A trader’s guide to quantitative trading

Learn about quantitative trading, with tips and examples of how to trade using a data-driven approach with Capital.com

Create an account Open a demo account

What is quantitative trading?

Quantitative trading, also known as ‘quant trading’, is a data-driven approach that involves mathematics and technology to inform trading decisions. Unlike traditional methods, which rely on human intuition, experience and emotions, quantitative trading uses algorithms and statistical models to identify market opportunities.

In other words, quantitative trading is a logical, scientific trading method that helps to minimise the chances of human error – especially those caused by emotions like fear or greed.

What is a quant trader?

A quant trader is a trader who adopts quantitative analysis and computational techniques to develop and execute their trading strategies. In the past, quant trading was favoured almost exclusively by large financial institutions due to its dependence on vast computational power and an advanced understanding of coding languages like Python, R and C++.

However, modern technology has made quant trading more accessible. Tools like Metatrader 4, Metatrader 5 and TradingView are offered on trusted trading platforms, with user-friendly interfaces through which traders can implement quant strategies without requiring extensive programming knowledge.

How does quantitative trading work?

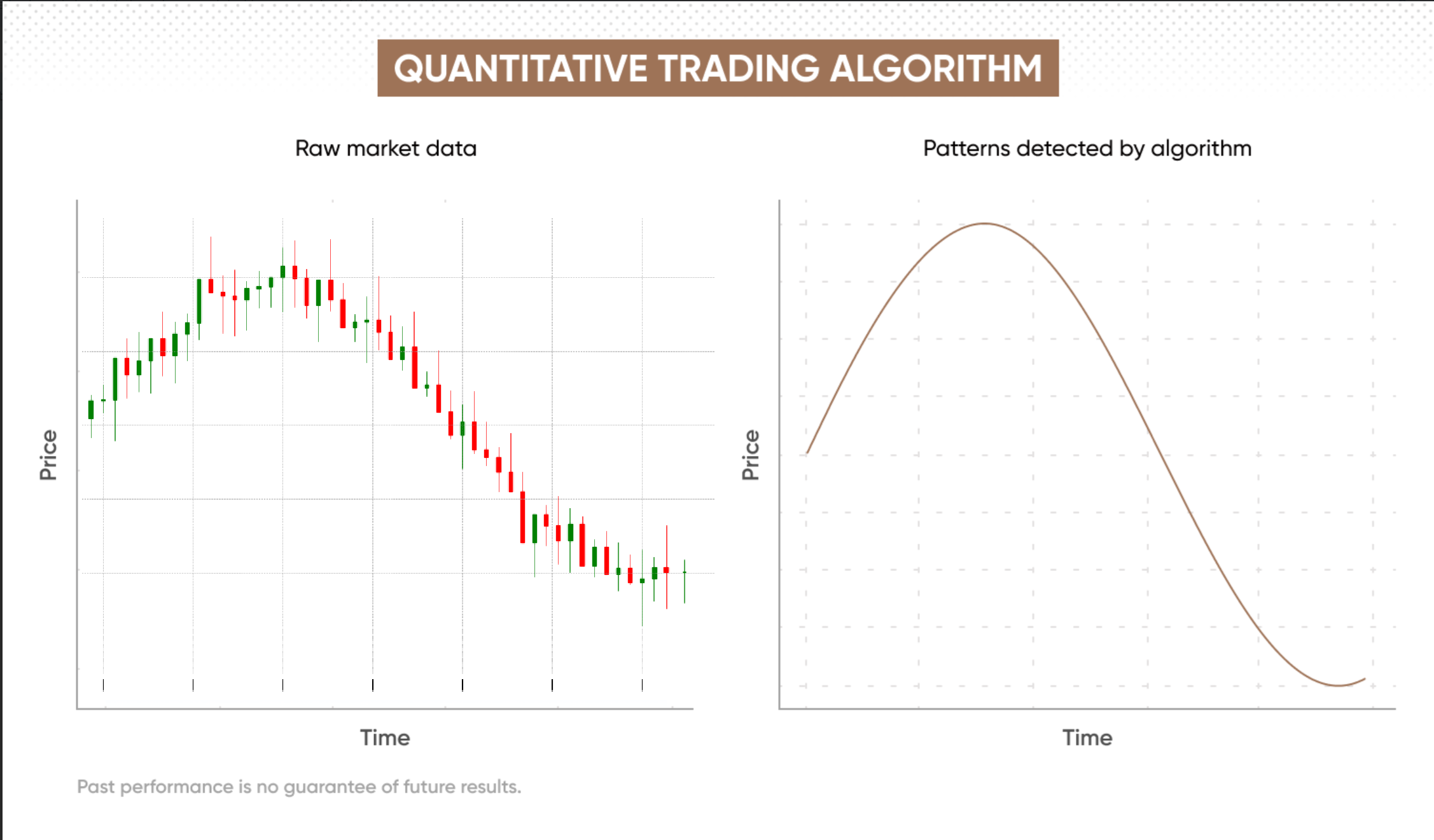

Quantitative trading works by using mathematical and statistical methods to analyse financial data. In quantitative trading, computer algorithms automatically perform technical analysis to identify market trends and patterns, often within fractions of a second, to provide actionable insights.

