How to trade in a bear market: CFD trading strategies

Periods of falling prices can challenge even experienced traders, yet they remain an integral part of the market cycle.

Trading in a bear market demands discipline and a clear understanding of strategies suited to periods of decline. The environment may be challenging, but with careful preparation and a structured approach, there can be potential opportunities to consider.

What is a bear market?

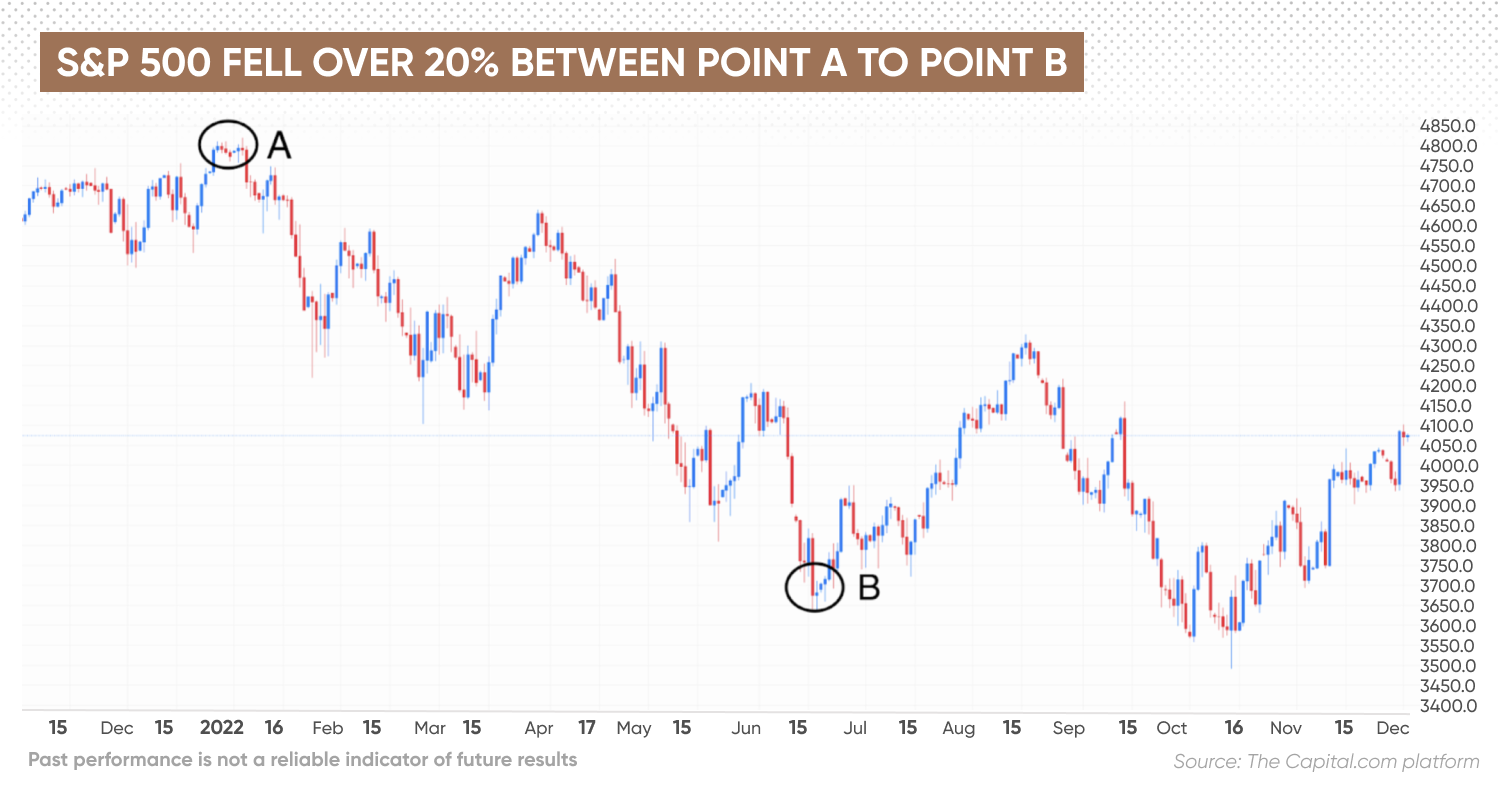

A bear market refers to a phase in which prices across a broad market index fall by around 20% or more from recent highs and remain under pressure for a sustained period.

