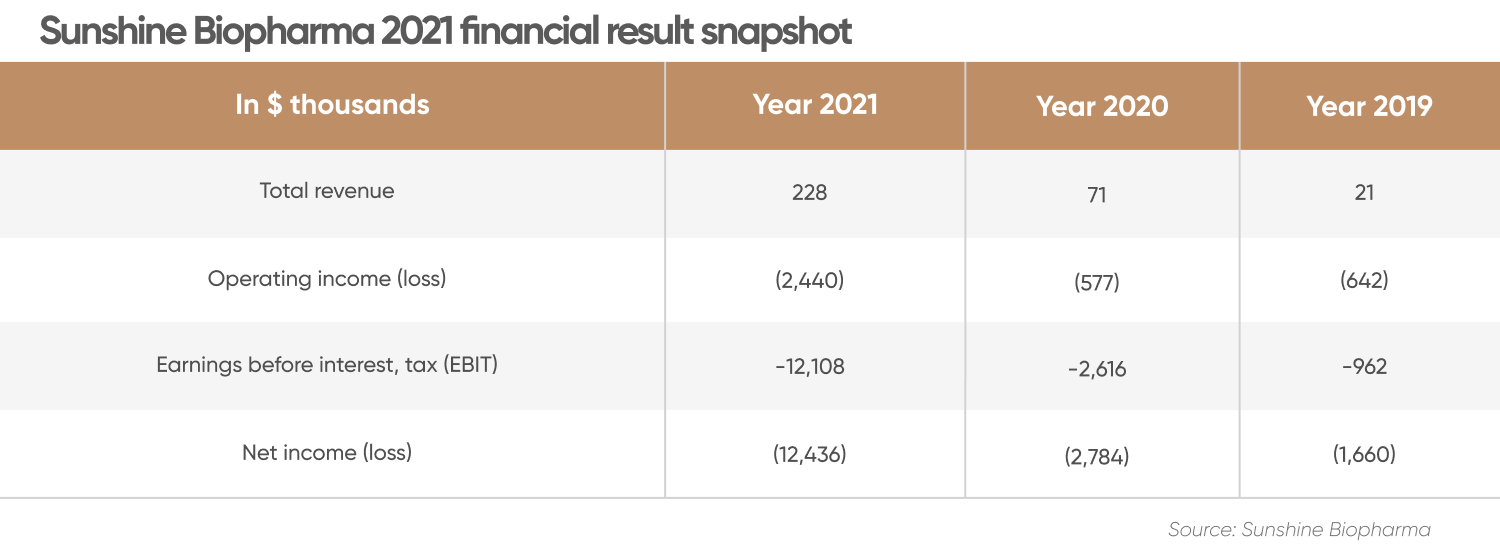

Loss deepens despite rising revenue in 2021

SBFM’s revenue in 2021 more than tripled from the previous year to $228,000 but surging operating expenses deepened the company’s losses.

According to SBFM’s annual financial statement for the year ended 31 December 2021, the company’s research and development costs spiked to $672,000 in 2021, a significant rise from the $2,000 in the previous year. Its sales, general and administration expenses more than tripled to $1.67m, compared with $517,000 in 2020. The company’s sales, general and administration costs accounted for 65.5% of the total operating expenses.

In its Securities and Exchange Commission (SEC) filing on 24 January, SBFM said:

SBFM also took on costly convertible debt financing to fund its research and development activities, incurring $10.7m losses in the first nine months of 2021. The company attributed the losses to the volatility of its stock price. SBFM’s net loss deepened to $12.44m in 2021, compared with $2.78m the previous year.

Sunshine Biopharma stock split

Sunshine Biopharma implemented a stock split by offering more of the company’s shares in a private placement in February this year to raise funds. As part of the private placement, SBFM issued 2.3 million shares of its common stock with investor warrants for the purchase of the newly issued shares. The investor warrants have an exercise price of $2.22 a share. It also issued 1.3 million pre-funded warrants with each warrant exercisable for one share of common stock and the purchase of the 1.3 million shares.

On 14 March, SBFM received gross proceeds of $8m before deducting transaction related expenses payable by the company.

Sunshine Biopharma stock buy, sell or hold?

At the time of writing (13 April), fintech company Macroaxis’s outlook for the stock was relatively neutral:

According to Macroaxis’ Sunshine Biopharma stock price target, the real value of the stock was estimated at $6.56, but could fall as low as $0.32 on the downside, and rise as high as $37.88 on the upside.

However, the analyst warned that SBFM’s stock price fluctuation was “extremely dangerous at this time”.

Sunshine Biopharma stock forecast

Forecast data provider Wallet Investor’s SBFM stock price forecast was bullish, as of 13 April, expecting the stock to rise to $5.65 in a year’s time and climb to $7.20 in the next five years.

A second analyst, Gov Capital, suggested that the stock price could be mostly stable in the short term. Gov Capital’s SBFM stock future price projection was at $5.30 in the next 12 months, falling in the next five years to $5.03.

According to AI Pickup, SBFM share price was predicted to fall to new lows in 2025 to 2032. The data provider forecast the average SBFM share price could fall to $2.56 in 2022, rising to $2.77 in 2023, and falling again to $1.90 in 2024. By 2025, the average SBFM’s stock price could plunge to $0.71 in 2025, $0.25 in 2026, $0.22 in 2027 and $0.20 in 2028. The downtrend could continue in 2029. The stock price was expected to fall to $0.14, reaching $0.12 in 2030 to 2032.

When considering whether to invest in the company’s stock, you should always do your own research, considering the outlook and relevant market conditions. A number of factors dictate whether stock prices rise or fall, including the company’s fundamentals and broader macro-economic factors. There are no guarantees. Markets are volatile. You should conduct your own analysis, taking in such things as the environment in which it trades and your risk tolerance. And never invest money that you cannot afford to lose.

FAQs

Is Sunshine Biopharma a good stock to buy?

Whether Sunshine Biopharma is a good stock for you to buy or not will depend on your investing goals and portfolio composition, among other factors. You should do your own research. And never invest money you cannot afford to lose.

Why has the SBFM stock price been going up?

The SBFM stock price has been going up recently because of the positive laboratory result of its cancer drugs. However, FX Street analyst Ivan Brian has warned that the commercialisation period of drugs can be long, which could affect the outlook for the company share price.

Will SBFM stock price go up or down?

Analysts are mixed about the SBFM stock prediction. Wallet Investor and Gov Capital expect SBFM price to rise in 2023 to 2028, but AI Pickup expects it to fall to below $0.20 in 2028 to 2032. Analysts’ forecasts can be wrong. Always do your own research before investing.