Cloudbreak (CDL) stock forecast: Will investors strike gold?

Can Cloudbreak Discovery shares regain some upwards momentum? We take a closer look at the latest CDL stock forecast.

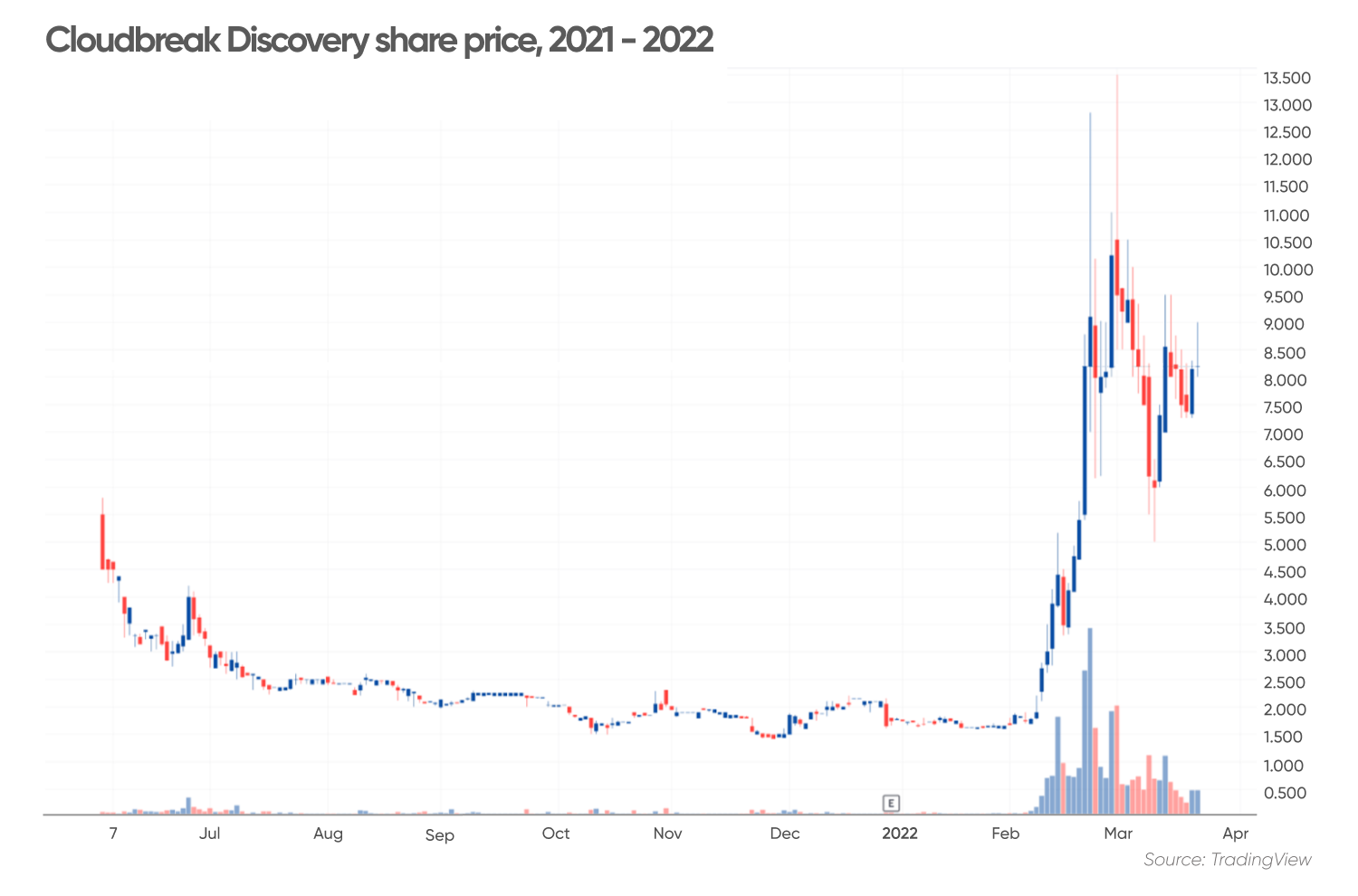

Cloudbreak Discovery PLC (CDL) caught investors’ attention as its share price soared by almost 400% between 8 and 28 February 2022.

However by April the sentiment had turned and the company saw 13 consecutive trading days of stock price decline. That decline has continued into May and today (10 May) it will open at 3.5p, 74% off its March peak.

In April it revealed losses of £2.8m for the second half of 2021 compared to a profit of £4.6m in the same period in 2020.

The mining project generator aims to identify undervalued sites and develop them with industry partners, but will investors strike gold?

Read on for a closer look at CDL stock forecast 2022 - 2025.

What is Cloudbreak Discovery?