It is typically accompanied by increased volatility, weaker investor confidence and widespread selling, often linked to economic uncertainty, lower corporate earnings or systemic financial stress.

Bear markets can last for months – or even years in more severe cases – so understanding the broader context is essential.

Different types of bear market

Recognising the type of bear market can help you tailor your approach. The three main types are:

- Cyclical bear markets: Often connected to economic recessions or cyclical downturns. These are relatively common and tend to last one to two years.

- Structural bear markets: Resulting from deeper issues such as demographic shifts, productivity declines, debt overhangs or other long-term imbalances. They can last several years or more.

- Event-driven bear markets: Triggered by specific shocks – for example, natural disasters or major geopolitical events. These tend to be shorter in duration but can involve sharp, rapid declines.

Being able to identify whether conditions are cyclical, structural or event-driven may help you assess how long the downturn could last and where potential opportunities might emerge.

Are we in a bear market?

A common rule of thumb is that a bear market begins when a major index falls 20% or more from a recent high. However, markets may display early signs of stress before that threshold is reached, and confirmation often comes only in hindsight.

Past performance is not a reliable indicator of future results.

Globally, the performance of major indices varies – some regions may be in or near bear territory while others remain more resilient – underlining the importance of diversification across regions and sectors.

How to trade in a bear market

Below are several approaches that traders may consider when navigating a downturn. None are guarantees – all trading involves risk, and past performance is not a reliable indicator of future results.

