Pinterest (PINS) stock forecast: Can content quality give a boost?

San Francisco-based social networking service Pinterest (PINS) had a volatile ride last year.

The company’s measures to improve the quality of content on its network gave the stock a push. But the decline in global monthly active users (MAUs) hit the share price.

Can the price gain momentum, and what factors will shape Pinterest stock projections in 2022?

Pinterest stock analysis

Pinterest stock plunged 60% over 2021. On 12 February that year the company announced that ‘Pinners’ would get access to videos from the runway, behind the scenes photos and more from New York Fashion Week by way of a partnership with Launchmetrics. On 16 February, Pinterest stock reached an all-time high of $89.15.

The stock is currently trading 70% below its record level (as of 10 February, 2022). After a series of lower highs and lower lows, the price action reversed, wiping out 60% of Pinterest value between February and December 2021. In 2022, the stock lost another 30% amid wider market volatility.

As of the time of writing (10 February), the one-day relative strength index (RSI) was pointing to ‘neutral’ at 36.41. An RSI reading of 30 or below would indicate the asset is in an undervalued condition, which may signal a trend reversal.

The stock’s commodity channel index (CCI) reading of -94 also identified the security as ‘neutral’. The commodity channel index is a momentum-based oscillator that weighs the current mean price against the average mean price over 20 periods. A reading of negative to near zero to over 100 may indicate an upward tendency in the stock’s price.

Stock fundamental analysis: 2021 earnings

Pinterest surpassed $2bn in unaudited revenue in 2021 for the first time, and attained its first full year of GAAP profitability in 2021. The company’s full-year revenue for 2021 reached $2.578bn, up 52% from $1.692bn a year earlier.

The company recorded unaudited net income of $316.438m, a rise from a net loss of $128.323m in 2020. Full-year diluted earnings per share were $0.46, up from a loss of $0.22 a year earlier. Adjusted EBITDA surged 167% to $814.369m from $305.004m over the reported period.

Global MAUs decreased 6% to 431 million in 2021 from 459 million in 2020. Average revenue per user (ARPU) stood at $5.79 in the reported period, marking an increase of 36% from $4.26 a year earlier.

Pinterest’s 2022 guidance

Looking ahead, the company announced that it expected its first-quarter 2022 revenue to grow “in the high teens percentage range” on a year-over-year basis.

For 2022, non-GAAP operating expenses are expected to grow nearly 40% from 2021, owing to higher investment in its native content ecosystem, core Pinner experience, and increased headcount across research and development, and sales and marketing.

“As we look ahead to 2022, we plan to further invest in our business as we scale the distribution of Idea Pins through our creator-led content efforts and enhance our core Pinner experience and shopping to make Pinterest the destination for inspiration and action on the internet,” said Ben Silbermann, Pinterest’s CEO and co-founder.

Factors that may impact PINS stock ahead

Pinterest has taken aggressive measures over the last six months to ramp up its content to attract more users to the platform.

In October 2021, Pinterest appointed Malik Ducard as its new chief content officer. Ducard is now responsible for developing the content strategy, directing the creative vision and building relationships with the creators’ community. Ducard has previously worked at YouTube as a vice president of content partnerships.

In October 2021, the company introduced Pinterest TV, which allows users to watch and shop across various categories such as food, beauty, home and do-it-yourself (DIY). Pinterest TV features a series of live, original and shoppable episodes featuring creators on the social media platform.

In late 2021, Pinterest acquired video creation and editing app Vochi. According to Bin Liu, Head of Creators Engineering at Pinterest, the company aims “to create a place where Pinners can go from inspiration to realisation”, and have more creator tools to help attain its goal.

In the most recent Pinterest stock news, in January 2022 the company unveiled Try On for Home Decor, an augmented reality-based shopping experience where users can shop on the platform with the help of AR.

Users can use the Pinterest Lens camera to virtually place items in their home and have a “try before they buy” experience. The new idea features furniture from US retailers like Crate & Barrel, CB2, Walmart, West Elm and Wayfair.

