Fortescue stock forecast: FMG shares have endured a tough year but the worst may be behind Aussie iron ore producer

Our Fortescue stock forecast overview looks at the prospects for the company in the wake of its increased focus on green energy operations.

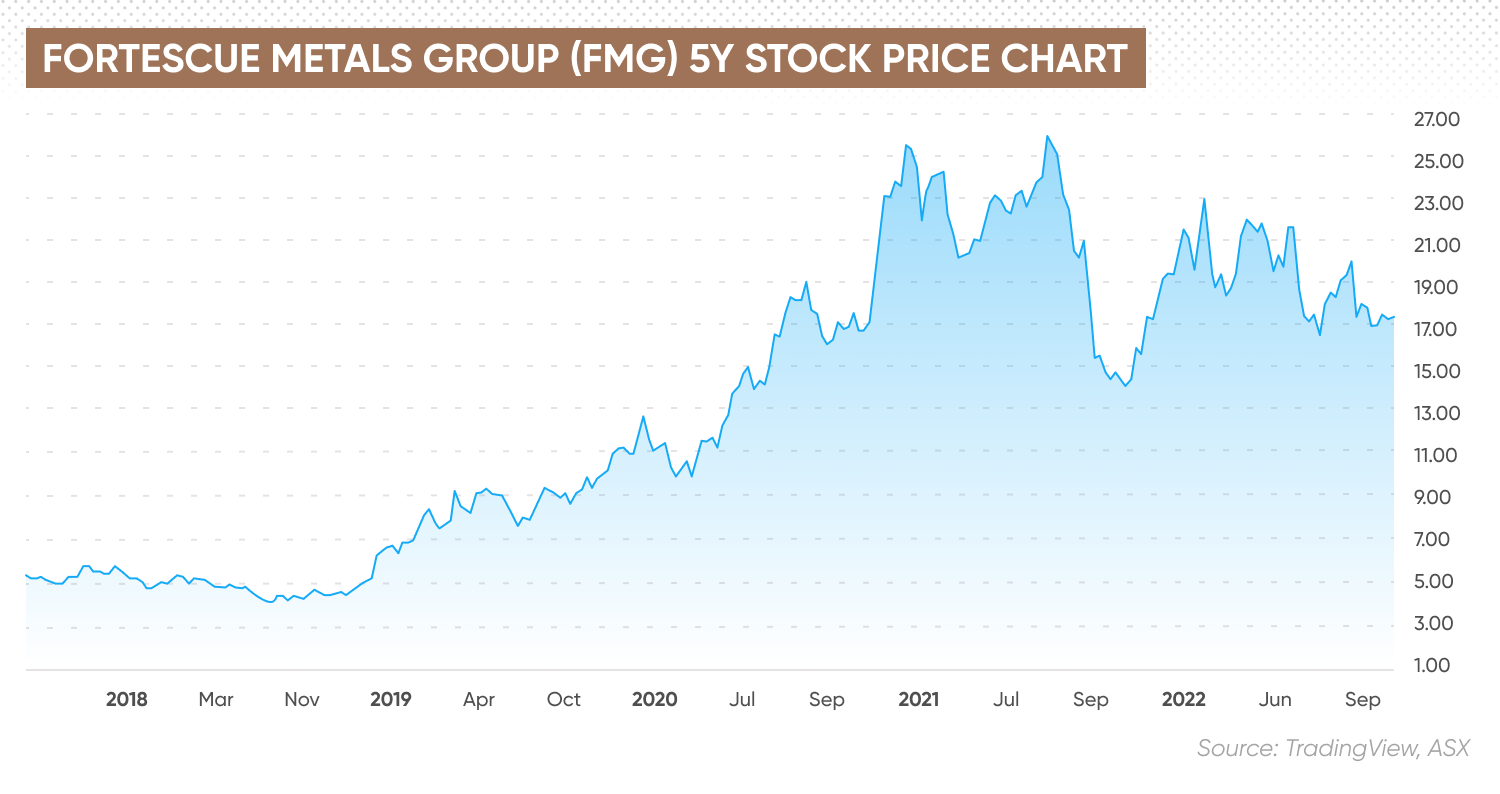

Investors in Fortescue Metals Group (FMG), the low-cost Australian iron ore producer, have certainly experienced highs and lows over the past year.

