Market analysis: EUR/GBP driven by diverging policy expectations

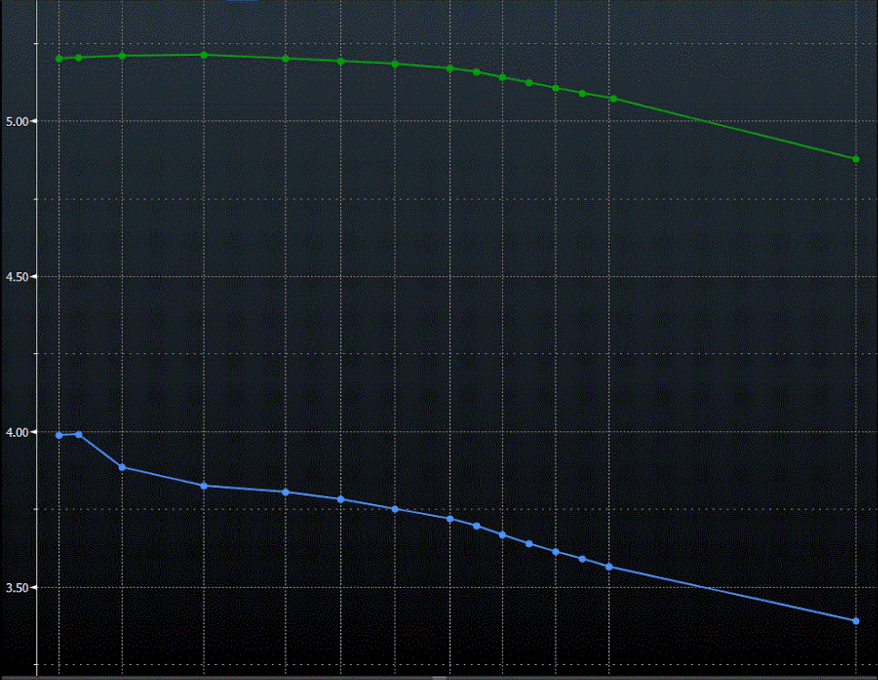

The EURGBP is driven by the question: which cuts first, the ECB or the BOE? Currently, swaps markets (chart below) imply that it will be the ECB (blue line).

The EURGBP is driven by the question: which cuts first, the ECB or the BOE? Currently, swaps markets (chart below) imply that it will be the ECB (blue line). As of the 24th of May, there’s an 84% chance of an ECB cut in June, with the markets baking in a strong possibility of another two before the end of 2024. Whether the ECB starts cutting in June depends on the next round of Eurozone inflation data, which is due on the 31st of May. If it shows a softer-than-expected number, the odds of a cut will likely increase. Meanwhile, signs of stickier inflation in the UK, with the latest CPI data this week coming in stronger-than-expected, are forcing the markets to push back the timing of the first BOE cut. Swaps (green line) imply that the BOE won’t cut until November and will likely be the only one this year.

(Source: Bloomberg)

Technical analysis: EURGBP

From a technical point of view, the EUR/GBP is testing a critical zone of support between (roughly) 0.8490 and 0.8505. A breakdown of that support level could be a bearish signal and herald further downside for the pair. In the short term, whether that happens or if the pair respects the level could boil down to next week’s European inflation data and whether it impacts expectations for what the ECB might do when it meets on June 6.

(Source: Trading View)