Egypt interest rate forecast in 5 years: Will CBE keep tightening to meet IMF requirements?

Egypt could maintain its hiking cycle to meet IMF’s loan terms.

The Central Bank of Egypt (CBE) raised its overnight deposit rate by 300 basis points (bps) to 16.25% on 22 December 2022, marking the fourth-rate hike during the year as the country is struggling to cool double-digit inflation.

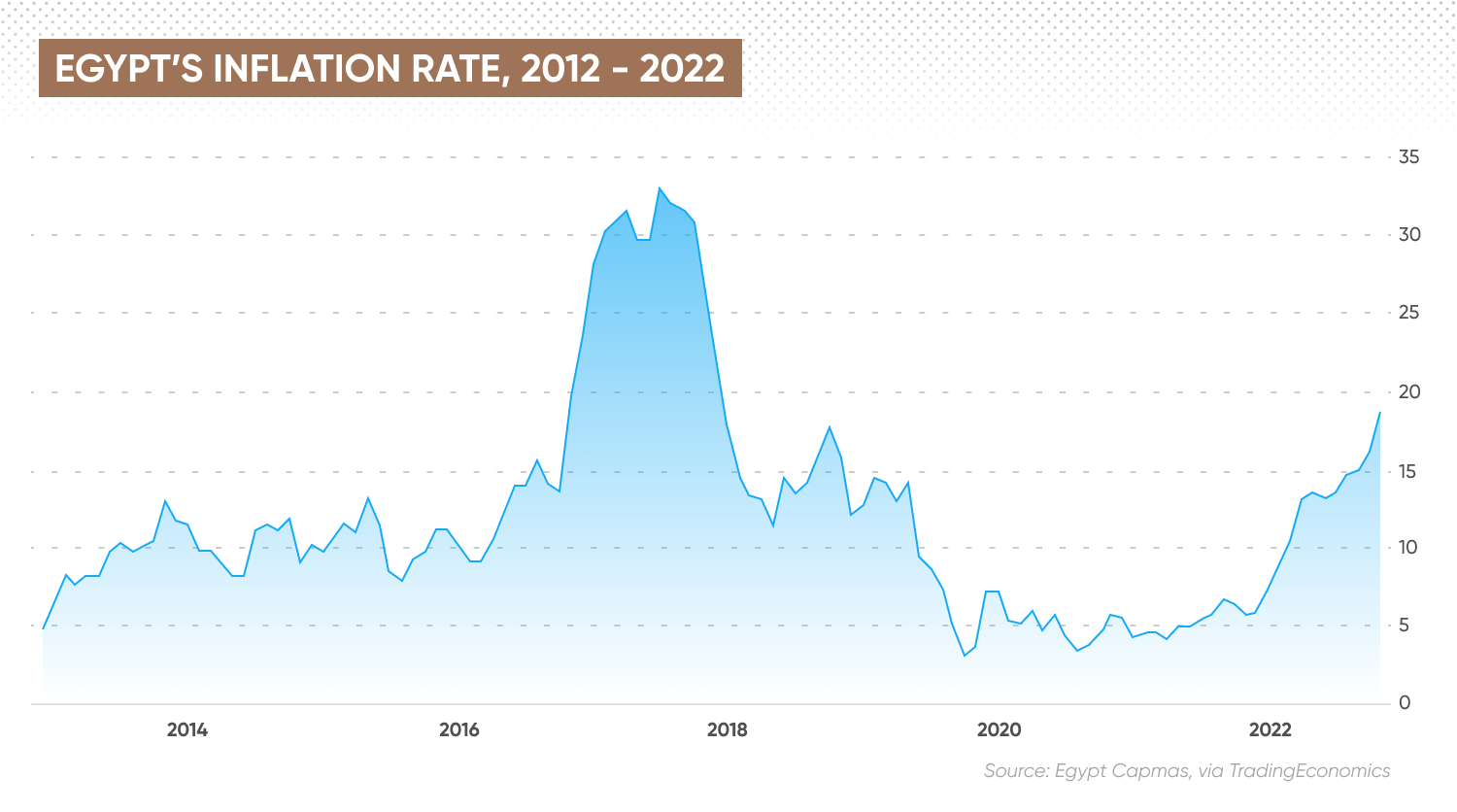

Headline inflation accelerated to nearly 19%, while core inflation, which excludes food and regulated items, surpassed 21% in the most recent reading in November, according to CBE’s data.

