Pakistani rupee forecast: Tightening foreign exchange reserves and political uncertainty pressure the PKR

What lies in store for the Pakistani rupee in the upcoming new year and beyond?

The Pakistani rupee (PKR) rebounded against other currencies in October, having approached July’s record lows in September. However, it has been trending lower again as the country’s foreign currency reserves continue falling and political instability weighs on sentiment.

The rupee plunged to record lows against the US dollar (USD) and euro (EUR) towards the end of July, trading above 240 to the USD, and revisited the lows in September. The PKR then strengthened in October as the dollar retreated, but weakened in November.

What has been driving the volatility in the value of the rupee against other currencies, and how is it expected to perform in the future? Will it continue to rebound or come under renewed pressure? In this article, we review the latest Pakistani rupee forecast outlook.

What is the PKR?

PKR is the abbreviation for the Pakistani rupee, the official currency of Pakistan.

The value of the PKR is measured against other currencies, creating the exchange rate. For example, PKR/USD measures the value of the rupee against the US dollar. The exchange rate determines how many rupees are needed to buy one dollar, which is the currency used in international trade and determines the cost of imports into Pakistan.

What drives the Pakistani rupee?

What determines the value of Pakistan’s rupee? Foreign exchange (forex) rates are typically driven by a country’s economic growth, the value of its imports and exports, and monetary policy, which determine whether the country is an attractive destination for investments and whether the currency is in demand.

As a consumption-based economy, Pakistan relies on imports of commodities, such as steel, chemicals and plastic. The country’s imports have soared over the past two years, increasing the trade deficit and draining its foreign currency reserves.

Pakistan’s trade deficit in US dollar terms widened by 28.89% month-on-month in August, climbing to $3.53bn, compared to $2.73bn in July. Imports decreased by 8.26%, according to data from Pakistan’s Bureau of Statistics. The decline in imports reduced demand for dollars, which had put pressure on the country’s foreign exchange reserves.

Historical PKR performance

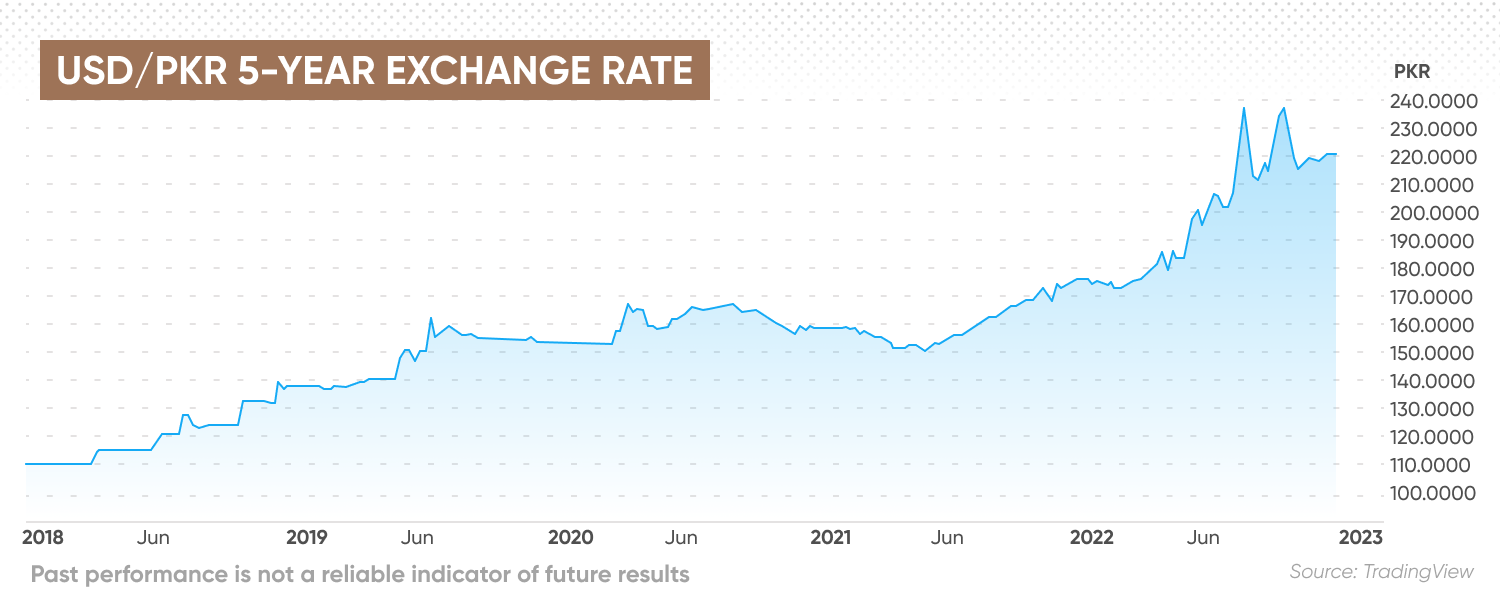

The Pakistani rupee has been in decline against other currencies, such as the US dollar, Indian rupee and the euro, since early 2018, when it transitioned to a free-floating exchange rate against the USD from a managed rate.

