Indonesian rupiah forecast: IDR showing signs of life as inflation starts showing signs of easing

We look at the recent performance of the IDR in our Indonesian rupiah forecast round-up.

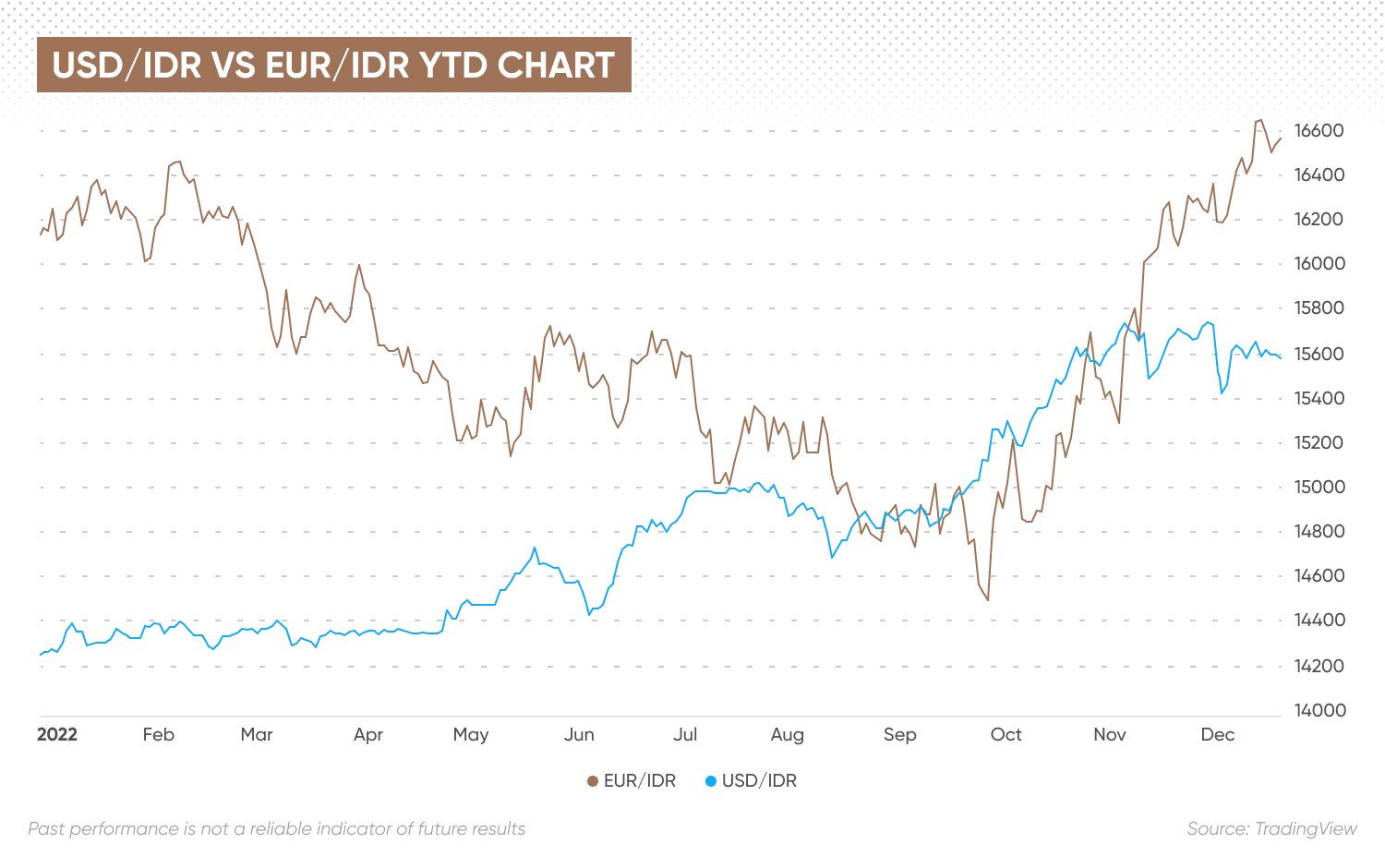

The Indonesian rupiah (IDR) has stabilised against the US dollar (USD) since early November. The greenback has softened against other currencies following a sharp run-up in 2022. But the rupiah has been trending lower against the euro (EUR) since late September, reversing previous gains to trade at its weakest level in a year.

