US CPI preview: easing expected in June but price pressures remain

Economists expected CPI to have dropped in June, but continued price pressures unlikely to allow Fed to cut just yet

US CPI is expected to have dropped marginally in June when looking at the year-over-year headline reading. Economists forecast the data to drop from 3.3% to 3.1% but on a monthly basis they expect inflation to have increased by 0.1%, a stronger reading than May which saw no increase in price pressures. Core CPI, which excludes volatile prices like food and energy, is expected to have remained unchanged at 3.4% with another 0.2% monthly increase, which suggests a firming up in prices in June.

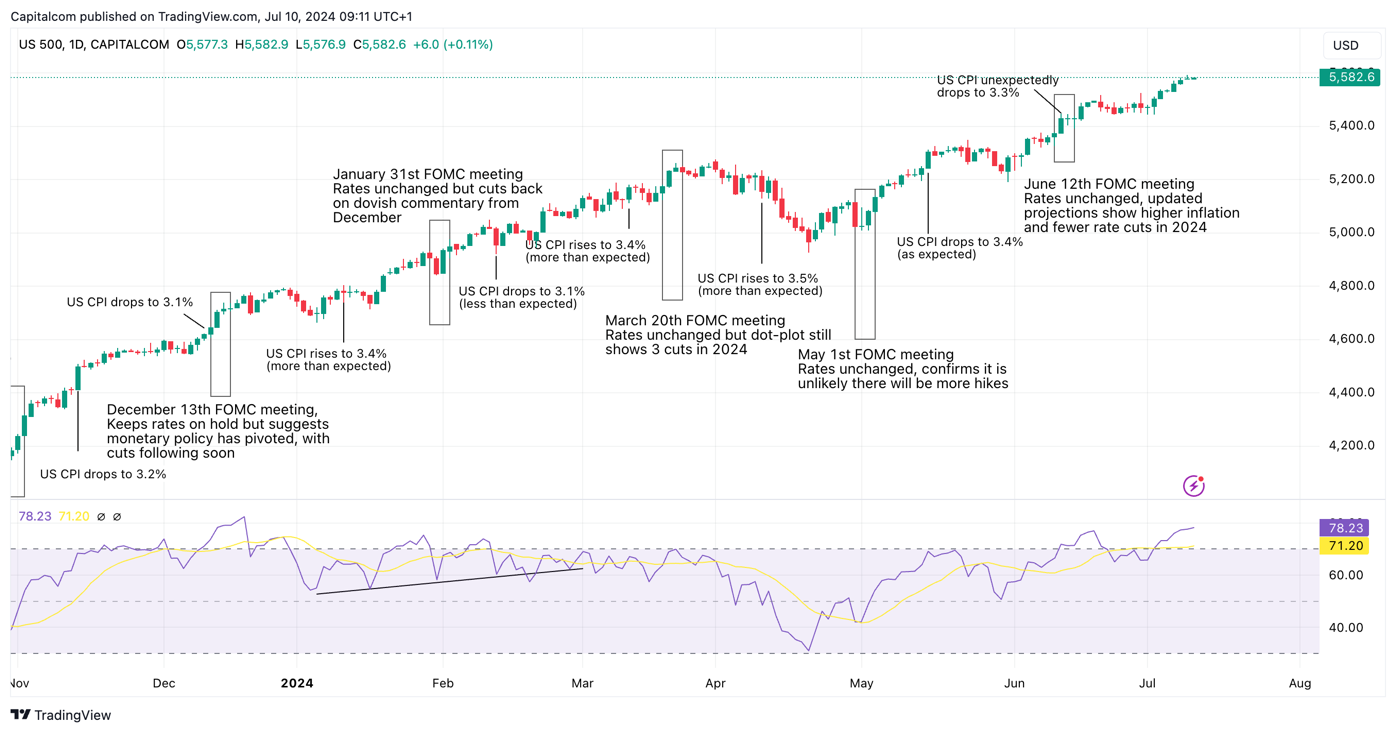

If the data comes in as expected the impact on markets could be quite broad. At first glance, a drop in headline inflation to 3.1% would represent the third consecutive month of declines and a step towards the Federal Reserve’s 2% inflation target. This could consolidate risk appetite further, weighing on the dollar and US yields whilst keeping the bullish momentum in equities. That said, persistent price pressures evidence in core inflation could continue to boycott the Fed’s plan to start cutting rates, limiting the positive reaction in markets.

Powell’s testimony on Tuesday confirmed that whilst there has been a significant cooling in the labour market which has taken it back to pre-pandemic levels, the central bank still needs more good inflation data to start cutting rates. He highlighted how risks have now become two-sided, both moving too quickly or too slowly on rate cuts. For now, the bank still needs to see further progress towards the 2% target in the long term in order to consider a rate cut appropriate.

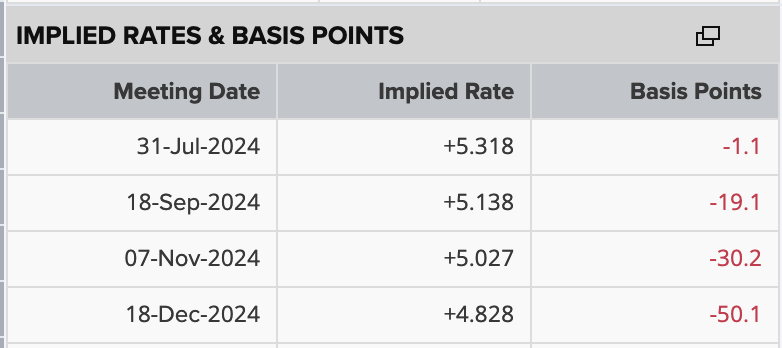

Markets are currently pricing in the first 25bps rate cut between September and November, with a 73% chance assigned for the former. The June CPI will be crucial to determine these expectations and possibly reshape the implied yield curve, although the expectations likely won’t change too much unless we see a big deviation from what’s been forecasted by analysts. A much weaker reading could bring expectations forward to the meeting at the end of this month, intensifying the pullback in US yields and the dollar. Alternatively, a much stronger reading could have the opposite effect, pushing yields and the dollar higher whilst potentially inducing a bearish reversal in equities which have been over-extended for a while.

FOMC meeting expectations

Source: refinitiv

The current bullish appetite in the S&P 500 has been intact since the beginning of June which has pushed the Rsi deep into overbought territory, the most it has been since December. A few weeks ago we saw some indecision creep into the index as the general market sentiment soured but buyers were quick to keep the momentum going which resulted in some sideways consolidation rather than a pullback.

Whilst the path of least resistance continues to point higher, new buyers will likely question how much further the index can go before a correction happens, which may start to show signs of fatigue in the rally. For now, 5,600 seems to be the next target whilst support remains intact at 5,445.

S&P 500 daily chart

Past performance is not a reliable indicator of future results.