The FMG stock price has endured an extremely volatile 12 months that’s seen it range between AU$14 and AU$22 a share.

As the market closed on 20 October 2022, the price stood at AUD $16.52, having lost 14% since the start of the year when it was trading at $19.85.

FMG Live Stock Price Chart

But are better days coming? In this Fortescue stock forecast overview, we take a look at the company’s finances and ask analysts what they expect from the stock.

What is Fortescue?

Fortescue Metals Group, a West Australian company established in 2003, is a globally recognised developer of infrastructure and mining assets.

Fortescue went public in August 2003. It is listed on the Australian Stock Exchange (ASX) under the ticker FMG.

The low-cost iron ore producer ships at an annual rate of more than 180 million tonnes, with more than 1.7 billion tonnes having been delivered to customers since 2008.

The company is diversifying its business through FFI (Fortescue Future Industries) – its green energy and technology operation. The aim of the corporation is to be an integrated global green energy and resources company.

Fortescue’s operations include three mining hubs in Pilbara, Western Australia, which are connected by rail to its five-berth Herb Elliott Port and the Judith Street Harbour towage infrastructure in Port Hedland.

FMG stock price analysis

The FMG stock price has had a tough year so far. It initially got off to a bright start, rising from AU$19.85 in early January to almost AU$23 by 14 February.

However, the market’s enthusiasm for the stock waned with the publication of the firm’s half-year results to 31 December, 2021, which revealed a 13% year-on-year decline in revenue to US$8.12bn.

The company also announced a 28% fall in earnings before interest, tax, depreciation and amortisation (EBITDA) from US$6.63bn to US$4.76bn.

As of 20 October 2022, Fortescue is currently the world’s 12th largest mining company by market capitalisation, according to data from CompaniesMarketCap.

The company’s stock price last stood at AU$16.55, representing a 14% decline year-to-date.

Fortescue Metals Group: Company development

According to Matthew Hodge, regional director at Morningstar, Fortescue has “grown from obscurity” at the start of 2008 to become the world's fourth-largest producer.

“Growth was fuelled by debt, now repaid,” he wrote in his Fortescue stock forecast.

“Expansion from 55 million tonnes in fiscal 2012 to about 185 million tonnes in 2022 means it supplies nearly 10% of global seaborne iron ore.”

Further expansion above 200 million tonnes is likely once it completes construction of its 22 million-tonne Iron Bridge magnetite mine.

“However, with longer-term demand likely to decline as China’s economy matures, we expect Fortescue's future margins to be below historical averages,” Hodge added.

Hodge pointed out that iron ore miners are being affected by slower economic growth and lower steel production in China, which has pushed down iron ore prices.

“More recently, Fortescue has diversified into green energy, with ambitions to become a major supplier of green hydrogen and green ammonia,” he added. “Its efforts here are at an early stage.”

Latest news: Deal with Tree Energy Solutions

Fortescue Future Industries, Fortescue’s green arm, recently entered a global strategic collaboration with Tree Energy Solutions (TES), an energy infrastructure developer.

The arrangement aims to accelerate the development of a world-leading green hydrogen and green energy import facility in Germany.

The investment of €130m (US$127m) will be funded by FFI’s unutilised capital commitment and provides FFI with a pathway for access to critical infrastructure to execute its strategy.

The first delivery of green hydrogen into TES’ terminal in Wilhelmshaven, Germany is anticipated to take place in 2026.

Dr. Andrew Forrest, Fortescue’s executive chairman, said: “The United Kingdom and Europe urgently need green solutions to replace fossil fuels and this investment will enable Europe to do exactly that. Not in 2050, but in four years from now.”

Other plans

In September, Fortescue announced plans to spend US$6.2bn by 2030 to eliminate fossil fuel risk and cut operating costs by US$818m a year.

The commitment was made as part of US President Joe Biden’s First Movers Coalition, which sees companies create markets for innovative clean technologies across eight sectors.

Dr. Andrew Forrest said the energy landscape had changed dramatically over the past two years, with an acceleration since Russia invaded Ukraine.

In a statement, he said: “We are already seeing direct benefits of the transition away from fossil fuels – we avoided 78m litres of diesel usage at our Chichester Hub in full-year 2022 – but we must accelerate our transition to the post-fossil fuel era, driving global scale industrial change as climate change continues to worsen.”

Separately, Fortescue is expected to announce its first major clean energy project within the next nine months.