What are the key drivers for the value of the rupiah? How do analysts expect the currency to trade in the future?

We look at the currency’s potential future heading into 2023.

What drives the IDR’s value?

The Indonesian rupiah is the official currency of Indonesia. It’s issued by the Bank Sentral Republik Indonesia (Central Bank of the Republic of Indonesia), also known as Bank Indonesia (BI). The rupiah has been Indonesia’s official currency since 1949, when it replaced the Indonesian Dutch East Indies guilder. After the currency depreciated sharply during the 1950s, BI introduced a new version of the rupiah in 1965 at a rate of 1,000 old rupiah to 1 new rupiah.

In recent years, the central bank has been calling on the Indonesian government to redenominate the rupiah, but lawmakers have yet to deliberate on the bill.

The value of the rupiah is driven by the growth of Indonesia’s economy, which is the largest in southeast Asia. Indonesia’s commodity exports and policies that regulate its exports play a key role, as well as monetary policy on interest rates and inflation. The country exports commodities, such as palm oil, coal, copper and nickel. Indonesia accounts for around one third of the world’s edible oil supply. It is the world’s largest exporter of palm oil, ahead of neighbouring Malaysia.

Rupiah exchange rates reflect global trends

The rupiah held its own against the US dollar and strengthened against the euro for the first few months of the year. The IDR was stable in the first quarter around the 14,300 level and shed just 3% against the USD in the six months to the end of August, while other Asian currencies such as the Thai baht and the South Korean fell by more than 10%. Indonesia’s exports outpaced imports for most of the year as the country benefited from rising commodity prices.

But the rupiah saw its largest monthly fall of the year in September, when it dropped by 2.5% as investors took into account declining foreign currency reserves, rising debt and an increase in foreign capital outflows. The country’s trade surpluses reached a record high in April, but subsequently narrowed.

The USD/IDR pair had briefly traded above 15,000 in July, but quickly retreated as the dollar pulled back on expectations of a more dovish turn in US monetary policy. However, as the US Federal Reserve (Fed) remained hawkish and the dollar climbed to fresh 20-year highs against a basket of other currencies, the pair moved back above the key level in September.

The USD/IDR rate reached 15,500 in late October, peaked above 15,700 in November, and has stabilised around 15,600 at the time of writing (21 December).

Against the euro, the rupiah strengthened from a rate of 16,118 at the start of the year to 15,155 in mid-May and, after moving to around 15,700 in late May and June, approached 14,500 in late September. But the EUR/IDR pair has since climbed, reaching a one-year high of 16,765 in December. The movement in the pair reflects a rebound in the value of the euro, which also bottomed out against the US dollar in late September.

Indonesia reported six straight quarters of gross domestic product (GDP) growth in rebounding from the Covid-19 pandemic-induced recession. Export demand drove a recovery in the manufacturing sector, while relatively low inflation supported domestic consumption. As a result, the BI was relatively late compared with other countries’ central banks in raising interest rates.

The rate of inflation accelerated in September to 5.95% from 4.69% in August and around 2% early in the year as the government cut fuel subsidies. Inflation moderated to 5.42% in November, but remains above Bank Indonesia’s target range of 2-4%.

According to analysis by the Dutch bank ING:

“Faster inflation by the second half of the year prodded the previously reluctant central bank to finally increase policy rates in a surprise move in August. BI has since been actively tightening, increasing rates by 75bp so far, and will likely need to continue tightening to support the IDR well into 2023. BI Governor Perry Warjiyo previously highlighted his preference for a stable currency, and we expect BI to hike rates by at least 100bp to help steady the IDR.”

