GBP/AUD forecast: Stagnant UK growth, persistent inflation put sterling on back foot

Will the pound or Aussie prevail? Read in our GBP/AUD forecast.

The British pound sterling has climbed to a three-week high against the Australian dollar despite the Reserve Bank of Australia (RBA) raising interest rates on Tuesday, as heightened US-China tensions weighed on the Aussie.

The RBA raised the headline interest rate by 50 basis points to 1.85%. The Bank of England (BoE) also raised that by 50 basis points to 1.75% on Thursday, leaving it below the Australian rate.

How has the GBP/AUD pair been performing and what are the factors to watch for the future? In this article we look at the pound/Australian dollar forecast outlook.

What drives the GBP/AUD exchange rate?

The GBP/AUD exchange rate shows how many Australian dollars – the quote currency – are needed to buy one British pound – the base currency. The Australian dollar, known popularly as the ‘Aussie’, is the world’s fifth most traded currency, even though Australia's gross domestic product (GDP) is the 12th largest in the world. Pound sterling is the fourth most traded currency, with the UK being the world’s fifth largest economy.

One of the primary drivers for foreign exchange rates is the economic performance of the home countries, and like other currencies the GBP/AUD pair responds to economic indicators, including gross domestic product (GDP), international trade data, interest rates and inflation.

The Australian dollar is considered to be a commodity currency – along with the New Zealand dollar and Canadian dollar – as the mining industry accounts for 11.5% of the Australian economy and resources make up 68.7% of its exports. As China accounts for 36.5% of Australia’s exports, traders often use the Aussie dollar as a way to take a position on China’s economic performance.

Sterling, the former global reserve currency, is one of the world’s strongest currencies, with a role in a major financial trading centre. The value of GBP has been predominantly driven by the status of the Brexit process since the UK voted to leave the European Union in a 2016 referendum. The health of the UK economy since the start of the Covid-19 pandemic has also been an important factor.

