Day trading explained: How to day trade

Discover the world of day trading with our comprehensive guide.

What is day trading?

Day trading is the practice of buying and selling financial instruments within the course of a day. A day trader typically starts trading when the market opens and finishes when the market closes. The idea is to speculate on small price movements.

Day traders can speculate using a variety of instruments from financial derivatives to assets such as stocks, foreign exchange, indices and commodities.

Highlights

- Day trading involves opening and and closing a position within the same market session.

- Day traders speculate on an asset’s short-term price fluctuations.

- Day trading is highly risky, so traders should do their own research, remember that prices can go down as well as up, and should never trade with more money than they can afford to lose.

- Day trading differs from conventional, long-term investing that aims to buy and hold in an asset or an instrument in the hope that its value will increase over the course of time.

- Historically, day trading was an activity exclusive to big financial firms, banks and financial professionals. However, with the growth of online trading platforms, day trading has become more accessible to retail clients outside the financial sector.

Day trading explained

Day trading is based around a market or asset’s price fluctuations. This means that, in many cases, traders may consider assets that move around, meaning there are more fluctuations. The relative liquidity of an asset is also something day traders may consider keeping in mind.

Derivatives, such as contracts for difference (CFD) are popular instruments for day trading, as they allow short selling and the use of leverage (restrictions may apply), which can magnify both profits and losses.

CFDs allow traders to speculate on the price movement without owning the underlying asset.

Day trading strategies

There are a range of strategies that traders could consider to day trade. These include, but are not limited to:

| Key indicators | Key concept | |

| Range trading | Support and resistance; Commodity channel index (CCI) | Identifying highs and lows of an asset’s price during the day (range) to inform entry and exit points. |

| Contrarian trading | Investor sentiment indicators | Trading against prevailing market sentiment, for example, buying in a bear market and selling in a bull market. |

| Breakout trading | Moving average convergence divergence (MACD), relative strength index (RSI), volume indicators, and other oscillators | Trading assets that broke out of their trading range - outside support and resistance - coupled with a strong momentum. |

| News trading | Fundamental analysis; earnings reports; economic readings | Trading based on the news that affects asset prices rather than based on technical analysis. |

| Mean reversion trading | Moving averages (MA); MACD, RSI | Identifying assets in an uptrend, buying the pullback, and selling the rally. Or vice versa for short-selling. |

| Pairs trading | Historical correlation of two securities | Trading two related assets in the market and opening a long position on one and a short position on the other to speculate on a trend that affects both. |

Day trading rules and risk

The rules of day trading vary from place to place, depending on which jurisdiction a trader is under. Make sure to conduct your own research, looking at the government websites and other official sources.

There are, however, market risks that are universal. Markets can move against a trader’s position. If this happens, a trader could lose their money. When learning to day trade make sure to also conduct due diligence on the asset you’re trading. Remember that prices can move against your position, and never trade with more money than you can afford to lose.

How to start day trading

You may consider taking these steps to start day trading:

-

Choosing the instrument you want to trade: You can choose between share dealing, a derivative or something else. This choice would depend on your risk tolerance, experience in the markets and trading goals.

-

Setting up a trading account with a broker: There are a number of brokers available to retail traders from discount brokers to full-services. Make sure to conduct your own due diligence finding a broker based on your personal needs.

-

Designing a day trading strategy: You can use technical analysis and fundamental analysis, forming your own trading strategy suitable for your goals.

Day trading example

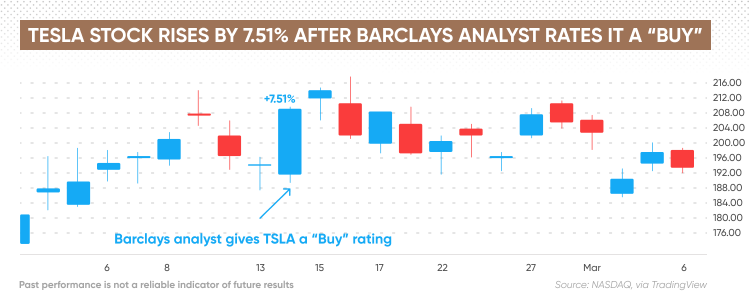

A potential example of day trading stocks comes in the form of Tesla’s (TSLA) performance on 14 February 2023.

Following the news that a senior analyst at Barclays initiated stock coverage, giving it a “Buy” rating and a $275 price target (versus $192 share price on the day), the stock went up by more than 7% in the course of the day, reaching as high as 9% increase intraday.

A day trader could have entered the market by buying Tesla when it opened at $191.94, around the time that the analyst made his forecast, and exited the market by selling it when it reached its intraday high of $209.25.

Note that this example is for illustrative purposes only. Of course, if the stock didn’t react to the rating, or reacted differently, the trader could have lost money.

The example above is for illustrative purposes only.

Things to watch out for when day trading

The are a few mistakes traders could avoid when day trading:

-

Not doing their own research: A trader who does not do their own research is at risk of losing their money because they are not as well informed as they could be.

-

Trading illiquid assets: If a trader’s assets are not liquid enough, then they may not be able to sell them.

-

Not controlling their emotions: Traders who keep their emotions in check may be more likely to make rational decisions than those who let their hearts rule their heads.

Conclusion

Day trading refers to a trading approach in which a position is open and closed within the same trading session or day. Day trading strategies include, but are not limited to, range trading, contrarian trading, pairs trading and news trading.

To start day trading, you may consider choosing an instrument you want to trade (for example via derivative products); then open a brokerage account, and design a trading strategy that’s suitable to your goals. Day traders may benefit from doing their own research, avoid trading illiquid assets and keeping their emotions under control.

Day trading carries a lot of risks. This is why you may need to do your own research, remember that prices can go down as well as up, and never trade more money than you can afford to lose.

FAQs

How does day trading work?

Day trading is the practice of opening and closing a trade within the same day or market session. The idea is to speculate on short-term price fluctuations.

What is the first rule of day trading?

The rules of day trading would depend on your personal circumstances such as your risk tolerance, trading goals and other factors. It’s important to do your own research, remember that markets can move in a direction that damages your position, and never trade with more money than you can afford to lose.

How much money do you need to day trade?

This would depend on the broker you are using and their requirements to start a day trading account and the chosen trading strategy.