What is a realistic IDR forecast for the future? How will the currency trade against the US dollar and euro?

Indonesian rupiah forecast: Will the IDR gain against the USD and EUR?

“Bank Indonesia (BI) expects the current account to settle between 0.4-1.2% of GDP for 2022 but revert to a deficit in 2023. This suggests that key support for the IDR in 2022 will not be around next year resulting in sustained pressure on the currency,” ING’s analysts stated last month.

“We expect the IDR to face depreciation pressure in the near term as moderating commodity prices could lead to a further narrowing of the trade surplus and less support for the currency,” ING analyst Nicholas Mapa added last week.

-

USD/IDR forecast

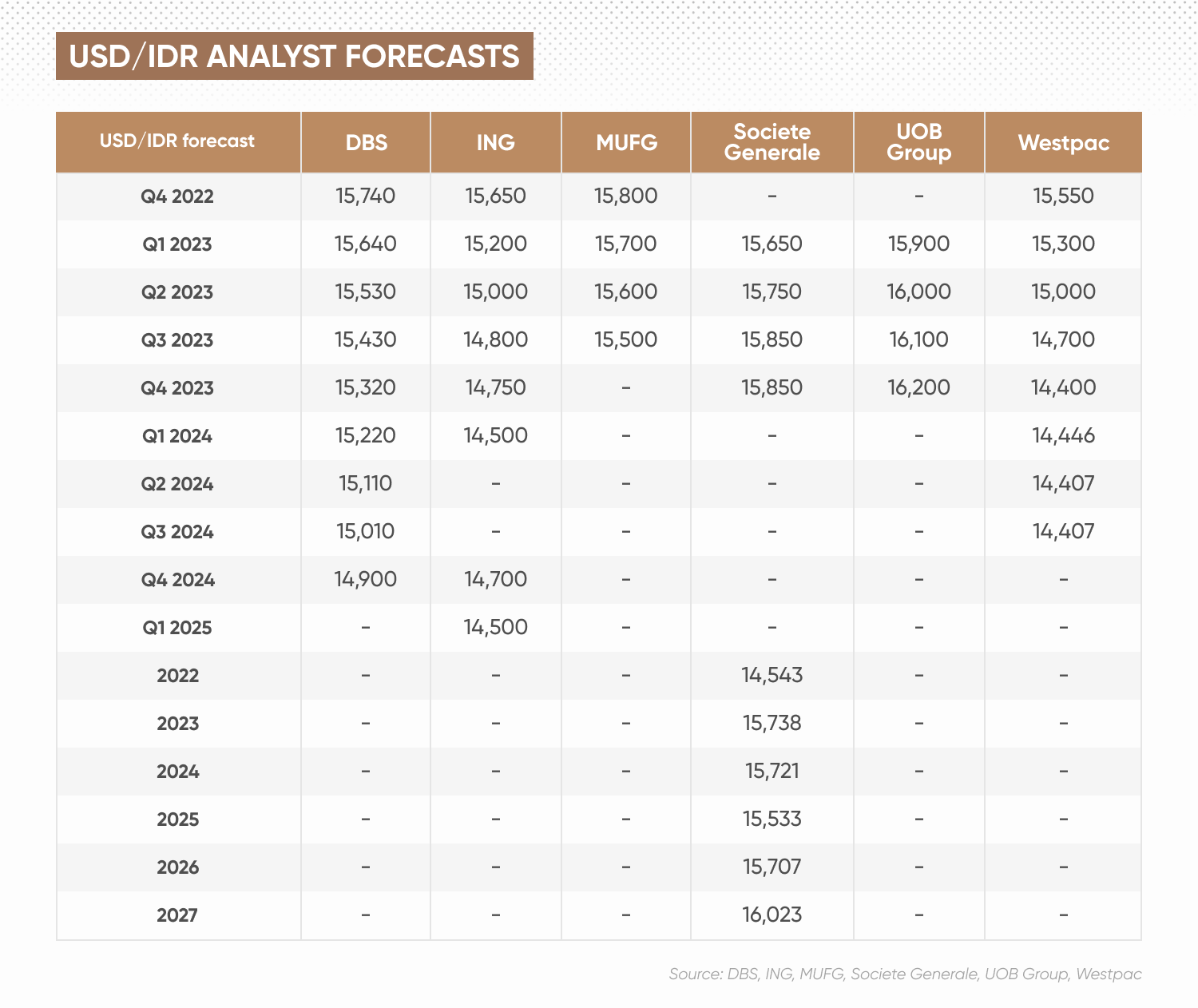

Technical analysis from Singapore-based UOB Group on 12 December indicated that a “rebound in USD/IDR could extend to 15,700; next resistance at 15,750 is unlikely to come into view… Support is at 15,550, followed by 15,500.”

Further out, UOB’s Indonesian rupiah forecast for 2023 projected that the rupiah could weaken next year, with the USD/IDR rate moving up from 15,900 in the first quarter to 16,200 in the fourth quarter.

Analysts at Japanese financial group MUFG Research saw support at a lower level:

“Current momentum will likely shift y/y inflation lower in the coming months. The pair will likely be driven by Fed expectations and commodity price movements over the coming week. For USD/IDR, further moves down may test support at 15,200. Otherwise, we anticipate some stabilisation around current levels.”

In contrast to UOB, the group’s IDR prediction estimated that the USD/IDR pair could slide from 15,800 at the end of 2022 to 15,500 in the third quarter of 2023.

At the time of writing, economic data provider Trading Economics had an Indonesian rupiah forecast of 15,710.40 for the end of 2022, rising to 16,061.29 by December 2023, based on its global macro models and analysts’ expectations.

