Key takeaways

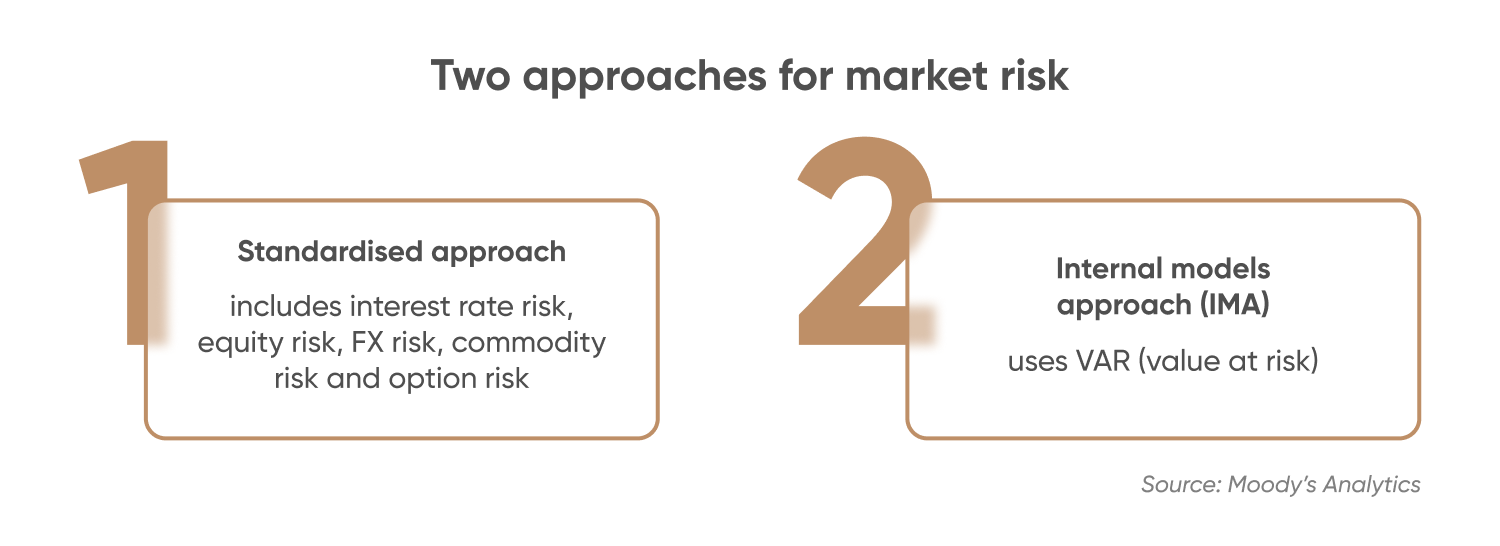

Internal models approach for market risk is one of two statistical approaches that banks can use to calculate or determine the amount of capital they require based on market risks. The greater the risk, the greater the capital requirement for a bank. The other one is the standardised approach.

Key takeaways

-

Internal models approach is one of two Basel Accord methodologies allowing banks to calculate market risk capital requirements using proprietary in-house measures instead of standardized measurements.

-

The approach emerged in 1993-1995 as part of Basel Committee regulations requiring banks to maintain minimum capital adequacy ratios to cover credit, market, and operational risks.

-

Banks must meet strict requirements including supervisory approval, passing backtesting and P&L attribution tests, and maintaining at least 10% of capital based on qualifying trading desks evaluated quarterly.

-

The approach feeds bank trading data into computer models producing value-at-risk estimates representing the likely maximum portfolio loss at a certain statistical confidence level.

-

While internal models enable more accurate risk analysis and efficient control, they risk increasing inconsistencies and unnecessary variation across banks.

The definition of internal models approach suggested that banks are permitted to forego external measurements in favour of their own methods for assessing market risks, particularly risks brought on by developments in the financial markets, the economy and technology.

Key points

Internal models approach for market risk is one of two methodologies that banks can use to measure capital requirements based on market risks.

Internal models methodology allows banks to measure risks using their own in-house measures.

The approach is part of Basel regulation, which requires banks to measure and report minimum capital adequacy ratio.

Internal models approach explained

What does the internal models approach mean? We must first become familiar with the Basel Accords to fully comprehend internal model approach meaning.

