Apple Q1 earnings expected to be impacted by weak Chinese economy

Apple Inc. (AAPL) reports its Q1 results after Wall Street’s closing bell on February 1, 2024. We preview what to expect from the results and analyse the stock’s technicals.

Apple Inc. (AAPL) reports its Q1 results after Wall Street’s closing bell on February 1, 2024. We preview what to expect from the results and analyse the stock’s technicals.

Weak Chinese demand expected to weigh on Apple earnings

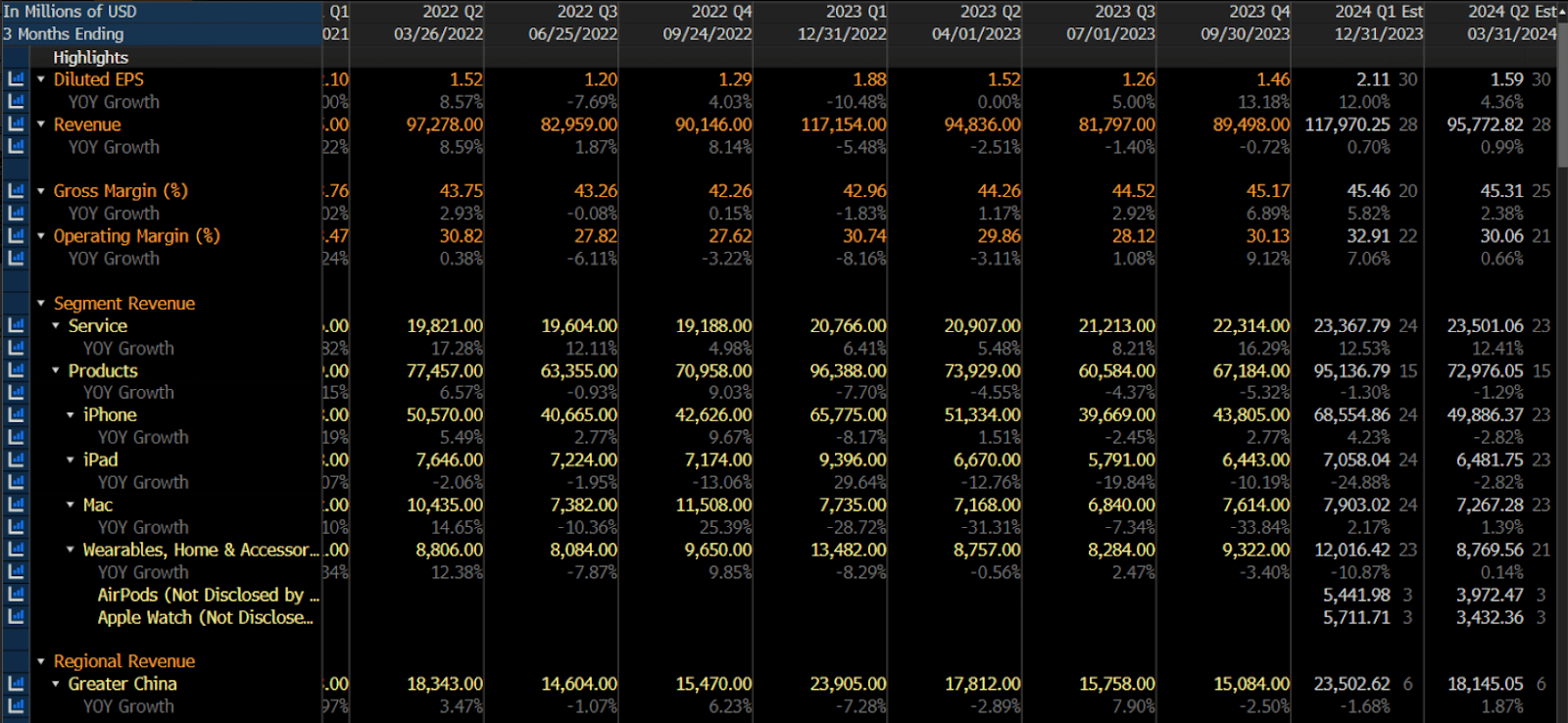

According to Bloomberg data, analysts forecast Apple’s earnings to grow roughly 12% in fiscal Q1 to $2.11 per share. The rise in earnings is expected to come despite flat revenue growth, with the increase owing to increased operating margins.

Weak consumer demand in China is projected to hurt Apple’s revenues, especially in its products division. Regional revenue in China is forecast to drop by 1.7%, with greater competition in that market from domestic players also impacting Apple’s topline. Services revenue is likely to drive Apple’s performance for the quarter, although a drop in fees from a year earlier risks slowing growth in that segment.

(Source: Bloomberg)

(Source: Bloomberg)

Investors will be keeping a lookout for commentary about future consumer demand – not only in China but also in the United States and other developed markets. Another issue could be supply disruptions, chip security, and the outlook for the Apple watch off the back of an ongoing patent dispute about the product’s oximeter feature.

According to Bloomberg surveys, the broker community remains relatively upbeat about the outlook for Apple shares. It retains a consensus “buy” rating, with 34 making that recommendation, 15 suggesting a “hold”, and 6 calling a sell. The consensus price target is below current market valuations at $199.82.

(Source: Bloomberg) Past performance is not a reliable indicator of future results

Technical analysis: Apple shares float below major technical resistance

Apple shares are in a structural uptrend; however, upside momentum is slowing. Significant resistance is at $200 per share, which coincides with the stocks’ all-time high. A break of that level, potentially off the back of this quarter’s results, could be a bullish signal. Meanwhile, technical support is around $180, with a push below that price signalling a possibly deeper sell-off.

(Source: Capital.com) Past performance is not a reliable indicator of future results