Lululemon (LULU) stock forecast: Will it continue rising?

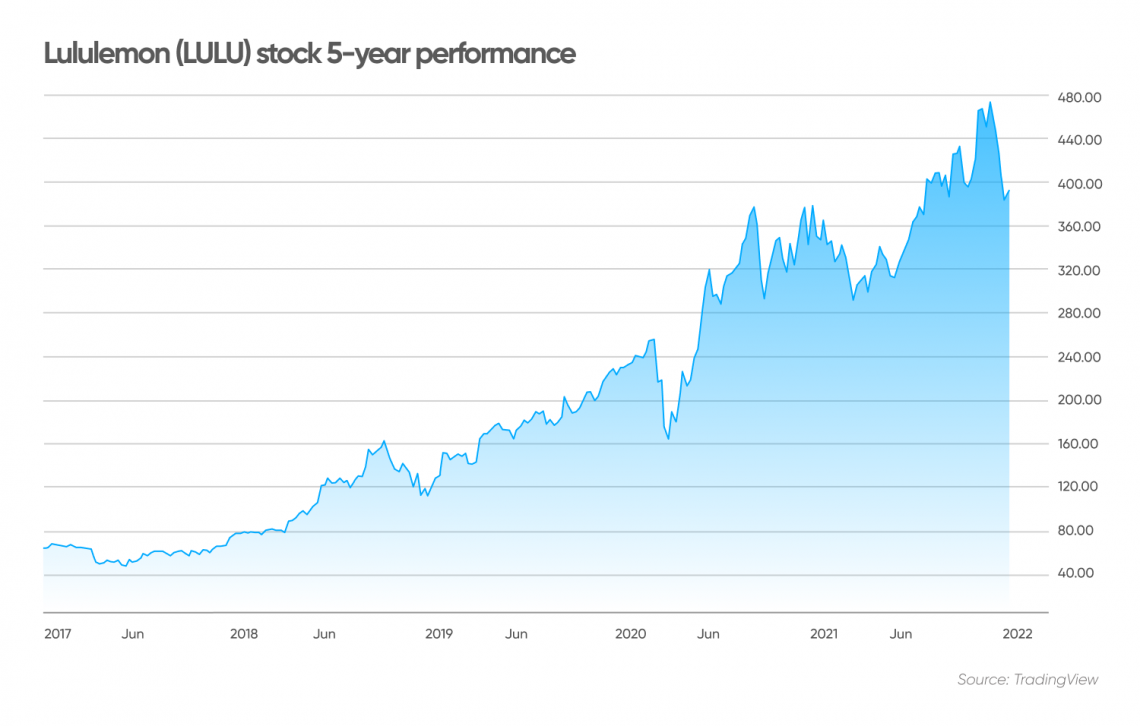

Sportswear brand Lululemon Athletica has been a remarkable success story for investors, with its stock having risen 508% over the past five years.

The yoga-inspired apparel company was founded by Chip Wilson in Vancouver, Canada, in 1998 and now boasts a market capitalisation of $50.62bn.

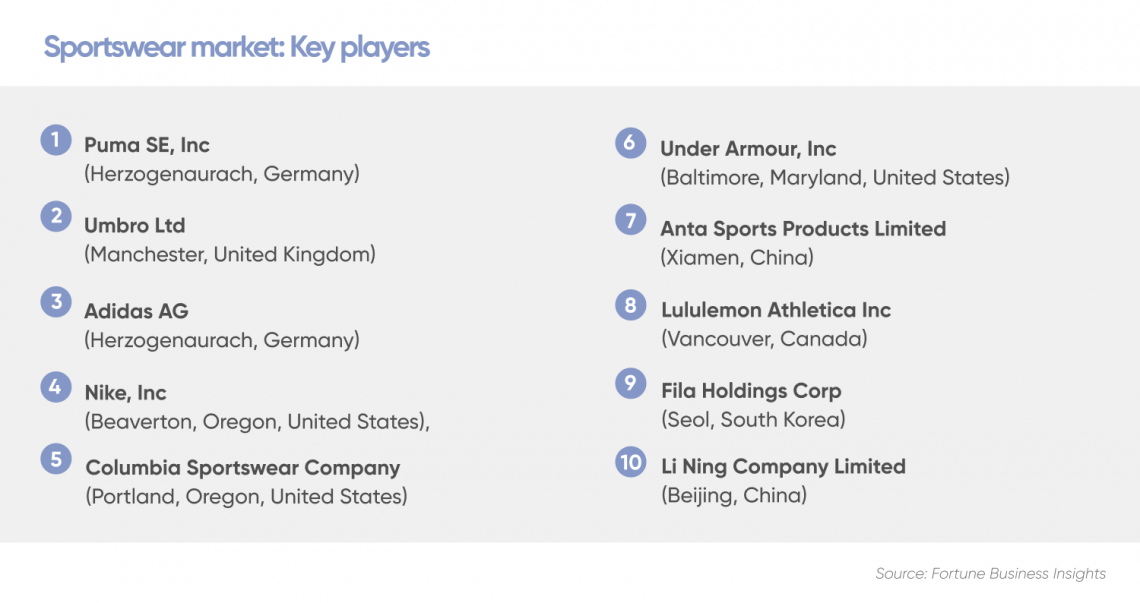

This makes it the third biggest sporting goods brand behind industry giants Nike and Adidas, according to companiesmarketcap.com.

