Porsche demerger: Volkswagen spin-off plans confirmed but geopolitical tensions could cause it to backtrack

Porsche demerger could be on the rocks due to geopolitical tensions.

Its official. Volkswagen (VOW3) announced on 5 September its plan to spin-off its luxury car division, Porsche in an initial public offering (IPO) on 29 Sepetmber, under ticker symbol (P911) but analysts are worried that the current macro environment may lead to a turbulent journey for Porsche IPO.

"One of the absolute key risks to the Porsche stock is the growing cost-of-living crisis as soaring energy costs are reducing disposable incomes in Europe. The sector that is the most at risk from lower demand during this challenging period is the consumer discretionary sector in which the car industry sits," Saxo Bank’s Head of Equity Strategy, Peter Garnry wrote in a note.

"While Porsche is in the high-end of the car industry selling to the 1% of the income and wealth distribution this part of society could also significantly reduce its consumption during the ongoing energy crisis and inflationary period. Because Porsche buyers are wealthy individuals it is not unreasonable to speculate that falling equity and bond markets could severely impact sentiment among the 1% richest of the world."

Garnry points out that a further risk for Porsche is if the EUR stages a strong comeback as it would the value of international sales and reduce its competitiveness abroad. The war in Ukraine or new Covid outbreaks can impact supply chains and demand for Porsche cars.

Volkswagen (VOW3) share price chart

Investors unsure of Blume

The day after the announcement on 6 Sepetmber, VOW3 share price rose by 5% and Porsche could be valued at as much as €75bn ($75.2bn) when it floats on the Frankfurt stock exchange

To prepare for the IPO, VW announced that the share capital for Porsche has been divided into 50% preference shares and 50% ordinary shares. As part of the IPO, "a total of up to 25% of the preferred shares in Porsche AG would be placed with investors from the holding of Volkswagen AG."

"In connection with the intended IPO, Porsche Automobil Holding SE would acquire 25% plus one share in the ordinary share capital of Dr. Ing. h.c. F. Porsche AG from Volkswagen AG at the placement price of the preference shares plus a premium of 7.5%," a VW statement continued.

VW has already confirmed that Qatar Investment Authority will buy a 4.99% stake in Porsche and apparently it has had further interest from T Rowe Price Group Inc.

But with the IPO going ahead now, there may be further uncertainty around the leadership of VOW3 and its ability to move forward with the Porsche stock market debut.