In an interview with Bloomberg TV, Guy Debelle, the chief financial officer of FFI, revealed a couple of projects were getting very close to a first investment decision.

Latest earnings

In late August 2022, the company announced that its full-year EBITDA had fallen 36% to US$10.6bn from US$16.37bn.

Elizabeth Gaines, Fortescue’s chief executive, said: “Guided by our unique culture and Values, the team has delivered another year of record operational performance for full year 2022, contributing to net profit after tax of US$6.2bn, the second highest annual profit in Fortescue’s history.”

In a call with investors and analysts, Dr. Andrew Forrest emphasised the importance of transitioning into a global green metals, minerals, energy, technology, and development company.

This business, he pointed out, must be capable of delivering not only green iron ore but also all of the minerals critical to the green energy transition.

“Fortescue can and will lead the green energy revolution, and once again set record-breaking industry benchmarks in everything we do,” he declared.

Fortescue stock forecast: Where will the price go next?

The stock is classed as a ‘moderate sell’, based on the Fortescue share price forecast of 11 Wall Street analysts compiled by TipRanks. Six analysts rated the stock a ‘sell’, while 5 gave it a ‘hold rating.

The average price target for the stock was AU$15.80, with the highest FMG stock forecast coming in at AU$17.00 and the lowest prediction at AU$13.40.

The average price target represents a -5.58% fall from the current price of AU$16.55, on 20 August 2022.

According to the algorithmic forecasts of Wallet Investor, Fortescue is a “good long-term (one year) investment” that could hit AU$21.28 over the coming year.

The site’s Fortescue stock forecast 2022 suggested the FMG stock price could reach $18.88 before the end of this year and continue to climb.

The Fortescue stock forecast 2025 has the price rising to just over $30 by October 2025. The five-year forecast to October 2027, meanwhile, puts it at a potential average price of AU$38.16.

Fortescue stock: Analysts’ views

So, what are the Fortescue stock predictions from market analysts?

Matthew Hodge, regional director at Morningstar, has reduced his fair value estimate for Fortescue to AU$12.50 a share, down from AU$14.00.

“Fortescue is more leveraged to the iron ore price than BHP and Rio given its higher operating costs due to lower-quality ore,” he wrote in his FMG stock forecast.

He also pointed out that given Fortescue’s predominant focus on iron ore, lower iron ore prices more than offset a weaker AUD/USD rate.

“Fortescue currently trades at a near 38% premium to our fair value estimate,” he said. “We think this reflects current iron ore prices, which despite recent declines are still highly elevated relative to the cost curve, as well as enthusiasm around the company’s bold green energy ambitions.”

However, Hodge believes it’s too early to get excited about green energy:

Danni Hewson, financial analyst at AJ Bell, believes there are potential positives for the stock, but also uncertainties.

She told Capital.com:

An example is China’s Covid policy, which is enough to sound alarm bells.

“Revenues at the Australian mining giant already look set to return to levels seen pre-pandemic and before the commodity spike that sent the company’s fortunes soaring,” she said.

Of course, the business does have potential. “It’s looking hard at cleaner, greener projects including renewable hydrogen, but the path is a long one with plenty of twists and turns,” she added.

The bottom line

Recent news about Fortescue Metals Group, while providing valuable insight into the company’s performance, should not be used as a substitute for your own research.

Always do your own due diligence before coming to an investment decision. And never invest more than you can afford to lose.

FAQs

Is Fortescue a good stock to buy?

Whether Fortescue is a good investment for you will depend on a number of factors. These include your opinion on the company, as well as your investment goals and attitude to risk. Remember to carry out your own research before coming to an investment decision. And never invest or trade more than you can afford to lose.

Will Fortescue stock go up or down?

No one knows for sure. The consensus view of analysts, compiled by TipRanks, gives an average 12-month price target of AU$15.80. However, there is a disparity, with the highest prediction coming in at AU$17.00 and the lowest down to AU$13.40.

Remember that analysts and algorithm-based forecast platforms can be wrong in their projections. Always do your own due diligence before making investment or trading decisions. And never invest or trade more than you can afford to lose.

Should I invest in Fortescue stock?

The decision to invest in Fortescue stock is up to you and must be based on an assessment of the company’s prospects and your own investment objectives. Remember that analysts can be wrong, so draw your own conclusions. And never invest money that you can’t afford to lose.