LULU stock rose10% from $356.40 at the start of January to $391.56 by the market close on 23 December 2021.

But what’s next for the brand, which makes a wide range of yoga, running, cycling and training clothes? Here we analyse the recent results and consider its future prospects.

LULU stock news: Latest results

In early December 2021, the Vancouver-based company reported net revenue had increased 30% to $1.5bn in the third quarter ended 31 October, in comparison to the same period in 2020.

As far as regional analysis is concerned, net revenue was up 28% in North America, and increased 40% internationally.

Total comparable sales increased 27%, with comparable store sales up 32% and direct to consumer net revenue rising 23% to $586.5m.

Gross profit increased 32% to $829.4m, while the gross margin rose 110 basis points to 57.2%.

According to Meghan Frank, Lululemon’s chief financial officer, continuing to execute at a high level enabled a strong third quarter performance and the upward revision to guidance.

Outlook for Lululemon: Full-year guidance

According to the company’s statement, net revenue for the fourth quarter is expected to be in the range of $2.125bn to $2.165bn.

Diluted earnings per share, meanwhile, should be between $3.24 and $3.31 for the quarter, with adjusted diluted earnings per share in the range of $3.25 to $3.32.

“For 2021, we expect net revenue to be in the range of $6.250bn to $6.290bn,” it stated. “Diluted earnings per share are expected to be in the range of $7.38 to $7.45 for the year.”

Chief executive Calvin McDonald believes the results demonstrate the “ongoing strength” of Lululemon and its tremendous near-term and long-term growth potential.

“We are pleased with our early holiday season performance and how the lululemon brand continues to resonate in markets around the world,” he said.

McDonald is also optimistic about future prospects.

Lululemon stock analysis: What are the global trends?

The global sportswear market is expected to gain momentum and reach $267.61bn by 2028 from $170.94bn in 2021, according to a report from Fortune Business Insights.

The study, which predicts a compound annual growth rate of 6.6% between 2021 and 2028, points out that the market stood at $160.61bn in 2020.

“The rising demand for comfortable yet stylish apparel is driving the sports wearables market growth,” it stated. “During the lockdown, consumption has increased even more.”

The report highlights the use of such products while playing sport and exercising, as well as simply relaxing at home.

Lululemon stock prediction: What do the analysts say?

