Georgian lari forecast: Will the GEL continue to rally or pare gains?

Will the Georgian lari continue to rally on foreign exchange inflows or has it topped out?

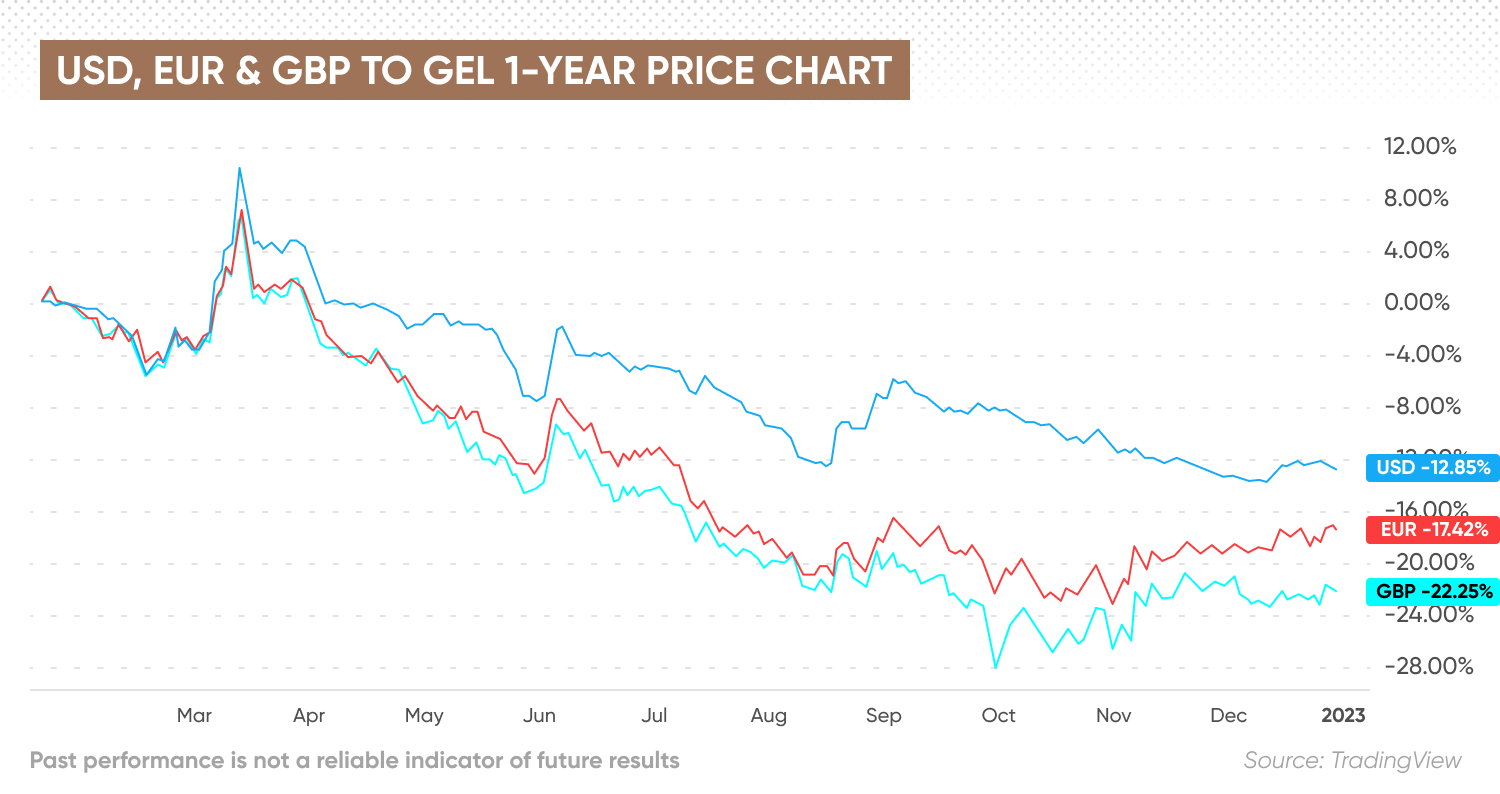

The Georgian lari (GEL) was one of the few emerging market currencies to gain against a strong US dollar (USD) in 2022. It rose 15.6%, as the war in Ukraine resulted in a surge in foreign exchange inflows. The GEL has also gained in value against the euro (EUR) and British pound sterling (GBP).

What affects the value of the lari and how has the Russia-Ukraine conflict contributed to its appreciation? Here we look at the GEL’s performance and the latest forecasts for its performance in 2023 and beyond.