The Pakistani rupee has been in decline against other currencies, such as the US dollar, Indian rupee and the euro, since early 2018, when it transitioned to a free-floating exchange rate against the USD from a managed rate.

Pakistan has since faced ballooning trade deficits and repeated currency devaluations.

The Pakistan rupee has fallen in value against the US dollar. It took140 rupees to buy one dollar at the start of 2019 and 160 by the end of 2020 as the US dollar strengthened during the Covid-19 pandemic.

The decline in the value of the rupee accelerated in the second half of last year, with the USD/PKR currency pair surpassing 200 rupees for the first time in May 2021.

The exchange rate ended 2021 at 176.20.

Part of the reason for the devaluation was the collapse of the banking system in neighbouring Afghanistan following the US withdrawal in August 2021, with local media reports indicating $2m was taken across the border from Pakistan into Afghanistan every day, contributing to the dollar shortage in Pakistan.

Pakistani rupee performance in 2022

The State Bank of Pakistan (SBP) has been using the country’s foreign currency reserves to try to slow the rupee’s depreciation in 2022, further reducing the number of US dollars left in the country.

The rupee’s decline accelerated in April when Prime Minister Imran Khan was ousted in a no-confidence vote and the government collapsed, putting at risk the country’s loans from the International Monetary Fund (IMF). The rupee lost 15% of its value in July, sliding to a rate of more than 240 against the US dollar on 28 July.

But the IMF indicated that by increasing its petroleum development levy (PDL), Pakistan met the preconditions for a loan under its seventh Extended Fund Facility (EFF) programme review.

Pakistan’s government has taken action to support the currency. At its meeting on 7 July, the SBP’s Monetary Policy Committee (MPC) raised its headline interest rate by 125 basis points (bps) to 15% and provided incentives for exports.

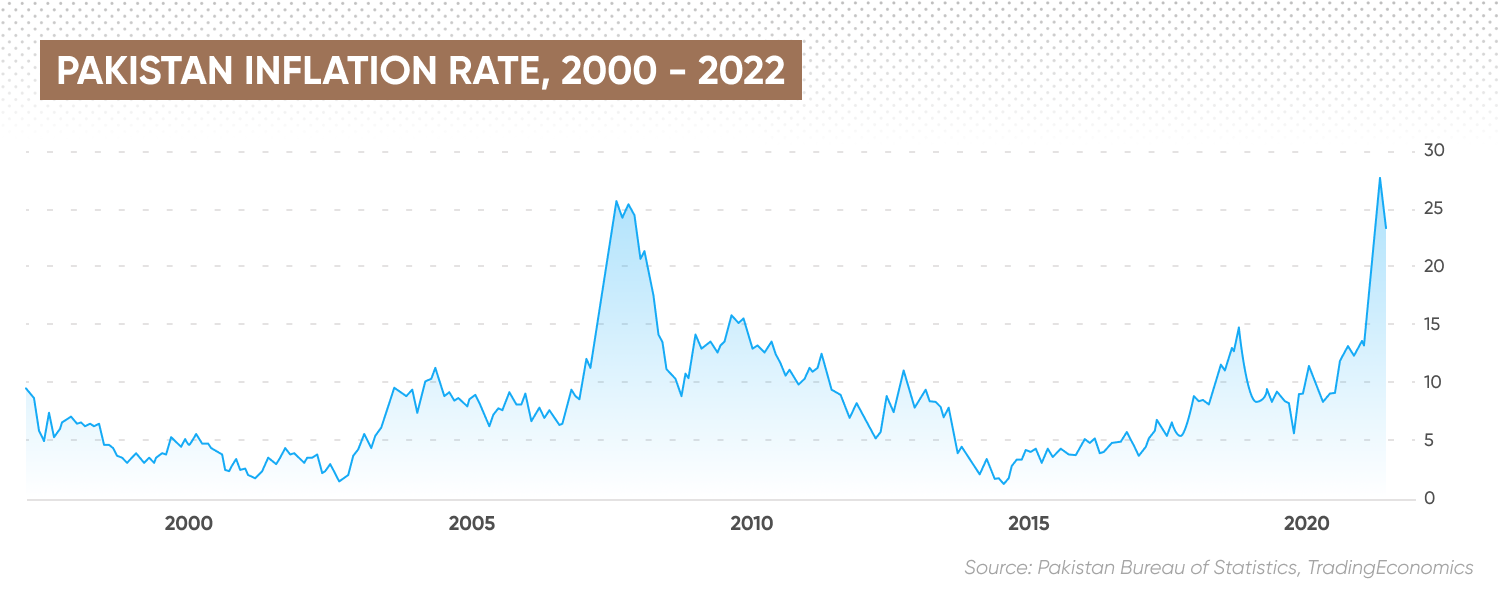

On 25 November, the SBP raised the rate by another 100 bps to 16% in response to inflationary pressures that “have proven to be stronger and more persistent than expected”.