The rate hike at the end of 2022 also came shortly after the International Monetary Fund (IMF) Executive Board approved the disbursement of a $3bn loan over 46 months to Egypt.

As part of the package, Egypt must carry out a monetary policy that aims to gradually reduce inflation to the CBE’s target. The requirement could add a challenge for the CBE to ramp up its tightening policy without sacrificing economic growth.

What will be Egypt interest rate forecast in 5 years as the country is set to implement the IMF's loan package?

Interest rates policy in Egypt

An interest rate is a fee or cost the borrower is charged with by a lender. In banking, the interest rate is the proportion of money a customer earns for saving their money in a bank. In other words, a customer acts as the bank's lender.

The central bank adjusts the policy interest rate to maintain stability in a country’s financial system. The interest rate set by the central bank determines the rates that banks charge one another and their customers.

When the central bank seeks to slow the rate of inflation, it raises interest rates. Higher interest rates make borrowing money more expensive for individuals and businesses, causing them to cut back on spending and slowing economic growth.

Lowering interest rates, on the other hand, will decrease borrowing costs, encouraging consumers to increase spending and investment, resulting in faster economic growth.

In Egypt, the Central Bank of Egypt (CBE) sets up the benchmark overnight deposit rate as the bank’s main monetary policy tool to control the inflation rate. The CBE’s inflation rate target for 2022 is 7%.

The Monetary Policy Committee (MPC) of the bank meets once a month to adjust the policy rate. The meeting is usually held on the first Thursday of each month.