What drives the value of the GEL?

The lari was introduced in October 1995 as the official currency of Georgia. It replaced the kupon lari, a provisional currency introduced in 1993 that replaced the Russian ruble (RUB) following Georgia’s independence from the Soviet Union in April 1991.

The Georgian economy is driven by tourism, agricultural production, the mining of industrial metals such as manganese and copper, as well as industrial output. As a result, inflows from tourism spending, exports of agricultural and industrial products and metals, and foreign investment can affect the value of the lari.

The lari climbs as war fuels unexpected growth

The lari has gained 27.6% against the dollar since May 2021, initially driven by an increase in tourism following the lifting of Covid-19 restrictions, and accelerated following the Russian invasion of Ukraine in February 2022.

Economists had initially predicted that the Georgian economy – and other economies in the region – would see growth decline on a fall in exports to major trading partner Russia.

However, as the International Monetary Fund (IMF) noted in December:

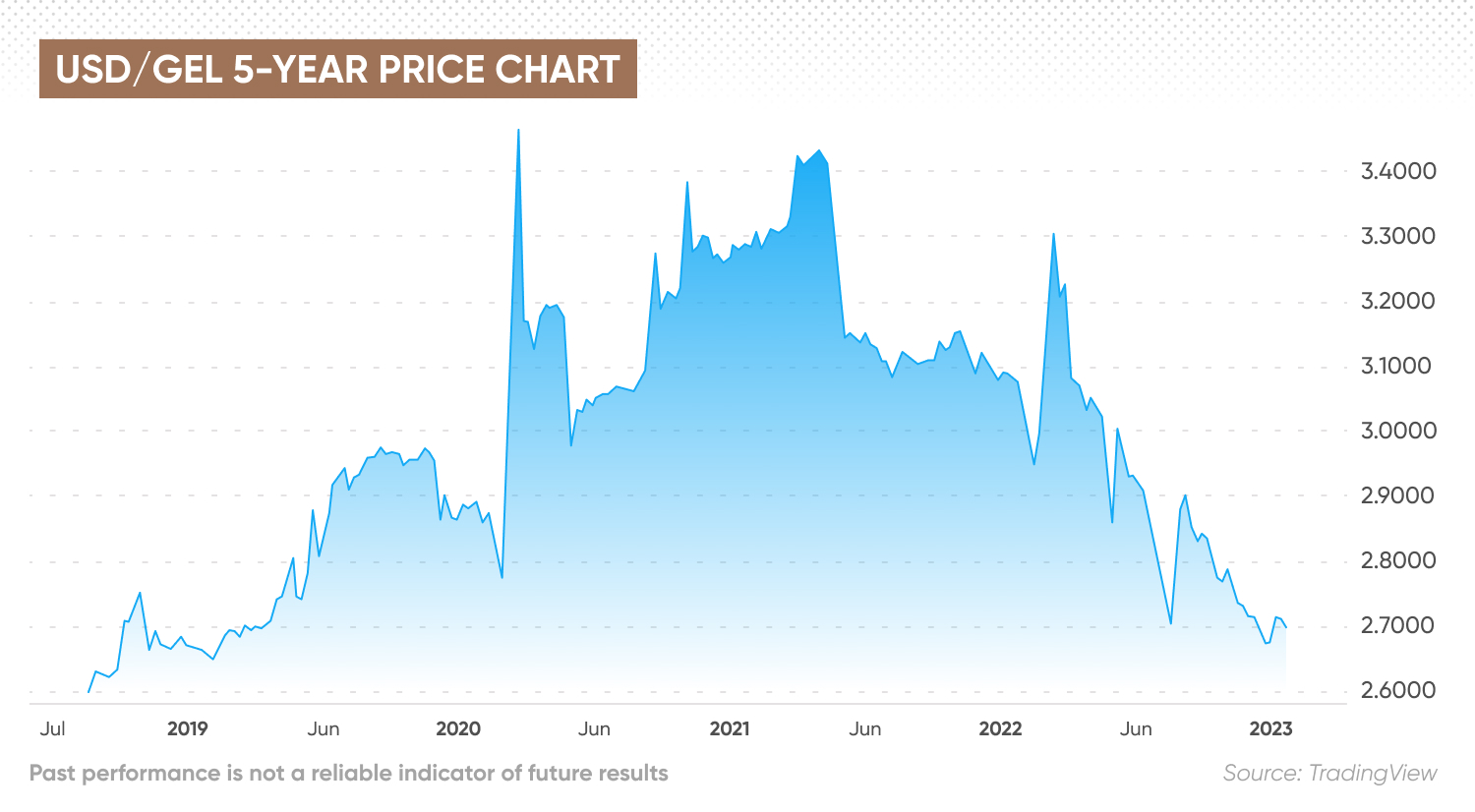

The US dollar to Georgian lari exchange rate spiked from 3.09 at the start of 2022 to 3.45 in March in an initial response to Russia’s invasion of Ukraine. But the USD/GEL pair quickly turned lower, trading down to 2.85 in May.