“Food prices have also accelerated significantly due to crop damage from the recent floods, and core inflation has risen further. Second, a sharp decline in imports led to a significant moderation in the current account deficit in both September and October. Despite this moderation and fresh funding from the ADB, external account challenges persist,” according to the MPC statement.

“Third, after incorporating the Post-Disaster Needs Assessment of the floods and latest developments, the FY23 projections for growth of around 2 percent and a current account deficit of around 3 percent of GDP shared in the last monetary policy statement are re-affirmed. However, higher food prices and core inflation are now expected to push average FY23 inflation up to 21%-23%.”

However, the MPC added that “while inflation is likely to be more persistent than previously anticipated, it is still expected to fall toward the upper range of the 5%-7% medium-term target by the end of FY24, supported by prudent macroeconomic policies, orderly rupee movement, normalising global commodity prices and beneficial base effects.”

Weekly SBP data showed that the country’s foreign currency reserves fell to $6.7bn on 2 December, down from $7.96bn a month earlier and $17.69bn in December 2021.

Pakistan’s trade deficit narrowed to PKR640.6bn ($2.88bn) in November from over PKR1trn in June, but was up by around 24% from October, according to Statistics Bureau data.

The rupee found some relief in October, as trade data for September showed a 39.99% year-on-year (YOY) increase in exports in July to September in rupee terms, outpacing a 19.35% increase in imports. In dollar terms, imports fell by 12.37%, allowing more dollars to stay in the country.

On 3 November, former Prime Minister Imran Khan was wounded in an assassination attempt. Khan has been calling for early elections since he was removed from office but was disqualified from holding public office by the Election Commission of Pakistan on October 21. The next election is due in October 2023. Khan resumed his rallies on 26 November.

The USD/PKR pair retreated to 213.65 in mid-August before rebounding to 239.85 on 23 September. The pair retreated again to 217.15 on 11 October, but it trended higher in November, reaching the 224 level on 9 December.

Against the euro, the rupee fell from its high of 245.74 in July to 215.40 in August, rebounding to 240.34 in September. The EUR/PKR pair then declined to 210.78 on 11 October, but was trading around 237 on 9 December as the rupee weakened.

What is the Pakistani rupee forecast outlook against other currencies in the current environment? Will the government’s policies provide support to the rupee or will it shed more value on the international forex markets? Read on for the latest PKR forecast analysis.

Pakistani rupee forecast: Will the rupee rebound?

An analysis by Trading Economics showed that the Pakistani rupee could see more downward pressure as political turmoil continues and as the US dollar and commodities remain high, weighing on the country’s reserves and threatening the external position and public financing conditions.

USD/PKR forecast

In its Pakistani rupee forecast for 2023 (as of 9 December),Trading Economics expected the USD/PKR exchange rate to move back towards the 240 low, trading at 239.149 in 12 months’ time from 227.43 at the end of 2022, based on global macro models and analysts’ expectations.

The USD/PKR forecast by algorithm-based service Wallet Investor estimated that the exchange rate could move to stabilise around 224 over the next few weeks to the start of January 2023. But the site’s long-term Pakistani rupee forecast for 2025 indicated that the pair could move past the 240 level again, ending the year at 274.90, and subsequently reach 308.47 in five years’ time – pointing to a fresh low for the value of the rupee.

EUR/PKR forecast

The rupee was expected to be relatively stable against the euro, with the EUR/PKR exchange rate moving from 235.832 at the end of the quarter to 236.137 in one year, according to Trading Economics’ PKR prediction.

But Wallet Investor’s PKR forecast predicted that the EUR/PKR pair could rise to new highs, from 236.876 at the start of 2023 to 251.491 at the end of the year, 280.801 at the end of 2025 and 309.424 in five years’ time.

Given the volatility of foreign exchange markets, analysts and forecasters have yet to issue a Pakistani rupee forecast 2030.

When considering any Pakistani rupee forecast, it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any trading decision. Keep in mind that past performance is no guarantee of future returns. And never invest more than you can afford to lose.

Stay up to date with the major forex pairs using our currency strength meter.

FAQs

Why is the Pakistani rupee falling?

The Pakistani rupee dropped to record lows against the US dollar and other currencies in July as the country faces tightening foreign exchange reserves, a high trade deficit and political uncertainty. The PKR has since gained some traction in the face of a weakening dollar.

Will the Pakistani rupee get stronger in 2022?

The direction of the rupee for the rest of the year could on the central bank’s policies in protecting the country’s foreign exchange reserves, as well as the size of the country’s trade deficit and the political landscape.

Is it a good time to buy the Pakistani rupee?

Whether it is a good time to buy the Pakistani rupee will depend on your trading strategy, risk tolerance and portfolio composition. You should do your own research so you can make informed trading decisions based on your personal circumstances. And never trade more than you can afford to lose.