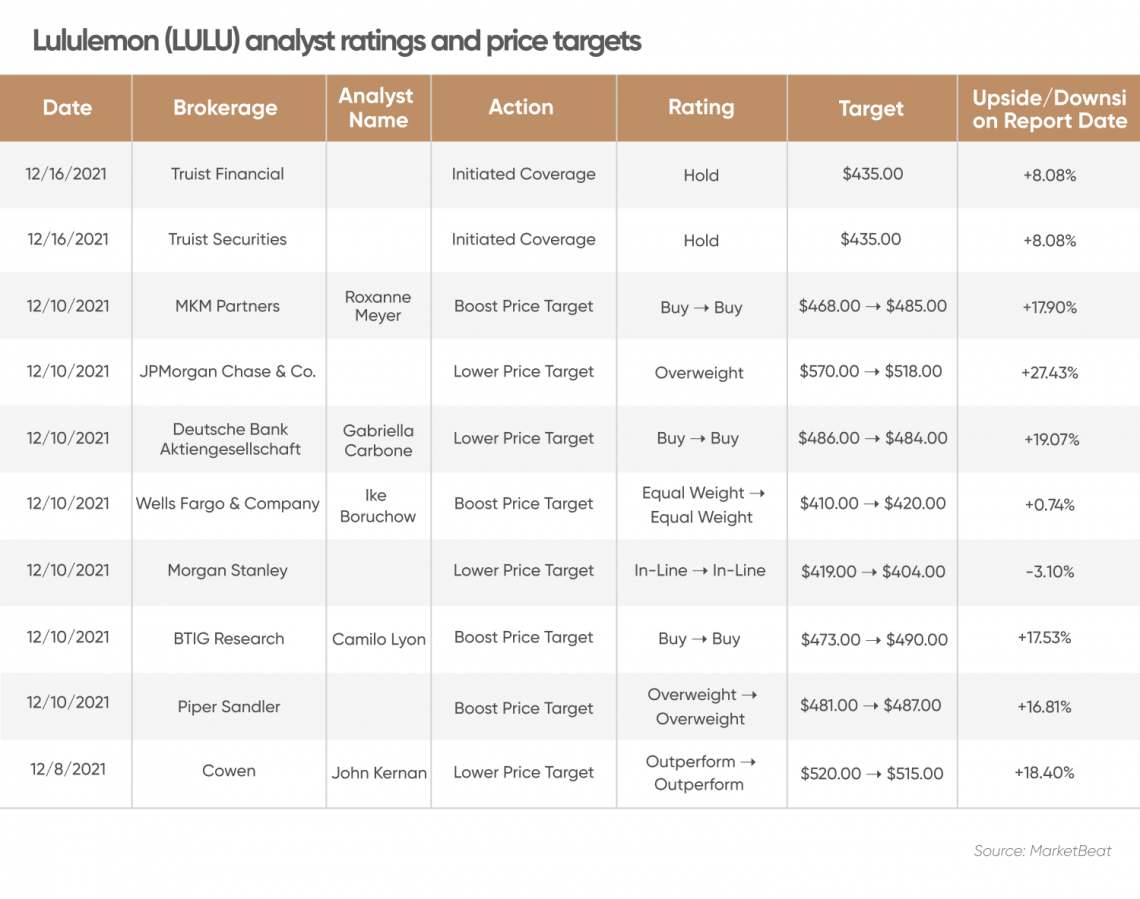

Matthew Boss, an analyst at JP Morgan, has an ‘overweight’ recommendation on the stock and a price target of $518 by December 2022.

In a broker note written on 10 December 2021, he highlighted how the brand still had an untapped international opportunity.

Boss pointed out the possibility of pushing out into newer categories, such as personal care, as well as the likelihood of benefiting from ongoing growth in the e-commerce business.

However, he also acknowledged potential risks to the rating and price target.

Over the longer term, Boss noted, management is guiding to further gross margin improvement from current levels.

“With the need for ongoing supply chain investments and spending in support of the international/omnichannel and brand building, margins are likely to remain under pressure, particularly if the top-line environment remains volatile,” he added.

According to Danni Hewson, financial analyst at AJ Bell, LULU could benefit from the current enthusiasm for sportswear.

Hewson believes Lululemon is a brand “with a host of admirers” and that the expanding group has helped increase sales over the first three quarters of this year.

“It knows its consumer, it innovates constantly, and it’s making real headway with new markets,” she said.

Hewson acknowledged its $500m acquisition of digital workout experience, Mirror, hadn’t quite delivered the expected bang for buck, but attributes that to people being fed up with home workouts.

David Swartz, equity analyst at Morningstar, believes LULU has a “solid plan” to expand its product assortment and geographic reach, while building its core business.

“While the coronavirus pandemic has been a challenge, we believe the firm benefits from the athleisure fashion trend and will continue to achieve premium pricing due to the brand’s popularity and the styling and quality of its products,” he wrote in a recent broker note.

Swartz expects Lululemon’s e-commerce operations to become “increasingly important” and sees opportunity for the business to expand outside of North America.

Longer-term Swartz forecasts that 2030 sales outside of North America will reach $3.6bn, up from about $1bn in 2021, and account for 23% of total sales.

Is Lululemon stock a buy, sell or hold?

Lululemon stock was rated as a ‘buy’, according to the consensus view of 24 analysts compiled by MarketBeat (as of 27 December).

Eighteen analysts shared ‘buy’ recommendations, while six believed it was a ‘hold’. Their consensus 12-month Lululemon share price forecast was $469.77, which would be a potential increase of 20% over the current price.

The LULU stock has been rated by around 14 analysts over the past 90 days, including JP Morgan, MKM Partners, Morgan Stanley and Piper Sandler.

Lululemon (LULU) stock forecast: How high could the price go?

According to the algorithmic forecasting of WalletInvestor (as of 27 December 2021), LULU stock was a “good long-term (one-year) investment that could rise almost 20% from $391.56 to $468.68 over the next 12 months to December 2022.

The site even forecasted the stock could possibly hit $569.21 by December 2023, before rising to $668.22 a year later, and reaching $765.52 by December 2025.

Its LULU five year stock forecast to December 2026, meanwhile, suggested it could reach $857.93, which would represent a 119% increase over its last closing price of $391.56 level.

When looking for Lululemon stock predictions, it’s important to bear in mind that analysts’ forecasts can be wrong. Projections are based on making fundamental and technical studies of the LULU stock’s performance. Past performance is no guarantee of future results.

It is important to do your own research and always remember your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never invest money that you cannot afford to lose.

FAQ:

Is Lululemon a good stock to buy?

Whether LULU is a suitable investment depends on your own investment objectives – and the opinion based on your own research. Remember, it’s important to reach your own conclusion of the company’s prospects and likelihood of achieving analysts’ targets.

Will Lululemon stock go up?

There are no guarantees. The consensus forecast of analysts (as of 27 December) was that the stock could reach $469.77 over the next 12 months. This would represent an increase of almost 20% over the $391.56 level at market close on 23 December. However, these predictions may turn out to be inaccurate.

How high can Lululemon stock go?

It’s impossible to know for definite whether the stock will continue rising or how high it can reach. Analysts outlined above believe the company has strong growth potential. Algorithmic forecasts by WalletInvestor suggested it could rise to $857.93 over the next five years. Still, analyst price targets can be wrong.

Read more: Microsoft stock forecast: Will the MSFT continue rising?

Markets in this article