GBP/AUD rate reflects economic turbulence

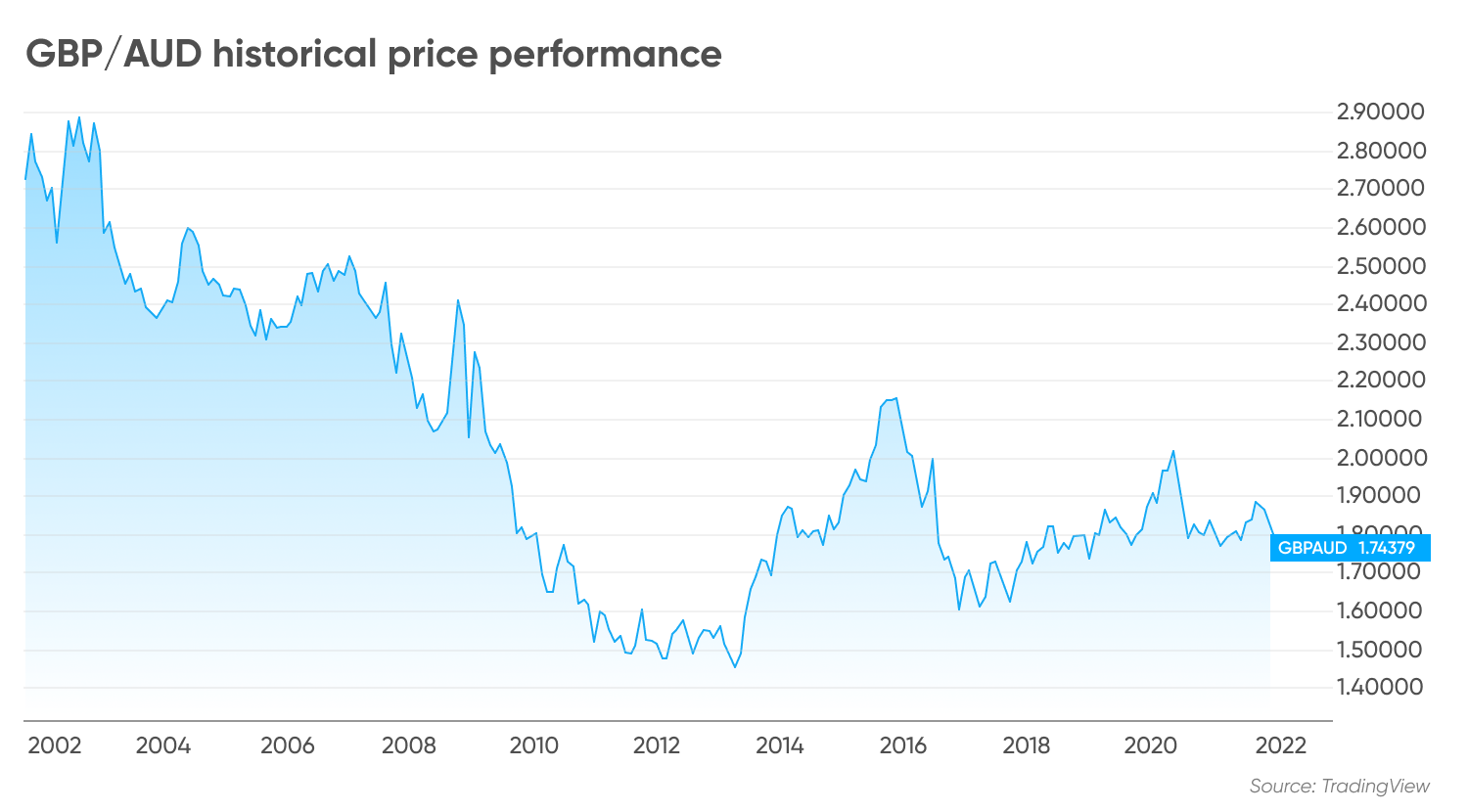

The GBP/AUD pair has been in a long-term downward trend since it spiked in 2008, as the Australian dollar has benefited from higher Australian interest rates and rising commodity demand from China.

The pair jumped to 2.53 in October 2008 as commodity prices collapsed during the global financial crisis, reducing the value of the Aussie against the pound. But the FX rate steadily declined in the wake of the crisis to a low of 1.46 in March 2013, as the RBA maintained higher interest rates than the BoE, making the dollar an attractive high-yielding investment.

The GBP/AUD pair rebounded as the UK’s economic outlook improved, increasing the chance that the BoE would raise interest rates, while the Australian dollar came under pressure. Falling commodity prices, an economic slowdown in China and cuts to Australian interest rates all weighed on the Australian currency. The pair climbed to 2.16 in September 2015, its highest level since 2009, as the Chinese stock market crashed.

The Australian dollar recovered in the following year, trading around 1.60 to the pound by the end of 2016. But then the Australian currency trended lower on concerns about the US-China trade war and slowing Chinese economic growth, with the pair briefly moving back above the 2 level in March 2020. The pair was trading back down to 1.76 by the end of 2020, with Chinese demand rebounding from the initial Covid-19 lockdowns.

Subsequent Chinese lockdowns have seen the pair move back to 1.90 in mid-2021 and early 2022, but it has been trading in a 1.73-1.77 range in recent months as traders weigh the impact of high inflation and rising interest rates in both the UK and Australia.

The GBP/AUD pair has moved down from the top of that range in late June to the bottom in late July. The rate then moved up to 1.76 on 3 August, after the RBA raised interest rates as expected on 2 August.

Analysts at Dutch bank ING noted: “the combination of a switch to a Fed-style fully data-dependent approach, and the view that inflation is expected to peak and moderate later this year, were read as dovish signals by markets. All this explains the Aussie dollar’s negative reaction… We also suspect that the AUD drop was exacerbated by the risk of resurging Sino-American tensions.”

Inflation in Australia has climbed to its highest level since the early 1990s, coming at 6.1% year on year in the June quarter. Domestic factors, including strong demand pushing up prices, a tight labour market, capacity constraints in some sectors and flooding in parts of the country, have combined with global factors to increase in inflation, the RBA said.

“Inflation is expected to peak later this year and then decline back towards the 2–3 per cent range. The expected moderation in inflation reflects the ongoing resolution of global supply-side problems, the stabilisation of commodity prices and the impact of rising interest rates… The Bank's central forecast is for CPI inflation to be around 7¾ per cent over 2022, a little above 4 per cent over 2023 and around 3 per cent over 2024,” the RBA said. “The Australian economy is expected to continue to grow strongly this year, with the pace of growth then slowing.”

The inflation forecast was higher than the RBA previously indicated and the bank is expected to increase interest rates by another 50 basis points in its next review.

Forex traders are watching for the BOE’s statement on Thursday for indications on how the UK’s economic outlook compares with Australia’s.