The history of the Basel Accords

The Basel Accords are international banking supervision accords developed by the Basel Committee on Banking Supervision (BCBS). Based in Basel, Switzerland, the BCBS develops standards for banking regulation. It provides a forum for regular cooperation on banking supervisory matters.

BCBS was founded in 1974 in the aftermath of a series of disruptions in the international currency and banking markets including the 1973 oil crisis and the collapse of Bankhaus Herstatt in West Germany. The committee now has 45 members comprising central banks and bank supervisors from 28 jurisdictions.

Basel I, Basel II and Basel III are the three accords or banking regulations that BCBS has released since its founding. The Basel I Accord, which was signed in 1988, is credited with establishing the 8% minimum capital-to-risk-weighted asset ratio. The purpose of the minimum capital adequacy ratio is to guarantee that banks have enough capital to cover their anticipated and existing debts.

The accord evolved overtime to respond with the current development in the market. In June 2004, Basel II was released with a revised capital framework to replace the 1988 accord.

Basel III was released in 2010, following the Lehman Brothers collapse in 2008, which triggered the global financial crisis. The third accord strengthened the Basel II capital framework, including by requiring higher global minimum capital standards for commercial banks. The committee has continued to revise the standards and has proposed another set of banking reforms informally called ‘Basel IV.”

Under the Basel Accords, banks must measure and report minimum regulatory capital requirement for credit, market, and operational risks. To measure these risks, BCBS offered two risk-sensitive approaches: the Standardised Approach and Internal Model Approach.

Banks can choose between using risk weighting that are tied to external measures – the standardised methodology or by using banks proprietary in-house generated measures, the internal model approach.

In short, the internal models approach measures risks that an individual bank is exposed to using their own in-house data.

What is market risk?

According to the Basel Framework, market risk is the risk of losses in on and off-balance-sheet positions as a result of market price movements. This applies to the following risks:

The risks associated with the trading book's interest rate-related instruments and equities.

Foreign exchange and commodity risk exist throughout the bank.

How does the internal models approach work?

The internal models approach originally emerged during discussions on the proposals for applying capital charges to market risks in 1993. The committee proposed a standardised methodology to measure market risks. However, the industry commented that the standardised approach raised several issues, including that the proposals were not sufficiently compatible with banks' own measurement systems.

After several tests and reviews, the committee agreed to include the internal models approach.

General framework for internal models

In 1995, BSBC provided a general conceptual framework that serves as the foundation for the internal models approach to measuring market risk exposure.

Price and position data from the bank's trading activities are fed into a computer model, which produces a measure of the bank's market risk exposure, which is typically expressed in terms of value at risk. This measure represents an estimate of the likely maximum amount that could be lost on a bank's portfolio with a certain level of statistical confidence.

Requirement for using internal models approach (IMA) for market risks

Banks have to meet a long list of requirements to use an internal models approach (IMA). They include the following:

P&L attribution test and backtesting

Banks that intend to use the approach must conduct and successfully pass backtesting at bank-wide level as well as profit and loss (P&L) attribution (PLA) test.

For a bank to continue to be eligible to use the IMA to determine market risk capital requirements, at least 10% of the bank's aggregated market risk capital requirement must be based on positions held in trading desks that qualify for use of the bank's internal models for market risk capital requirements by passing the same backtesting and PLA tests. The bank must evaluate this 10% criterion on a quarterly basis.

Backtesting is used to compare the P&L values with the value at risk (VAR) figures.

Approval of the bank’s supervisory authority

The use of internal models to determine market risk capital requirements is subject to explicit approval from the bank's supervisory authority.

The supervisory authority will only approve a bank’s use of internal models to determine market risk capital requirements if these minimum conditions are met, including:

The supervisory authority is satisfied that the bank’s risk management system is conceptually sound and is implemented with integrity

The bank has a sufficient number of staff skilled in the use of sophisticated models not only in the trading area but also in the risk control, audit and, if necessary, back office areas

The bank’s trading desk risk management model has a proven track record of reasonable accuracy in measuring risk

Risks and benefits of using internal models approach

When a bank uses internal models to calculate its risk-weighted assets (RWAs), the guiding principle is that they can more accurately analyse risk factors and take control more efficiently.

The danger of using the internal models approach is that it could increase inconsistencies and unnecessary variation.