Hong Kong 50 forecast: Third-party targets

The Hong Kong 50, a CFD that references the Hang Seng Index, tracks the performance of some of the largest and most actively traded Hong Kong-listed companies, making it a widely followed benchmark for regional equity markets.

Hong Kong 50 (HK50) is trading around $26,593.4 HKD as of 11:18am on 12 January 2026 (UTC), moving within an intraday range between 26,135.9 and 26,605.2 on Capital.com’s feed. The current level is broadly in line with spot and CFD indications for Hong Kong’s main equity benchmark, which has been fluctuating near the mid-26,000s in recent sessions. Past performance is not a reliable indicator of future results.

Price action is unfolding amid broader gains across Hong Kong equities, with the Hang Seng Index up about 0.8–0.9% in Monday morning trade. This move has been supported by strength across technology, consumer and property shares (Trading Economics, 2 January 2026).

Hong Kong 50 forecast 2026–2030: Third-party targets

As of 12 January 2026, analyst views on the Hong Kong 50 (HK50), which tracks Hong Kong’s blue-chip equities via the Hang Seng benchmark, span a wide range of potential outcomes for 2026, as institutions assess earnings recovery, policy support and global risk appetite.

DBS Bank (regional equity outlook)

DBS Bank’s 2026 Outlook report sets an end-2026 target of 30,000 for the Hang Seng Index. This implies mid-teens percentage upside from late-2025 levels, based on a 13x forward price-to-earnings multiple. The bank cites compressed risk premia, stronger technology-sector earnings and supportive policy measures as key assumptions, while noting the outlook remains sensitive to regional growth conditions (DBS, 12 January 2026).

Standard Chartered (HSI range scenario)

Standard Chartered’s North Asia CIO team maintains a 12-month base-case range for the Hang Seng Index at 28,000–30,000, with a downside risk band around 26,000–28,000 should sentiment or policy support weaken. The bank frames this scenario against expectations for targeted stimulus from Beijing and a still-accommodative global rates environment, while highlighting geopolitics and potential shifts in Federal Reserve policy as key risks (AASTOCKS, 17 December 2025).

HSBC Private Bank (2026 investment outlook)

HSBC Private Bank’s Q1 2026 Investment Outlook suggests the Hang Seng Index could reach 31,000 by the end of 2026, with an internal reference point of 30,000, alongside a 6,600 level for the Hang Seng Tech Index. The outlook highlights technology earnings growth, index concentration in major platform stocks and global capital flows as supportive factors, while also noting sensitivity to changes in interest-rate expectations (HSBC Private Bank, 9 December 2025).

Citi (mid‑year and year‑end targets)

Citi maintains a mid‑year 2026 HK50 forecast around 27,500 and a year‑end target of 28,800. The bank ties this trajectory to expectations for moderate earnings growth and a gradually improving macro backdrop, while highlighting possible headwinds from global rates and currency moves (The Standard HK, 7 January 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

HK50 price: Technical overview

The HK50 index is trading around 26,593.4 as of 11:18am (UTC) on 12 January 2026, holding above a cluster of short- and medium-term moving averages. The 20-, 50-, 100- and 200-day SMAs are located near 25,919 / 26,009 / 26,004 / 24,803, respectively. The 20-over-50 alignment remains intact, while price is also above the 10-day SMA around 26,197 and the 9-period Hull MA near 26,404, keeping price action above key trend markers without a direct test of support. RSI (14) sits in the upper-neutral zone around 59, while ADX (14) remains subdued near 15, pointing to positive but not strongly directional momentum.

On the topside, the nearest classic pivot resistance (R1) is around 26,234, with R2 near 26,838 becoming relevant on a sustained daily close above the first level. On pullbacks, initial support is marked by the pivot point (P) near 25,660, followed by the 100-day SMA close to 26,004. A deeper move towards S1 near 25,057 would place the broader consolidation range back into focus if broken on a closing basis (TradingVIew, 12 January 2026).

This technical analysis is provided for informational purposes only and does not constitute financial advice.

Hong Kong 50 index history (2024–2026)

The HK50 index has seen a strong recovery over the past two years, climbing from around 15,400 in January 2024 to about 26,600 on 12 January 2026, as the index rebounded from a period of weakness and then pushed into higher trading ranges. The move gathered pace through 2024, with HK50 dipping below 17,000 in April before grinding higher into the 18,000–19,000 area by mid-year, then finishing December 2024 just under 20,100 as sentiment towards Hong Kong equities began to stabilise.

In 2025 the index extended those gains, briefly trading near 21,100 in April before accelerating into the mid‑20,000s by late summer and closing the year around 25,600–26,200, reflecting improving risk appetite and a series of higher lows on the chart. By early January 2026, HK50 was holding in the 26,000–26,600 zone and settled at 26,591.4 on 12 January 2026, marking a sizeable rise over the two‑year period as volatility eased compared with the sharp swings seen in early 2024.

Past performance is not a reliable indicator of future results.

Hong Kong 50 (HK50): Capital.com analyst view

The Hong Kong 50 index has moved into higher ground over the past year, trading around 26,593.4 as of 11:18am (UTC) on 12 January 2026 and holding above a cluster of short‑ and long‑term moving averages that point to a sustained recovery from the lows seen in early 2024. This pattern can be read as evidence of improving sentiment towards Hong Kong equities as risk appetite has normalised, although an alternative view is that the index’s advance leaves it more exposed to setbacks if global or regional conditions deteriorate.