The Australian Performance of Manufacturing Index (Australian PMI) expanded for a sixth straight month at 55.7 in July – down from 56.2 in June and the joint lowest in the past six months.

The UK manufacturing Purchasing Managers’ Index (PMI) fell from 52.8 to 52.1 in July – its lowest level since June 2020. Manufacturing output contracted for the first time since May 2020, reflecting lower demand in the consumer and intermediate goods industries. The rate of expansion in investment goods dipped to a four-month low. A number above 50 indicates expansion, while a number below 50 points to a contraction in activity.

The UK’s National Institute of Economic and Social Research (NIESR) issued a gloomy economic outlook on 3 August.

What is the outlook for sterling and the Aussie dollar in the current economic environment? We look at a range of analysts’ views below.

GBP/AUD forecast: Does the pound or Aussie have the stronger outlook?

Currency analysts see potential for weakness in both the pound and the Aussie dollar, which could see continued relative stability in the GBP/AUD forecast.

“For ‘risk-on’ currencies like the AUD, NZD, and CAD, our analysis shows that risk appetite is more dominant over relative rate considerations,” according to analysts at Hong Kong-based HSBC. “Perhaps, this is because the market focus is shifting to what this inflation battle will mean for global economic activity. With a slowing global economy and growing focus on recession risks, ‘risk-on’ currencies should generally underperform ‘safe-haven’ currencies (like the USD and JPY) over the coming weeks and months, in our view.

“Like in the US and the eurozone, expect RBA rate expectations and AUD to become significantly more sensitive to data releases from now on,” according to analysts at ING.

Spanish bank Santander was also bearish on the outlook for sterling, noting: “We now expect more BoE rate hikes in 2H22 to fight inflation but doubt that they will support the pound. Instead, with the UK economy already likely to underperform, growth risks should keep the pound under pressure.”

The bank’s analysts added: “We do not believe that these extra rate hikes will provide much support for the pound but instead may anchor the currency at close to current levels in 3Q22. More rate hikes could be viewed as simply keeping up with the neighbours. The central banks of most developed economies apart from the BoJ will also be hiking rates, suggesting that policy/yield differentials are not expected to move strongly in the pound’s favour.”

Analysts at Danske Bank in Denmark expected the pound to weaken more than the Aussie in the medium term, with the GBP/AUD forecast for 2022 indicating that the exchange rate could decline from 1.71 in a month to 1.70 in three months’ time, although it could then rebound to 1.77 in a year.

The GBP/AUD forecast from Trading Economics predicted that the pair could trade at 1.75112 by the end of this quarter and at 1.76988 in one year, based on its global macro model projections and analysts’ expectations.

National Australia Bank expected the Australian dollar to stabilise against the pound into 2023, with the AUD/GBP cross rate rising to 0.61 by December from 0.58 in the current quarter, and holding at 0.61 throughout next year before moving back to 0.59 in 2024.

For the longer term, the GBP/AUD forecast for 2025 from forecasting service WalletInvestor indicated at the time of writing (August 4) that the exchange rate could decline to 1.678. The website’s algorithm predicted that the rate could fall further to 1.619 in five years’ time.

The GBP/AUD prediction from The Economy Forecast Agency showed the pair trading at 1.707 at the end of 2025 from 1.719 at the end of 2022, 1.744 at the end of 2023 and $1.637 at the end of 2024.

Analysts have yet to issue a GBP/AUD forecast for 2030.

When looking at any GBP/AUD forecast, it’s important to keep in mind that foreign exchange markets are highly volatile, so analysts and algorithm-based forecasters can and do get their predictions wrong.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And neve invest money that you cannot afford to lose.

FAQs

Why has GBP/AUD been rising?

The GBP/AUD currency pair has been in a long-term downward trend, but has traded higher in recent weeks on changing expectations surrounding inflation and interest rates in Australia and the UK and rising US-China tension.

Will GBP/AUD go up or down?

The direction of the pound against the Australian dollar could depend on economic data from the UK and Australia, as well as expectations about Chinese economic activity given the country’s role as the largest destination for Australian exports.

When is the best time to trade GBP/AUD?

You can trade the GBP/AUD pair around the clock on weekdays. The best time to trade is often around the release of economic data or major world events, which can drive market volatility.

Is GBP/AUD a buy, sell or hold?

The right trading strategy for the GBP/AUD pair will depend on your personal circumstances, risk tolerance and portfolio composition. You should do your own research to develop an informed view of the market. And never trade more than you can afford to lose.