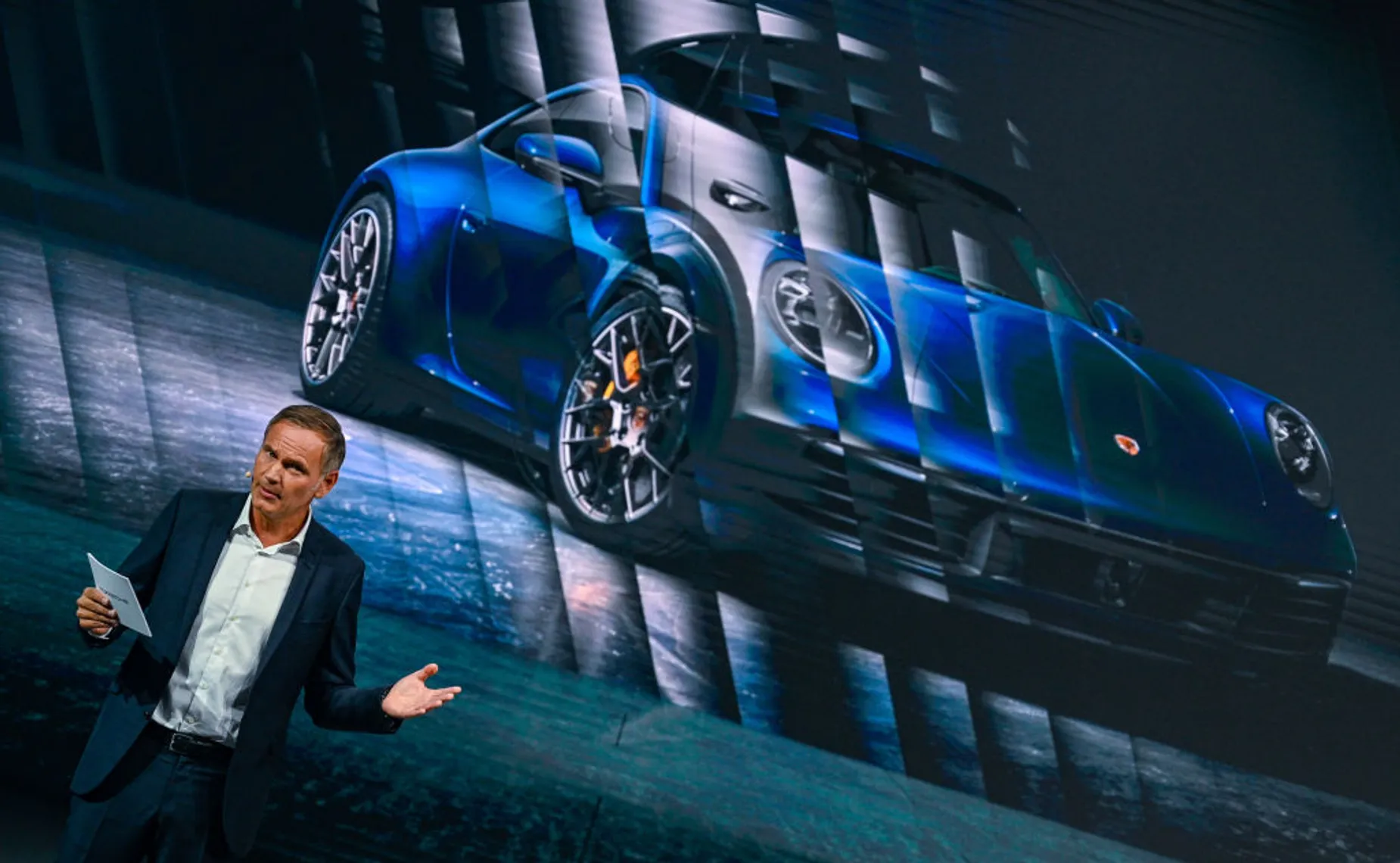

The VOW3 board voted on July 22 to oust current CEO, Herbert Diess and replace him with Oliver Blume, who is the CEO of Porsche. The change will come into place on September 1 and Blume will hold the dual role of CEO at both Porsche, as well as its parent company.

Now that VOW3 is about to change leadership, some investors believe under Blume’s leadership that a Porsche Initial Public Offering (IPO) will not be able to move forward.

Out of 58 institutional investors with holdings in VW polled by Bernstein Research, nearly three quarters viewed Blume as a negative influence when it comes to the prospects of a Porsche listing. Over 60% polled had concerns about Diess’ departure and that it could hurt VW’s stock performance.

With that said, in February, executive chairman and founder of Square Financial, Philippe Ghanem, said that despite intense market tensions, with rising inflation and the conflict in Ukraine, the timing is still right for a Porsche listing.

“It’s not at all a bad idea. You, as an investor, want to see solid companies with solid management. You like to see such good leadership exposed in the market,” he says.

Ghanem gave Ferrari (RACEm) as an example, which used to be a private company but proved to be a success when it was listed on the stock exchange because many were passionate about the brand. He argued that Porsche, which he described as a unicorn brand, has that ‘X Factor’ too.

Ferrari (RACEm) share price chart

Ghanem explained: “Their iconic cars from the 80s/90s have huge value. People want to invest and be exposed to a solid asset and the share would be viewed in the same way. The shares will be considered as an asset and people will boast that ‘they own some Porsche’.”

Volkswagen (VOW3) and Porsche SE, which is its top shareholder, drew up a preliminary agreement in February to list Porsche and it was described as one of the largest stock market debuts.

It’s thought that VOW3 wanted to list Porsche to raise capital for its Electric Vehicle (EV) range. Research from Bloomberg Intelligence (BI) has also shown that Tesla (TSLA) will keep the EV crown for at least another 18 months, but that the automaker will struggle to sell a meaningful share of EVs in 2022 and 2023 and the throne could soon be usurped - by VW.

Its also believed that Porsche themselves will be pushing to enter the EV race.

"The main question for potential shareholders in Porsche is whether the company can make a successful transition to become fully EV while preserving or even expanding margins. It is clear when you compare Porsche to Ferrari that there is room for improvement and a potential upside if Porsche can improve its operations and expand on its already strong brand," Garnry added.

"Volkswagen has promised that synergies will continue to exist between the Volkswagen group and Porsche, but for the future success of Porsche we believe the key is more autonomy."

Tesla (TSLA) share price chart

VOW3 share price has fallen 20% this year and, like most car companies, has been plagued by issues with production due to the semiconductor shortage.

Capital.com Chief Market Strategist David Jones said: “2021 was a tough year for the car sector, with the global chip shortage meaning that many have had to drastically cut back vehicle production. This goes some way of explaining VW's poor performance in the second half of 2021.”