Factors such as shifts in Chinese policy, global interest‑rate expectations and sector‑specific news can all support the index if they remain favourable, but they could equally weigh on prices if data disappoints or risk sentiment turns, underlining that both upside and downside scenarios remain possible.

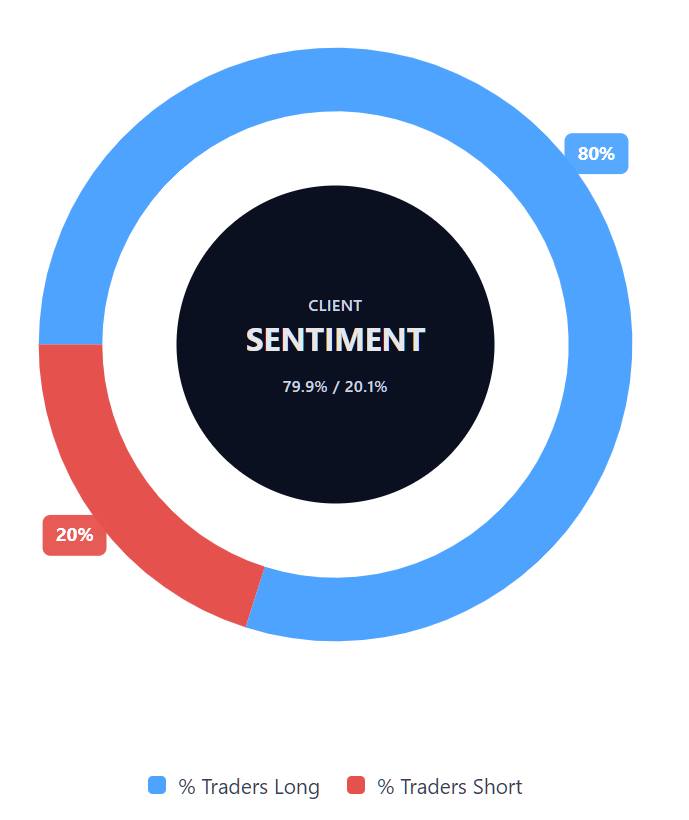

Capital.com’s client sentiment for Hong Kong 50 CFDs

As of 12 January 2026, Capital.com client positioning in the Hong Kong 50 CFDs shows 79.9% buyers versus 20.1% sellers, a heavy-buy stance that puts buyers ahead by about 59.8 percentage points. This one-sided tilt towards longs highlights a clear preference for upside exposure among current HK50 traders, while a minority is positioned for potential declines. This snapshot reflects open positions on Capital.com and can change.

Summary – Hong Kong 50 (2026)

- Hong Kong 50 (HK50) rose from around 20,000 in January 2025 to the mid‑20,000s by year-end, marking a strong recovery phase over the year.

- The index saw notable volatility in April 2025, briefly trading near 21,100 before trending higher into the 25,000–26,000 area by the fourth quarter.

- Moving averages and oscillators for late 2025 pointed to an established uptrend, with HK50 holding above its key 20/50/100/200‑day SMA cluster.

Past performance is not a reliable indicator of future results.

FAQ

What is the five-year Hong Kong 50 index forecast?

There is no single agreed five-year forecast for the Hong Kong 50, as longer-term outlooks depend on factors such as corporate earnings trends, economic growth in China, policy developments and broader global financial conditions. Over recent years, the index has experienced both periods of recovery and phases of consolidation. Analysts generally treat multi-year projections as broad indications rather than precise expectations, noting that outcomes can vary significantly depending on macroeconomic conditions, investor sentiment and external risks.

Is Hong Kong 50 a good buy?

Whether the Hong Kong 50 is considered attractive varies by individual objectives, time horizon and risk tolerance. The index offers exposure to large, established companies listed in Hong Kong, with notable representation across sectors such as finance and technology. However, prices can be volatile and are influenced by regional policy decisions, global interest-rate trends and shifts in market sentiment. As with any market, potential opportunities need to be considered alongside the risk of losses, and future outcomes remain uncertain.

Could Hong Kong 50 go up or down?

The Hong Kong 50 can move in either direction, sometimes over relatively short timeframes. Prices may rise if earnings expectations improve, policy measures are supportive or global risk appetite increases. Conversely, the index could fall if economic data disappoints, geopolitical tensions rise or financial conditions tighten. Market movements are rarely driven by a single factor, and both upside and downside scenarios remain possible depending on how underlying conditions develop.

Should I invest in Hong Kong 50?

Decisions about investing in the Hong Kong 50 depend on personal circumstances, financial objectives and individual risk appetite. The index reflects the performance of major Hong Kong-listed companies, but it is also exposed to market volatility and external shocks. This content is provided for informational purposes only and does not constitute investment advice. Anyone considering exposure to the index may wish to evaluate their understanding of the associated risks and seek independent guidance if appropriate.

Can I trade Hong Kong 50 CFDs on Capital.com?

Trading Hong Kong 50 CFDs on Capital.com lets you speculate on movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.