Alibaba stock forecast: Third-party price targets

Alibaba (BABA) is trading at $157.65 in early Tuesday trading (16 September 2025) after hovering within the $157.51-$158.40 intraday range, positioning near recent highs amid broader Chinese stock market strength.

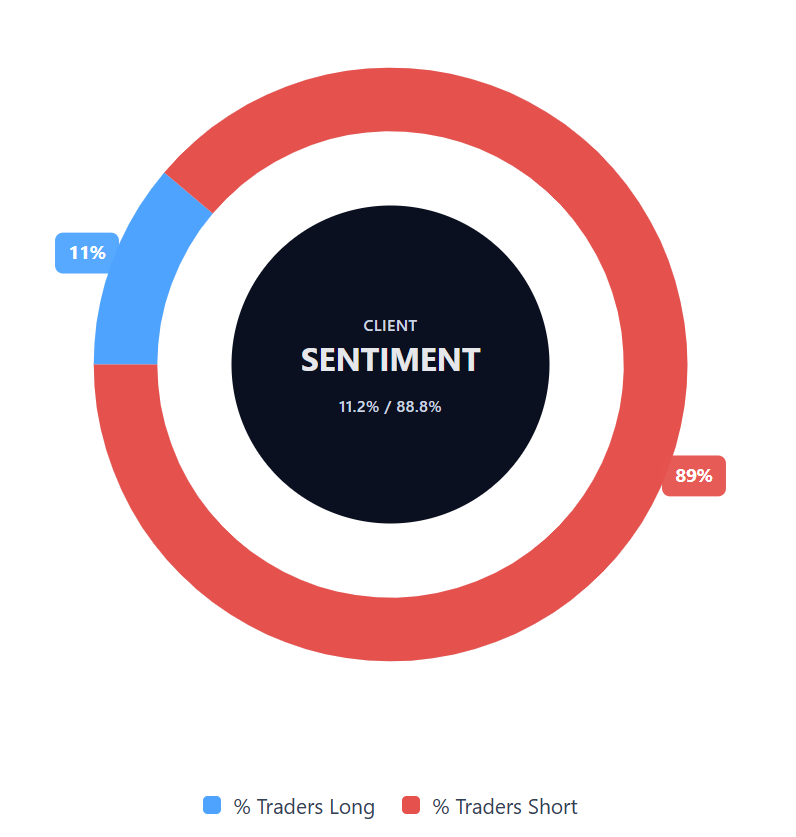

The shares reflect a 2025 high of $158.40, while client sentiment towards BABA CFDs shows strong bullish bias, with buyers comprising 88.78% versus 11.22% sellers as of 9:27 UTC (Capital.com, 16 September 2025).

The move comes as Chinese equities maintain momentum, with the CSI 300 Index at 4,520 points and the Shanghai Composite at 3,862 points – both extending multi-month rallies supported by institutional flows and AI-driven optimism. Alibaba's recent $3.2bn convertible bond offering – the largest of 2025 – allocated 80% toward cloud infrastructure expansion. The company is also progressing with proprietary AI chip development to reduce reliance on Nvidia semiconductors amid U.S. export restrictions. The broader rally in Chinese technology stocks reflects rising domestic institutional activity, with margin financing balances reaching 2.3tn yuan – the highest since 2015 – as retail investors gradually rotate from low-yielding deposits into equities, supported by yuan stability near 7.11 per dollar (Reuters, 27 August 2025).

Alibaba stock forecast 2025-2030: Analyst price targets

MarketBeat (consensus tracker)

MarketBeat calculates an average 12-month price target of $167.40 for Alibaba as of 15 September 2025, with a range spanning $145.00 to $195.00, based on 15 analyst ratings. The platform notes a stable consensus view amid broad-based 'buy' recommendations, as analysts flag sustained cloud momentum and disciplined cost management (MarketBeat, 15 September 2025).

Benzinga (aggregated analyst ratings)

Benzinga tallies a consensus price target of $153 from 18 analysts, with the highest recent mark at $195 from Benchmark on 2 September 2025, and a triple-firm average (Jefferies, Barclays, Citigroup) of $185 as of 10 September 2025. The upward shift is attributed to positive earnings momentum, buyback activity, and operational leverage gains (Benzinga, 15 September 2025).

TradingNews (Wall Street consensus)

TradingNews highlights that Wall Street’s 12-month consensus price target stands at $152.41, generally ranging from $150 to $155. This assessment is based on long-term EPS growth expectations above 20% annually and Alibaba’s leading position in Chinese tech (TradingNews, 28 August 2025).

Past performance or forecasts are not reliable indicators of future results. Analyst price targets are based on assumptions that may not materialise, and actual outcomes could differ significantly.

BABA stock price: Technical overview

On the daily chart, BABA holds above its key moving-average cluster – the 20/50/100/200-DMAs at ~133 / 124 / 122 / 115 – with the 20-over-50 alignment intact, underscoring an established uptrend. Momentum is stretched: the 14-day RSI is around 74, while ADX(14) at 32 indicates a strong trend as price remains above the MA band.

The first level to watch topside is the 170.3 pivot; a daily close above this would bring 175 back into view. On pullbacks, initial support sits at the 129.3 daily pivot, followed by the 122-DMA shelf. A move below the 122-DMA may indicate of a deeper retracement toward the 115 area (TradingView, 16 September 2025).

This is technical analysis for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Past performance isn’t a reliable indicator of future results.

Follow the Alibaba stock price with our BABA live price chart.

Capital.com’s client sentiment for Alibaba

Alibaba CFD buyers account for 88.8% vs sellers at 11.2%, which puts buyers ahead by 77.6 percentage points and signals a notable buy-side skew (16 September 2025). This snapshot reflects open positions on Capital.com and can change.

FAQ

Who owns the most Alibaba stock?

SoftBank Group is the largest single shareholder, owning roughly 24.9% of Alibaba’s total shares as of the June 2025 annual report, followed by founder Jack Ma’s charitable foundation at around 4%. Institutional investors such as BlackRock and Vanguard also hold significant stakes, each above 5% (MarketScreener, August 2025).

Is Alibaba a good stock to buy?

Suitability depends on individual goals and risk appetite. Analysts remain split – some highlight cloud-computing growth and artificial intelligence (AI) investments, while others emphasise regulatory risk and competition. Always conduct your own research and ensure alignment with your strategy.

Could Alibaba stock go up or down?

Alibaba’s share price can react to earnings, regulatory developments, interest rates, sector competition, and macroeconomic events. Potential drivers include strong cloud performance and AI uptake; downside risks include policy tightening or weaker consumer demand.

Should I invest in Alibaba stock?

Trading Alibaba CFDs provides flexibility for short-term positioning, while purchasing shares offers longer-term exposure. However, CFDs are traded on margin, and leverage above 1:1 amplifies both potential gains and potential losses. Your approach should reflect your experience, time horizon, and risk management strategy.