Egyptian interest rate history

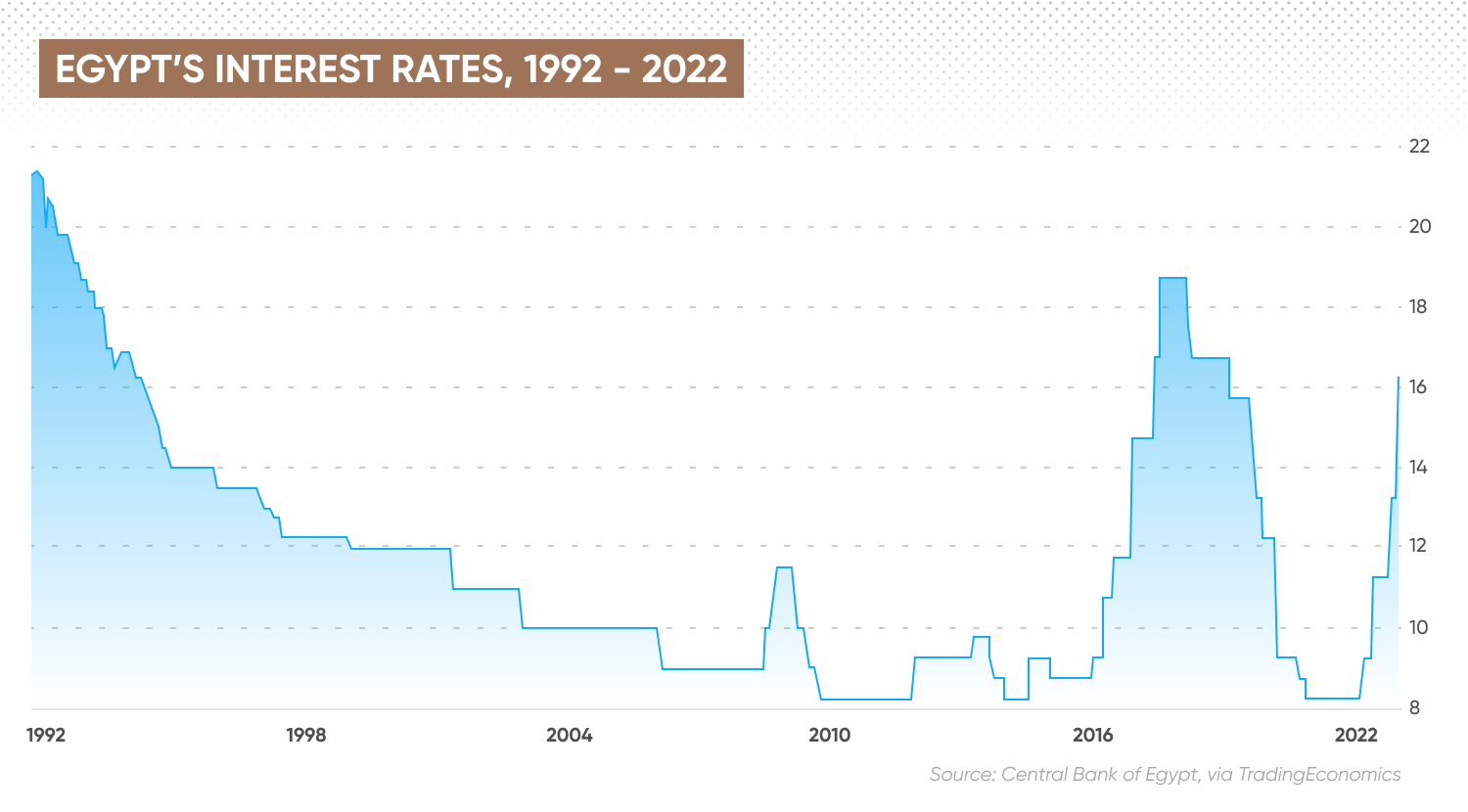

Interest rates in Egypt touched an all-time high of 21.40% in October 1991. The lowest Egypt interest rates were recorded at 8.25% in September 2009.

After lifting the overnight deposit rate to 18.75% on 28 December 2017 to cool inflation that soared to 33%, CBE began to ease policy between 2018 to 2019.

The country’s fiscal policy reforms of 2016 saw the adoption of a flexible exchange rate against other currencies resulting in a sharp depreciation of the Egyptian pound. The Egyptian pound's (EGP) depreciation, particularly against the US dollar (USD), increased import costs, giving rise to inflation.

A series of rate cuts brought down interest rates in Egypt to 12.25% in November 2019 from 17.75% in February 2018 as the inflation rate decelerated. The benign inflation rate in developed countries and low crude oil prices helped to cool inflation in Egypt. By October 2019, the pace of price growth in the country eased to 3.1%, the lowest rate since December 2005.

The CBE kept the overnight deposit rate unchanged at 12.25% until March 2020 when it lowered the rate by 300 bps to 9.25% to support growth during the Covid-19 pandemic. In September 2020, the CBE cut the overnight deposit rate by 50 bps, bringing it to 8.25%, which was kept unchanged until February 2022.

In March 2022, the bank’s MPC held a special meeting and decided to raise Egypt’s interest rates by 100 bps to 9.25%, which also marked the start of the current hiking cycle. The CBE attributed the decision to start the tightening cycle to rising global inflationary pressure caused by the pandemic, the Russia-Ukraine war and rising global commodity prices.

Over 2022, Egypt raised its policy rate by a total of 800 bps in four meetings.

Inflation to stay at the double-digit in near term

The CBE mentioned rising demand pressure as the reason for continuing the rate hike cycle in December, citing high broad-based inflation and real economic activity growth.

The bank expressed concern about global commodity price uncertainty due to several factors, noting:

Inflation soared to an annual rate of 18.72% with the core inflation accelerating to 21.5% in November, the highest since 2017.

Higher prices of food items remained the biggest contributor to November’s inflation, according to the bank. The price growth was also amplified by price increases in the service sector, notably higher spending on restaurants, cafes and retail items.

The World Bank in December’s Egypt Economic Monitor forecast the inflation rate to accelerate at an average of 16.7% in fiscal year (FY) 2022/2023, slowing to 10.8% in FY 2023/2024. The report stated:

According to Statista, the inflation rate in Egypt was expected to average 11.97% in 2023, accelerating from 8.5% in 2022. Egypt’s inflation rate was projected to ease to 8.05% in 2024, cooling further to 7.1% in 2025 and steady at 6.9% from 2026 to 2027.