Algorithm-based forecaster Wallet Investor’s Indonesian rupiah forecast for 2025 showed at the time of writing that the dollar could rise to 16034.42 by the end of the year, after rising from 15,551.43 to 15712.73 during 2023, 15,876.10 at the end of 2024 and 16,397.68

AI Pickup’s machine learning-based Indonesian rupiah forecast for 2030 projected that the pair could end the decade at an average of 15,260.62, after declining from 15,648.3 in 2023 to 14,810.36 in 2026.

-

EUR/IDR forecast

In its IDR forecast against the euro, Wallet Investor predicted that the exchange rate could decline from 16,438.20 at the start of 2023 to 16,325.04 by the end of the year, 16,197.67 by the end of 2024 and 16,075.64 by the end of 2025. By the end of 2027, the euro could weaken further to a rate of 15,908.40, the forecast showed.

The euro to Indonesian rupiah forecast from Trading Economics projected that the EUR/IDR pair could fall below 16,000 sooner, dropping from 16,358.4 at the end of this quarter to 15,919.6 in one year.

The bottom line

If you are looking to consult an Indonesian rupiah forecast to help inform your forex trading, it’s important to remember that currency markets are highly volatile, making it difficult to come up with accurate long-term predictions. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Has the Indonesian rupiah been going up or down?

The IDR has stabilised against the US dollar as the dollar has weakened on prospects of a less hawkish approach to monetary policy, while the IDR has continued to trend lower against the euro.

Will the Indonesian rupiah get stronger in 2023?

The direction of the IDR against other currencies will likely depend on monetary policy in Indonesia and the US, as well as commodity prices and Indonesia’s trade balance, among other factors.

Is it a good time to buy Indonesian rupiah?

Whether now is a good time for you to trade the rupiah depends on your personal circumstances. You should do your own research to decide whether IDR is a suitable investment for your portfolio. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.