Pinterest (PINS) stock forecast

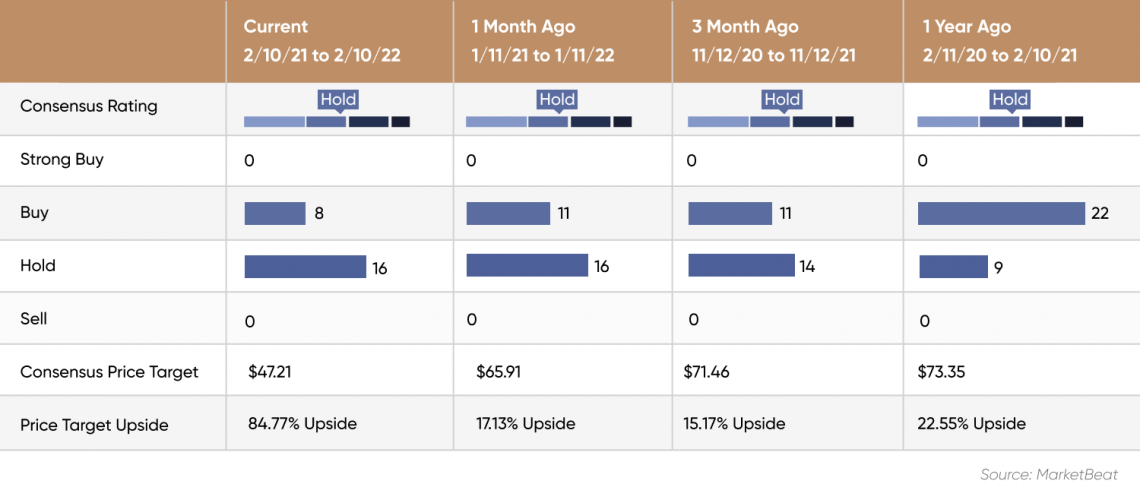

Analyst ratings compiled by MarketBeat shared different price targets for Pinterest stock. The consensus rating was ‘hold’, based on 24 analysts’ views, as of 10 February 2022. Of the 24 analysts covering the stock, eight rated it as a ‘buy’, while the remaining 16 rated it a ‘hold’.

The analysts’ consensus 12-month PINS stock price target was $47.21. It had an upside potential of 76.15% based on the 9 February closing price of $26.80. Stock projections varied from the low price target of $33 to a high of $105.

Of the most recent ratings, JPMorgan Chase & Co. analyst Doug Anmuth lowered his price target from $55 to $50, with a ‘neutral’ rating. MKM Partners’ Rohit Kulkarni also lowered the Pinterest share price forecast from $74 to $60, giving it a ‘buy’ rating.

According to the algorithm-based PINS stock forecast from Wallet Investor, as of 10 February, Pinterest stock could reach $25.103 by the end of December 2022, $26.938 by the end of December 2023, $28.828 by the end of 2024 and $30.960 by the end of 2025.

Although Wallet Investor did not provide targets for 2030, its longer-term Pinterest stock prediction expected the price to hit $33.056 in December 2026 and $33.586 in February 2027.

When looking for Pinterest stock projections, it’s important to bear in mind that forecasts can be wrong. Projections are based on fundamental analysis of the company’s balance sheet and technical analysis of the PINS stock performance. Past performance is no guarantee of future results.

It is vital to do your own research, and remember that your decision to trade or invest should depend on your attitude to risk, your expertise in the market, the spread of your portfolio and how comfortable you feel about losing money. Remember, you should never invest or trade money you cannot afford to lose.

FAQs

Is the Pinterest stock a buy?

Analyst ratings compiled by MarketBeat shared different price targets for the stock. The consensus rating was ‘hold’ based on 24 analysts’ views. as of 10 February 2022. Of 24 analysts covering the stock, eight rated it a ‘buy’, while the remaining 16 rated it a ‘hold’.

Note that price predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

Why has the Pinterest stock price been dropping?

The decline in the platform’s number of active users is a major reason behind the price decline. According to the company’s latest earnings release, its MAUs fell 6% year over year to 431 million in 2021 from 459 million in 2020.

Will Pinterest stock go up or down?

Several factors determine whether a company’s stock price increases or declines. Some of these are dependent on the company’s overall performance, while there are also broader macro-economic factors at play.

Among the 24 analysts’ ratings compiled by MarketBeat, the consensus 12-month PINS stock price target was $47.21 (as of 10 February 2022). It had an upside potential of 76.15% based on the 9 February closing price of $26.80. The stock projections varied from the low price target of $33 to a high of $105.

Note that price predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

Markets in this article