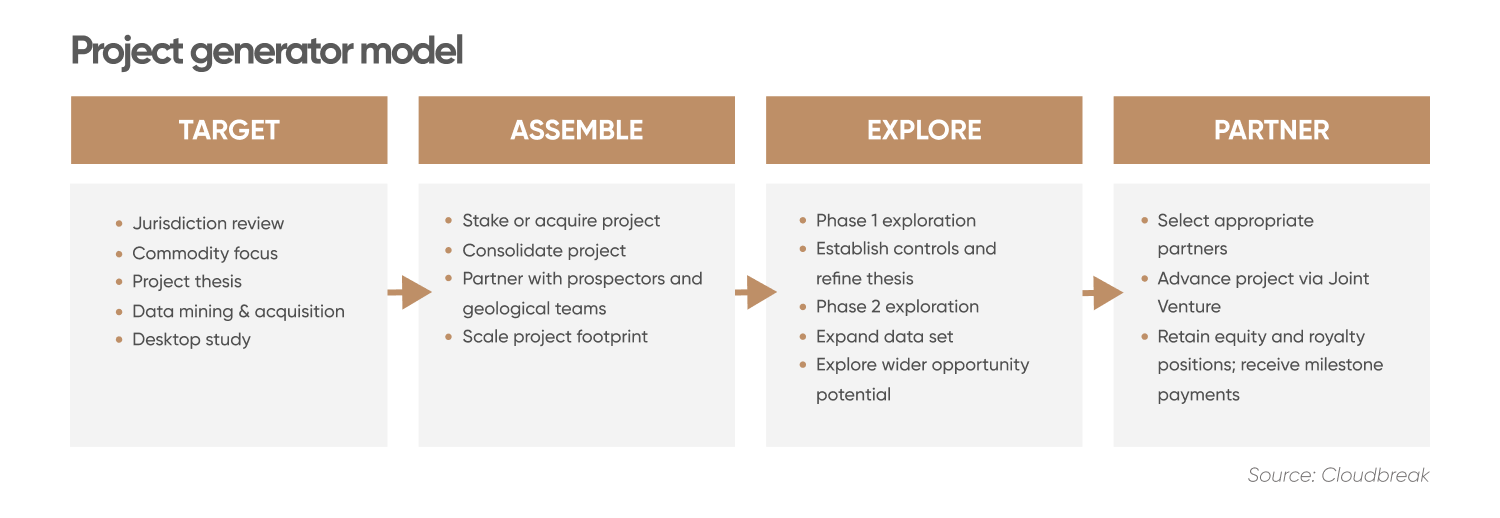

As a mining project generator, Cloudbreak operates at the first stage of the mining process: it seeks to identify undervalued projects in the natural resource sector, and goes on to advance them through joint ventures with industry partners.

Through this model, Cloudbreak benefits from exposure to exploration and development projects across multiple commodities and sites. It also crucially limits its exposure – by advancing projects through partnerships, Cloudbreak benefits from its partners’ balance sheets and their technical teams.

The company generates revenues by maintaining equity positions and royalties, and by arranging cash and milestone payments with its third party developers.

This project generator model has met with early success. In a 15 February 2022 corporate update, Cloubdreak revealed that 13 of its 17 projects were being advanced by partners. This has given investors exposure to over CAD$5m of exploration expenditures incurred by partners over the coming 12 months.

Cloudbreak’s key focus is on copper, lithium and precious metals, though it also considers lead, zinc and industrial mineral projects.

It currently lists US Lithium brines, West African gold and copper, energy and ‘fuels to support the clean energy transition’, and ‘commodities which support a greener economy’ among its acquisition targets.

CDL stock analysis: Past performance

CDL shares came to market on 3 June 2021, after Imperial X PLC changed its name to Cloudbreak Discovery PLC. Trading opened at 5p, but prices plummeted, hitting 2.33p by 19 June 2021 as markets reacted negatively to CDL stock news of a strategic alliance with Alianza Minerals.

But by 25 June 2021, the share price leapt by almost 27%, hitting 4p as Cloudbreak announced the joint development of a Serbian boron deposit site. The share price fluctuated over the autumn of 2021, but by 26 November had dipped again, reaching an all-time low of 1.43p.

By the start of 2022, the Cloudbreak share price was sitting at 1.65p, meaning investors faced a loss of over 63% on the stock’s launch price.

The bull run started on 7 February 2022 set off by an AGM on 4 February and a positive 15 February corporate update. The latter revealed that the firm had successfully confirmed mineralisation across its Northwest Portfolio, and that it was continuing to make progress with its West African site.

Kyle Hardy, president and CEO of Cloudbank commented at the time that: “There is currently a fundamental shift taking hold in the metals and energy sectors which will result in increased consumption of critical metals globally.