The pair climbed to 3.02 in June as the US Federal Reserve (Fed) accelerated the pace of interest rate hikes, but retreated to 2.70 in mid-August.

The USD/GEL rose to 2.91 at the end of August, but with the lari continuing to strengthen, the rate dropped back to 2.66 in December, its lowest level since 2019.

The rate has stabilised between 2.66 and 2.70 over the past month.

The lari has also strengthened against the euro since April 2021. That has offset some of the impact on prices for energy and food imported from the eurozone, although a strong currency also has the effect on reducing demand for exports as they cost more for buyers in other currencies.

The EUR/GEL exchange rate fell from 4.19 in April 2021 to 3.50 at the start of 2022. While the pair climbed to 3.76 in response to the invasion of Ukraine, it then dropped to 3.05 in May. Following an uptick to 3.24 on 1 June, the EUR/GEL pair fell further to 3.76 in August. The pair was unable to break the 3.0 level in a September rally that topped out at 3.92, after which it fell to 2.67 in early November, its lowest level since April 2017. The pair has since bounced up to 2.88, remaining down by 31% since the 2021 peak.

Against the British pound, the lari declined from 4.83 in May 2021 to 3.95 in early February 2022. The pair rebounded to 4.51 the following month, but then accelerated its decline to 3.05 in late September before turning higher to trade around 3.25 currently.

The arrival of more than 112,000 immigrants as of November into a country of 3.7 million people has resulted in a housing crisis and driven consumer prices higher on rising demand.

The strengthening in the value of the lari has enabled the National Bank of Georgia (NBG) to increase its foreign exchange reserves, as strong tourism as well as inflows and remittances to migrants have boosted the flow of money into the country.

The NBG made net foreign currency purchases of $350m between March and October, increasing its gross international reserves (GIR) to $4.4bn, according to the IMF.

What is the outlook for the lari in the future? Is the lari a good investment for foreign exchange traders?

Georgian lari forecast: Will the GEL make further gains?

Predictions from currency forecasters at the time of writing on 10 January indicated that the lari could shed some value over the near term but continue to strengthen in the long term.

The Georgian lari forecast for 2023 from economic data provider Trading Economics showed that the USD/GEL pair could trade up from 2.72 at the end of this quarter to 2.89 in 12 months’ time.

The Georgian lari forecast against the US dollar from algorithm-based forecaster WalletInvestor indicated that the USD/GEL pair could rise to 2.979 by the end of 2023 and return to the 3 mark by December 2024. But the US dollar to Georgian lari forecast for 2025 projected that the pair could then turn lower, from 3.11 in March of that year to 3.02 by December, and reaching 2.155 by January 2028.

Against the euro, WalletInvestor’s forecast showed that the lari could initially fall, with the EUR/GEL pair rising to 3.118 by the end of 2023, but then retreating to 3.0 by the end of 2025 and 1.858 in five years’ time.

Trading Economics predicted that the EUR/GEL pair could rise from 2.85179 at the end of this quarter to 2.88131 in one year, based on its global macro model projections and analysts’ expectations.

Keep in mind however, that forecasts generated by algorithms are based on past performance and are unable to take into account geopolitical and macroeconomic volatility. If you are interested in a Georgian lari forecast to inform your trading, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest or trade with more money than you can afford to lose.

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Has the Georgian lari been going up or down?

The Georgian lari has rallied to its highest levels in several years against other currencies, driven by rising foreign exchange inflows following the Russian invasion of Ukraine.

Will the Georgian lari get stronger in 2023?

The direction of the Georgian lari will depend on geopolitical factors such as the war in Ukraine and the flow of foreign exchange from immigrants and tourists.

Is it a good time to buy the Georgian lari?

Whether it is a good time for you to buy the Georgian lari is a personal decision you should make based on your personal circumstances, risk tolerance, expertise in the market, the spread of your portfolio and how comfortable you feel about losing money. Remember to never invest more than you can afford to lose.