Economic growth to decelerate in 2023 before rebounding

The state of the Egyptian economy is another key factor the CBE could watch out for when hiking interest rates as it aims to curb inflation without causing a recession.

Egypt's gross domestic product (GDP) growth rate, a common gauge of economic health, was expected to slow to 4.5% in FY 2022/2023, down from 6.6% in FY 2021/2022. The Ukraine war and Covid-19-related disruptions were pinned as the key factors to hurt the country’s economy, according to the World Bank. The agency said:

The World Bank projected Egypt’s economic growth to inch up to 4.8% in FY 2023/2024 as it continued to push ahead with macroeconomic stabilisation and structural reforms.

Fitch Solutions in November forecast the country’s GDP growth rate to slow from 6.6% in FY2021/22 to a decade-low of 3% in FY2022/2023. The firm said:

Investment growth was expected to slow sharply amid lower capital spending to reduce the fiscal deficit and imports. Furthermore, shortages of US dollars will weigh on exports by reducing product availability and limiting access to raw materials, according to Fitch.

Statista’s forecast saw Egypt's economy growing by 4.38% in 2023, down from 6.61% in 2022. In 2024, the country's economy was expected to recover to 5.18%, accelerating to 5.58% in 2025, 5.75% in 2026, and 5.85% in 2027.

Further depreciation of EGP

The Egyptian pound has continued to weaken with the USD/EGP currency pair hitting a record low of 24.7 on 29 December following the final approval of IMF’s $3bn loan on 16 December.

The decision enabled immediate disbursement of $347m of the loan to meet the balance of payments needed and support the budget, the IMF stated.

Apart from the requirement for CBE to hike interest rates to reduce inflation, the package also called for a permanent shift to a flexible exchange rate regime to increase resilience against external shocks and to rebuild external buffers.

As of 29 December, USD/EGP has strengthened roughly 58% year-to-date (YTD). Trading Economics forecast as of 29 December was for the USD/EGP to surge to 27.56 in 12 months.

Egypt interest rate forecast in 5 years

With inflation predicted to stay high and economic growth anticipated to slow, what will be the Egypt interest rate forecast over the next five years?

Trading Economics’ Egypt interest rate prediction saw the overnight deposit rate to average 17.25% in 2023 and 16.50% in 2024.

Fitch Solutions forecast Egypt, along with Morocco and Algeria, to keep their interest rate at 2022 levels. The firm did not give Egypt interest rate forecast in more detail.

In a separate note on 27 October, Fitch Solutions suggested that the CBE could hold the interest rate to assess the impact of tighter financial conditions on inflation.

Trading Economics and Fitch Solutions did not provide Egypt's long-term interest rate forecast due to the complexity of factors, including the inflation rate, the impact of the permanent shift to a flexible exchange rate as part of IMF’s loan requirement and economic growth.

When looking at Egypt interest rate forecasts, keep in mind that analysts' projections can be incorrect. Forecasts should not be used as a substitute of your own research.

Always conduct your own due diligence before trading, looking at the latest news, a wide range of commentary, technical and fundamental analysis. Remember that past performance does not guarantee future returns. And never trade with money you can't afford to lose.

FAQs

Is the interest rate in Egypt going up or down?

Trading Economics as of 29 December expected CBE to continue hiking Egypt’s interest rate at least until 2023, before starting its rate cut cycle. Meanwhile, in November note Fitch Solutions projected Egypt to keep its interest rates in 2023 at the same level as in 2022.

However, bear in mind that analysts’ forecasts can be wrong. You should always conduct your research in making an interest rate forecast in Egypt.

How high will Egypt's interest rates go?

Trading Economics, as of 29 December, forecast that Egypt's interest rate could peak at 17.25% in 2023. As always, keep in mind that any prediction can be wrong.

Where will interest rates be in 5 years?

Trading Economics along with other forecasting agencies did not provide an outlook on Egypt projected interest rates in 5 years or beyond 2024 due to the complexity of factors, including the inflation rate, the impact of the permanent shift to a flexible exchange rate as part of IMF’s loan requirement and economic growth.