“Cloudbreak’s portfolio and strategy positions us at the vanguard of this shift and enables our shareholders to benefit from the changing dynamics within the metals and mining sectors.”

The share price surged further after a 2 March ‘share placing’ which saw the stock reach a record high of 8.5p on 4 March. This ‘placing’ saw almost 20 million shares placed at 750p (a 20% discount on the 1 March closing price) and raised £1.5m for working capital and project generation initiatives.

The share price dipped again, hitting 7.3p on 11 March as markets reacted uncertainly to the announcement that Cloudbreak had entered into an option agreement (precursor to a joint venture) to enter exploration on a Canadian site. At the time of writing (10 May 2022), it sat at 3.5p.

Volatility

As a project generator engaged in the speculative stage of the mining process, Cloudbreak has seen significant share price volatility.

Cloudbreak’s relative strength index (RSI) pushed above 70 four times in February as the stock entered its bull run. A figure above this threshold signals that a stock may be overbought and overvalued and due a price correction.

As the share price began to dip in March, the RSI also fell, tipping below 30 between 9 and 10 March, suggesting the stock was oversold and undervalued and due an upwards price correction.

The RSI reading was 45.82 at the time of writing (10 May 2022).

Risky business

Volatility is only one of the hurdles facing shareholders. As a mining projects generator in its early days, the company may encounter significant risks.

Cloudbreak’s 2021 results presented a mixed picture. Cash and cash equivalents were up significantly to £1.3m from £6,478 in the previous financial year, attributed to fundraising activities completed during its float. But it still isn't making a profit, reporting a loss of £902,060 in the year ended 30 June 2021, down from £1.1m for the previous financial year.

Its latest financial release also highlights a long list of principal risks and uncertainties. Chief among these are exploration risks, with the report highlighting that “exploration is a high risk business and there can be no guarantee that any mineralisation discovered will result in proven and probable reserves or go on to be an operating mine”.

Finding funding

Cloudbreak is also subject to significant funding risk. Its only sources of funding are through issuing further equity capital or bringing in partners to fund exploration and development costs. And both of these mechanisms hinge on the success of the Group’s exploration activities and its investment strategy.

These challenges could also be heightened further by difficult market conditions as investors shy away from mining and extraction.

“A post-Covid surge in demand, plus rising demand for some metals to build clean energy infrastructure, has been met by restrained investment in mining and extraction capacity due to a growing focus on ESG commitments,” said Westpac analyst Justin Smirk in a 7 February commodities briefing.

Small but agile

With a market capitalisation of around £17.4m, Cloudbreak is a small player compared to industry giants like Glencore (GLEN), which boasts a £60bn market cap. But Cloudbreak maintains that this can be an advantage, providing it with the agility to pivot between different commodities in search of the best prospects and opportunities.

“The Company has a well defined business strategy which limits its downside risk quickly by attracting quality partners to advance assets, giving Cloudbreak discovery exposure and considerable exploration exposure while minimising dilution,” Cloudbreak said in its financial release.

“Our business model is not constrained by geographic location or commodity, allowing us to diversify our range of assets, jurisdiction and partners.”

Growing market for ‘green metals’

And Cloudbreak has set ‘green metals’ in its sights. The company lists fuels to support the clean energy transition and commodities which support a greener economy among its acquisition targets.

This could prove to be extremely profitable, with a November 2021 IMF report predicting that: “The world’s historic pivot toward curbing carbon emissions is likely to spur unprecedented demand for some of the most crucial metals used to generate and store renewable energy in a net-zero emissions by 2050 scenario.”

The report saw lithium prices rising several hundred percent from their 2020 levels, peaking at around 2030, and Cloudbreak is looking to develop US lithium brines. Never mind striking gold; investors will want to know whether Cloudbreak can strike lithium.

Cloudbreak (CDL) stock forecast 2022-2025

The question on investors’ lips remains: are Cloudbreak Discovery shares buy, sell or hold? However Wall Street analyst coverage on the stock is limited and algorithm-based forecasting sites are not providing a service for this stock.

Always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

FAQs

Will the CDL share price go up or down?

On 22 March 2022, Wallet Investor’s long-term algorithmic forecasts saw the Cloudbreak share price hitting 10.6p in March 2023, rising to 22.5p by March 2027. However on 10 May the site was no longer provides a forecast for this stock.

It’s worth noting that price predictions are frequently wrong and forecasts are no substitute for your own research. Note that algorithm-based projections can be inaccurate as they are based on past performance, which is no guarantee of future results.

Always perform your own due diligence before investing. Never invest or trade money you can’t afford to lose.

Should I invest in Cloudbreak Discovery?

The decision to invest in a company depends on your own portfolio needs and your risk appetite. Always perform your own due diligence before investing. Never invest or trade money you can’t afford to lose.