Quantitative trading works by using mathematical and statistical methods to analyse financial data. In quantitative trading, computer algorithms automatically perform technical analysis to identify market trends and patterns, often within fractions of a second, to provide actionable insights.

For example, a trader might recognise a trend or chart pattern using quantitative analysis, then build a quantitative trading algorithm that analyses price and volume data to confirm the signal, or anticipate major market movements.

High frequency trading (HFT) and algorithmic trading are often used in conjunction with quantitative trading. HFT allows computers to automatically execute trades in a fraction of a second, enabling traders to react quickly to market changes and potentially benefit from fast-paced price fluctuations.

Quantitative trading – pros and cons

Benefits

It offers increased speed versus traditional methods, along with the ability to analyse relationships between price, volume, and other variables across asset classes.

Risks

Algorithms are still designed and configured by humans, so the potential for error remains. A small mistake, such as incorrect parameters or even a minor miscalibration, can lead to misinterpretation of data and costly mistakes.

Quantitative trading models and techniques

Quantitative trading combines algorithms, data analysis and statistical models to anticipate market movements automatically based on predefined conditions.

Here’s how it works:

Data collection

Large datasets are gathered from sources including historical price and volume data, as well as alternative data like news sentiment and macroeconomic indicators.

Analysis

Algorithms analyse the data for trends, patterns and correlations between asset prices. Machine learning and statistical techniques are often employed to uncover deeper insights.

Strategy development

Algorithms create trading strategies based on this analysis, such as mean reversion or momentum trading.

Backtesting

Strategy is tested against historical data to evaluate potential success, although past performance does not guarantee future results.

Execution

If backtesting is successful, the strategy is applied to real-time market data. Ongoing performance monitoring is essential for traders to adjust as needed.

Risk management is key for quant traders. Tools like stop-loss orders automatically close positions at a preset loss limit, and limit exposure to further losses*. Take-profit orders lock in profits by closing positions when a predefined profit target is met. These tools help minimise risk, especially during high-frequency trading sessions.

*Stop losses are not guaranteed

Quantitative trading vs algorithmic trading

Both quantitative and algorithmic trading use automation, but quantitative trading focuses on the data-driven development of strategies, while algorithmic trading emphasises the execution of trades according to those strategies. In other words, all quantitative trading is algorithmic, but not all algorithmic trading is based on quantitative models.

| Aspect | Quantitative trading | Algorithmic trading |

|---|---|---|

| Focus | Data-driven strategy development | Automated trade execution |

| Tools | Statistical models, algorithms, backtesting | Pre-programmed trade execution rules |

| Usage | Often by large institutions, but increasingly accessible to individuals | Used by retail traders, institutions, and hedge funds |

Quantitative trading strategies with examples

Quantitative trading strategies rely on mathematical models, algorithms and statistical analysis to help traders make disciplined decisions. These techniques minimise emotional decision-making and can be customised based on trading preferences, profit goals and risk tolerance.

Here are two popular quantitative trading strategies.

Mean reversion strategy

The mean reversion strategy assumes that asset prices will revert to their historical average over time.

In this strategy, quant traders look for instances where the market price deviates significantly from its long-term mean. For example, if an asset is trading below its historical average, a trader might take a long position, anticipating the price may rise back to the mean. Conversely, a short position may be taken if the price is above the mean.

A more advanced version is pairs trading, where traders compare two correlated assets. If the price ratio between them diverges from its historical mean is a more advanced version of mean reversion strategy. Traders compare the price movements of two correlated assets, and compare the current price ratio with its historical mean, traders may go long on the undervalued asset and short on the overvalued one, expecting the ratio to normalise.

Example: A stock’s price falls 15% below its 200-day moving average, indicating a potential buying opportunity. Using quantitative analysis they confirm that the stock historically bounces back to its mean, and enter a trade based on this expectation.

Trend following/momentum strategy

Trend following strategy, or momentum strategy, assumes that when an asset is trending in a particular direction, it will continue to do so. Traders use momentum indicators to gauge the strength of a trend. If an uptrend has significant bullish momentum, they may enter a long position expecting the trend to continue. Similarly, if a downtrend has high momentum, they may enter a short position.

Algorithms typically identify momentum using technical indicators such as moving averages, relative strength index (RSI) and moving average convergence divergence (MACD).

Example: A momentum trader identifies a commodity that's been steadily rising, supported by strong trading volume. They use an algorithm that buys when the price crosses a key moving average and exits when momentum slows, minimising the risk of sudden reversals.

FAQ

What is quantitative trading?

Quantitative trading is a data-driven approach to trading that relies on mathematical models and algorithms to inform decisions. It uses computers to analyse large amounts of data – including price and volume – to identify trading opportunities.

Unlike qualitative analysis, which relies on human intuition, quantitative trading aims to minimise emotion-based decisions and help traders react swiftly to market conditions.

What are some quantitative trading strategies?

Common quantitative trading strategies include mean reversion – buying undervalued securities and selling them when their prices revert to the average. Statistical arbitrage exploits price discrepancies between correlated assets, and momentum trading identifies and aims to capitalise on established trends.