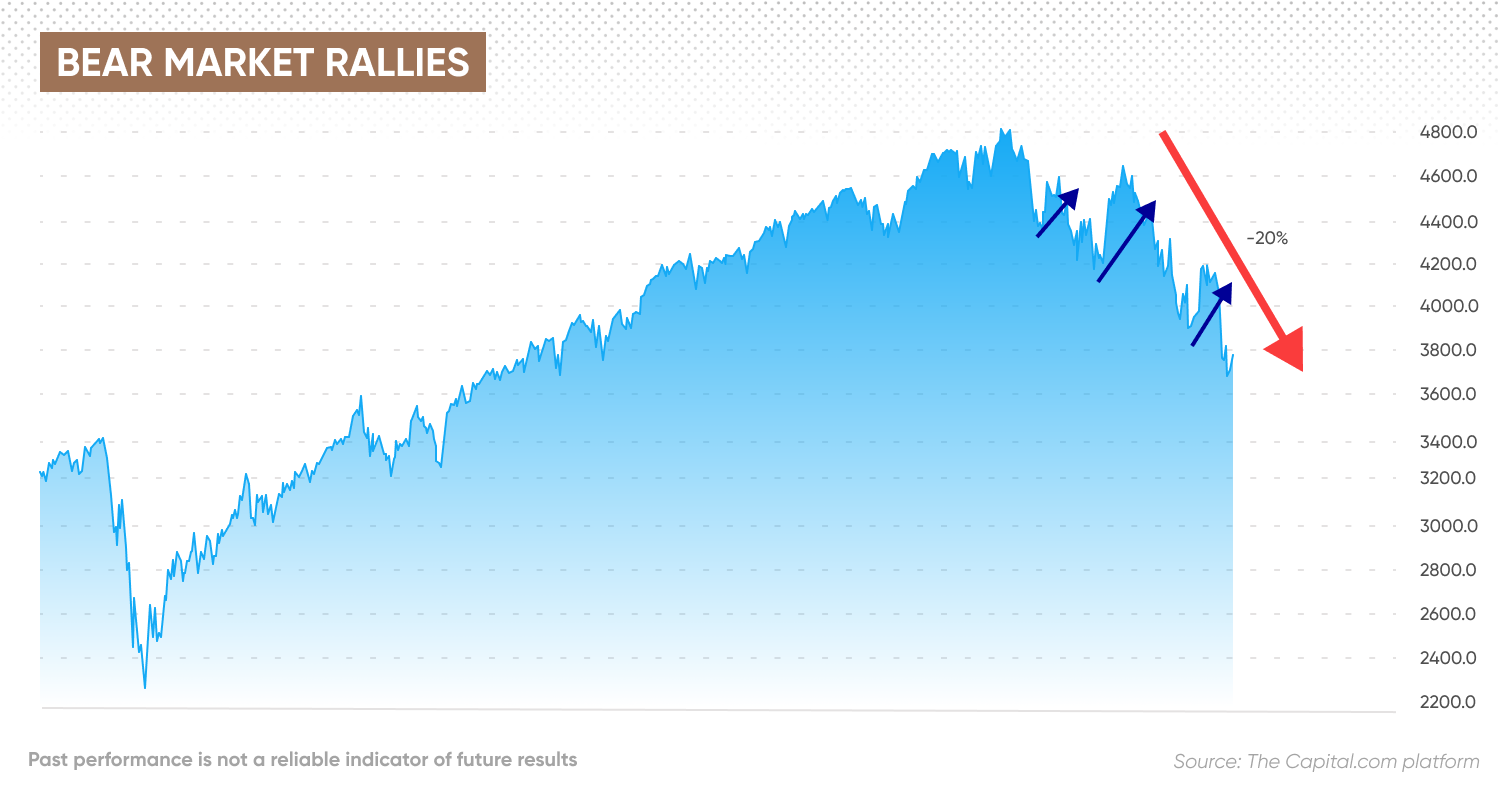

Bear market rallies

A bear market rally is a temporary upward movement in prices during a broader downtrend, typically defined as a rise of around 10% or more from recent lows.

Past performance is not a reliable indicator of future results.

These can offer trading opportunities, but caution is essential: such rallies do not necessarily signal the end of the bear market. The key is to engage selectively during short-term momentum and apply discipline when sentiment turns.

Short-selling

Short-selling involves selling an asset you do not own, anticipating that its price will fall. In a bear market, this may align with the prevailing trend but carries significant risk, particularly if prices move higher instead.

It can also be used as a hedging tool to offset potential losses elsewhere in a portfolio.

Stop losses and limit orders

The volatility typical of bear markets makes risk management and order control especially important.

A stop-loss order helps limit potential losses if a trade moves against you, while a take-profit or limit order can secure gains during short-term rebounds.*

Used together, these tools promote discipline and capital protection in uncertain conditions.

*Stop-loss orders are not guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee if activated.

Trading indices and ETFs

Index-tracking ETFs are often popular in rising markets due to their diversification and accessibility. In a bear market, they can still play a role:

- As instruments for hedging or short exposure, or

- As vehicles for gaining exposure to assets at potentially lower valuations if you believe the market is stabilising.

However, it’s vital to understand the structure, leverage and risks of any ETF or derivative before including it in your trading strategy.

Final thoughts

Trading in a bear market is demanding and inherently risky. Yet, with clear objectives, disciplined risk control and awareness of broader market context, traders may be better equipped to navigate challenging periods.

Create an account Open a demo account

FAQ

What is a bear market?

A bear market is a sustained period of price declines – typically 20% or more from recent highs – across a major index such as the S&P 500 or FTSE 100. It usually reflects slower economic growth, lower corporate earnings and weaker investor confidence. Volatility often rises as sentiment shifts, creating both potential risks and short-term trading opportunities.

How long do bear markets last?

The duration of a bear market varies depending on its underlying causes. Cyclical bear markets, often linked to recessions, may last one to two years, while structural bear markets, driven by deeper economic or financial issues, can persist for longer periods. Event-driven bear markets, caused by external shocks such as geopolitical events, tend to be shorter. Although recoveries follow eventually, their timing and strength remain uncertain.

How can you trade during a bear market?

Trading in a bear market requires discipline, patience and sound risk management. Some traders seek to capture short-term rallies within a broader decline, while others may use short-selling strategies or gain exposure through indices and ETFs. Using stop-loss and take-profit orders can help manage exposure in volatile conditions. The aim is not to forecast every price move, but to respond methodically to changes in market direction.

Can I trade CFDs during a bear market on Capital.com?

Yes, you can trade contracts for difference (CFDs) on more than 5,000 global markets with Capital.com. CFDs enable you to speculate on both rising and falling prices, offering flexibility across different market conditions. The platform provides risk-management tools, real-time data and free educational resources designed to support informed trading decisions. Remember, CFD trading involves margin, and leverage amplifies both your profits and your losses.